Closing Comments

Lynn Miller

February 16th, 2016

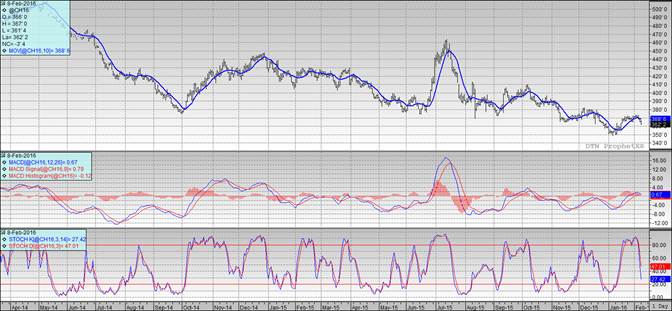

Just a reminder, we are getting close to futures expiration. If you hold basis fixed or futures fixed contracts against the March we are only 8 days from the pricing deadline. We will need to get these contracts either rolled or priced by next Friday. If you have any questions please give us a call and we will walk through some scenarios with you to help you make the best possible decision for your operation.