Closing Comments

Lynn Miller

February 10th, 2016

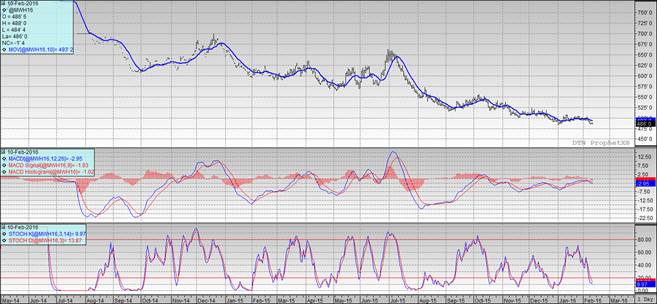

Corn:

High world supplies, low world prices and slowing demand continue to pressure the corn market. Ethanol production was up to 969 thousand/barrels per day with the grind up also just shy of a million bushels. But with increased production comes increased stocks. Ethanol stocks are now starting to challenge the highs from 2012. Increased stocks and reduced margins are put the pinch on. Poet has announced 2-day shut downs and shorter receiving hours at 6 of its facilities across Indiana and Ohio. ADM is looking into options including a potential sale of its dry mill ethanol plants due to poor profitability.

Export sales tomorrow estimated between 800 -1,100 mt vs. 1,129 last week.

Technically, all three indicators remain bearish the March futures. The stochastics are now in oversold territory but do not appear ready to issue a buy signal. Support on this move appears to be sitting at $3.58 today. My next sales targets would still be $3.70, 3.75 and $3.82.

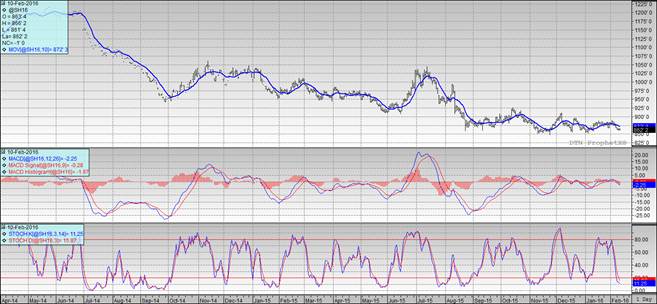

Soybeans:

Lack of fresh news in yesterday’s USDA report seems to have invited the bear camp back in to increase their short positions. All in all the lack of new news is keeping traders off the dance floor. The S. American weather issues are basically done, there is nothing new on the horizon for a risk to new production at the moment and total stocks are big. I tend to believe we will see this market set back at least to the contract lows we have already put in or maybe lower before we see a weather born rally during US production.

Export sales tomorrow estimated between 300-600 mt vs -44 last week.

Technically, all three indicators remain bearish the March futures. The Stochastics remain in oversold territory, but no buy signal yet. The inside consolidation is probably a good sign for a move upward. Support continues to sit at $8.52. My selling targets would remain $8.80, $8.90, $9.00, $9.12 then $9.35 if you really want to reach.

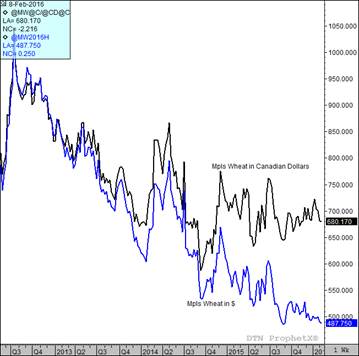

Wheat:

So, for all these months we’ve been talking about the strength of the dollar vs. the Argentine Peso or the China Yuan and its effect on Soybean prices. But how about we bring that closer to home? Let’s look at US Spring Wheat vs. the Canadian dollar. The Minneapolis Grain Exchange has HRS at $4.88 on the board to be basis the US dollar that the producer would receive, but in Canada that equates to $6.80. The strength of the US dollar is truly reeking havoc on our ability to sell grains, thus increasing our carryouts and bringing US values down even more.

We did hear rumors today that Russia is once again talking about slowing or totally halting exports. The thought is Russia’s domestic supplies are tightening. Although this brings some support, without a weather scare the fact remains there is a lot of wheat in the world and the US is not competitive.

Export sales tomorrow estimated between 150-350 mt vs. 67 last week.

Technically, all three indicators continue to be bearish the Minneapolis March. Just as in corn and beans, the stochastics has entered oversold territory with no buy signal issued yet. Once again the $4.82 level held support and the trading range remained narrow. My price targets continue to be 5.00, $5.10, $5.20, $5.28 and $5.39.