Closing Comments

Lynn Miller

February 16th, 2016

Just a reminder, we are getting close to futures expiration. If you hold basis fixed or futures fixed contracts against the March we are only 8 days from the pricing deadline. We will need to get these contracts either rolled or priced by next Friday. If you have any questions please give us a call and we will walk through some scenarios with you to help you make the best possible decision for your operation.

Corn:

A nice session today in corn with a close near the session highs. Higher global financial markets probably offered some support. Farmer selling remains slow and is most likely offsetting the market pressure from slow demand for the time being. Exports today were 27 million bushels vs. 28 last year.

The market is looking for increased new crop sales as we approach $4.00 December futures.

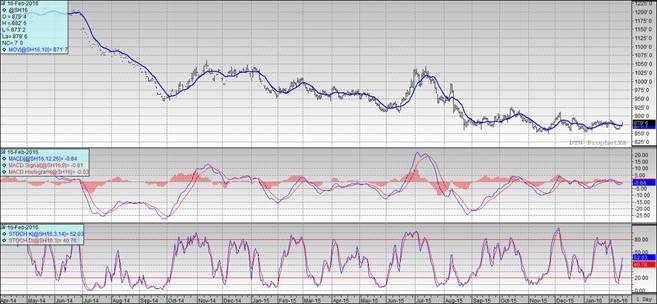

Technically, two of three indicators remain bearish the March futures. The stochastics are the first to issue a buy signal with the MACD and moving average still remaining bearish. We are closing the gap on the moving average; however. Support has wiggled its way back up to $3.61. My next sales targets would still be $3.70, 3.75 and $3.82.

Soybeans:

We started the day off with NOPA crush numbers that were less than fabulous at 150.5 million bushels vs. the 154.0 that was expected. This come as a result of slipping US margins. On the other hand, we hear that Chinese margins are improving which very well could have triggered their pricing of some futures.

Export sales were not stellar, but steady and within ranges at 64 million bushels vs. 49 last year. Some feel that US Export estimates may still be too high.

Technically, two of three indicators remain bullish the March futures. Only indicator lagging today is the MACD. I’m a little leery of the stamina this rally will have with the stochastics already climbing to 52 with one day’s price action. We did manage to maintain over the moving average through the entire days trade. Support has moved all the way up to $8.75. My selling targets remain $8.80, $8.90, $9.00, $9.12 then $9.35 if you really want to reach.

Wheat:

Just as in corn, wheat was helped along today with higher global financial markets and short covering by the traditional funds. Slow global demand and a stronger dollar are the two biggest price hurdles this market has right now. Exports remain slow, but tracking similar to last year at 14 million bushels vs 15 last year.

I keep looking at this market, and to be honest I don’t really like what is being laid out for us. Basis is working against us, widening out rather quickly with slower demand and mill access to quality wheat. If we are paying DP charges we can stop these by basis fixing, but a -0.57 under the March is not that attractive and the market carry will work against us when we roll it. It feels like this might just keep piling up. I am probably at the point I would consider just pricing out wheat on any rally we can get and take the lickin’. Then, if you are comfortable re-owning it in your own margin account, there might be opportunity at $4.65 or so. If you’re not comfortable with making your own trade, setting basis might be the better of two evils. I wish I could make up some good news, but we just don’t have much to hold onto. The one thing I do know, is generally when we feel the most vulnerable is when we have the most opportunity.. So we’ll see.

Technically, two of three indicators have now turned bullish the Minneapolis March. We managed to hold a close over the moving average and the stochastics has signaled a buy deep in oversold territory. $4.82 continues to be our support line. My price targets remain 5.00, $5.10, $5.20, $5.28 and $5.39.