Closing Comments

Lynn Miller

February 3rd, 2016

The story of the day is the US Dollar. Global currency markets ran into trouble today as investors dumped the dollar amid falling interest rates in the US and continued nervousness about the global economy. The dollar tumbled against the Euro and the Japanese yen, posting declines not seen in months. Volatility in the dollar began to spike last Friday when Japan moved to push yields below zero. “It’s hard to be bullish the dollar when you are afraid that growth will slow” – Peter Gorra, head of FX at BNP Paribas in New York.

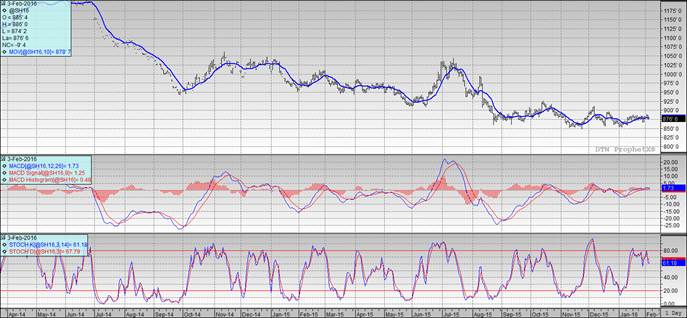

Below is a chart of the dollar’s action on a daily chart. You can see that today’s close was below the 100-day and came back to close on the 200-day moving average after trading significantly below that level. The MACD also took a 90 degree downturn to a bearish stance, while the stochastics have been indicated sell now for a while.

Corn:

Weekly ethanol numbers were once again below the prior week (although still above last year) and ethanol stocks continue to climb. Talk today of increased famer selling and softer US basis levels. I would have to assume this activity is taking place east of us as we are pretty static and quiet in our little corner of the world. Crude made a nice recovering today as the dollar tanked to lend some support.

Export sales tomorrow expected between 800-1,000 tmt vs. 871 last week.

Technically, two of three indicators remain bullish the March futures. The stochastics have issued a sell signal. We couldn’t hold the $3.72 support line today, moving us back to $3.62. My next sales targets would be $3.79, $3.85 and $4.10 if we can retrace to our high on October 8th.

Soybeans:

Talk of increased farmer selling pushed the bean market back below the 100-day moving average today. Some producers are looking at negative 2016 cash flows, and the thought of the market is the sales now are being made to cover costs. Some sales are being made to cover operating notes also as the lack of carry in the market doesn’t justify the additional interest.

Export sales tomorrow expected between 400-600 tmt versus 648 last week. Some feel the US’s export window is closing.

Informa today raised the 2015 world soybean crop 600 mt, with a drop in Brazil production offset by an increase in Argentina. 2016 world production was dropped 1.5 mmt.

Technically, two of the three indicators have turned bearish the March futures. $8.82 gave way today, moving support back down to $8.75. My selling targets would remain $8.80, $8.90, $9.00, $9.12 then $9.35 if you really want to reach.

Wheat:

Liquidation of long bean/short wheat and long corn/short wheat spreads buoyed the wheat market today. And a sharply lower US dollar helped us out also.

Export sales tomorrow expected between 200-400 tmt vs 294 last week.

Technically, all three indicators are once again bullish the Minneapolis March futures. I’m starting to think these technical are confused. Support has returned to $4.98. If you need to make some wheat sales, a few bushels at $5.00 futures would still not be a bad idea. My price targets would be 5.05, $5.10, $5.20, $5.28 and $5.39.