Closing Comments

Lynn Miller

February 1st, 2016

Corn:

A weak session today, mellowed further by short covering from managed money. This is a seasonal trend to incrementally cover shorts as we get closer to spring. The latest CFTC report shows the managed money crowd has covered over 70,000 contracts, only to be replaced by active selling in the merchant sector of countries such as Argentina and Brazil.

Weekly corn exports were 27 million vs. 26 last year.

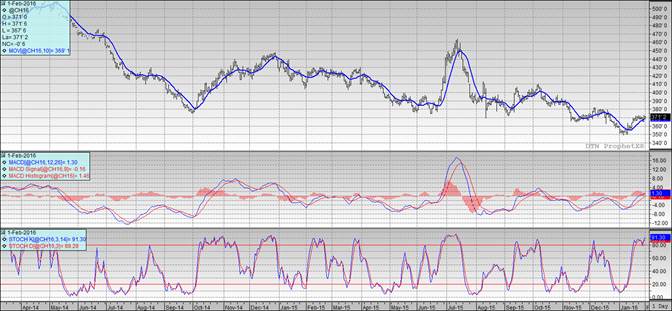

Technically, all three indicators are once again bullish the March futures. The stochastics are in major overbought territory at 91.30. Support continues to sit at $3.69. We were unable to muster a close at or above the $3.72 lever; therefore, the charts have not changed. After you make your sales at this level we’ll look for $3.79, $3.85 and $4.10 if we can retrace to our high on October 8th.

Soybeans:

A small pullback of Friday’s month-end gains today mostly focused on unsure and wavering weather forecasts for South America. The noon update showed rains in both Brazil and Argentina which likely brought on additional selling pressure. The 5-day forecast has Argentina dry and Brazil mostly dry with the exception of the southern region. 6-10 days are bringing moisture. All in all the trade is now ready to start reducing Brazil production estimates.

Exports today only 42 million bushels vs 62 last year.

Technically, all three indicators remain bullish the March futures. Nearby support has returned to $8.75. $8.82 is the next level we need to conquer to keep moving on up. My selling targets have moved up a notch to $8.82, $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

A lower session, but ending off of the lows as short-covering by the funds cut our losses. News that Egypt rejected a French wheat cargo for Ergot dropped EU futures to new lows and offered us resistance today. Egypt will be tendering tonight, despite the US being eligible our chances are slim to gain this business as we are priced well over competitive levels. Some expect the US Winter Wheat crop condition to be raised with El Nino sticking around to provide good growing conditions coming into Spring/Summer.

Exports today were 10 million bushels.

Technically, two of three indicators are bearish the Minneapolis March futures. Closing below the moving average and finding the stochastics in full sell mode.. Support held at the $4.98 area today. If you need to make some wheat sales, a few bushels at $5.00 futures might not be a bad idea. My price targets would be 5.05, $5.10, $5.20, $5.28 and $5.39.