Closing Comments

Lynn Miller

December 1st, 2015

Free DP on Soybeans – effect immediately for all new deliveries. Free DP opens up options for you. You could use this as an opportunity to haul piled beans before you have quality concerns, or you could move beans in Condo to Free DP so you could haul corn.

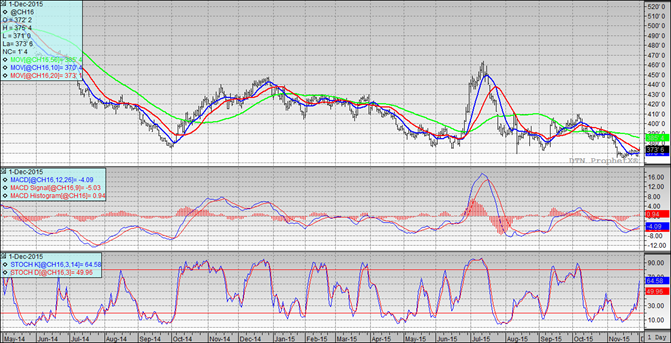

Corn:

Bullish sentiment from yesterday’s ethanol mandate carried over into today’s session. However, some feel the new 2016 mandate will only add 100-150 million bushels to corn usage. Funds were in big time yesterday, but stood to the sidelines more today.

What price is it going to take to get you to sell corn? Some fell it’s going to be a tight hold until we get closer to $4.00 cash. Export prices are becoming more competitive with talk that Brazil exports have slowed down, plus tension between Russia and the Ukraine are leading to uncertain in exports for that region.

Technically, all three indicators are bullish the March. We saw an outside day higher yesterday in this March contract, which could be signaling a change in trend. Nearby support continues to hold at $3.64. Now that the bid has changed to the March, my selling targets are $3.75, $3.82, $3.87 and $3.92. You can see below the we traded through the 20-day moving average (red line). The next goal, maintain momentum, would be to trade to the 50-day moving average at $3.85

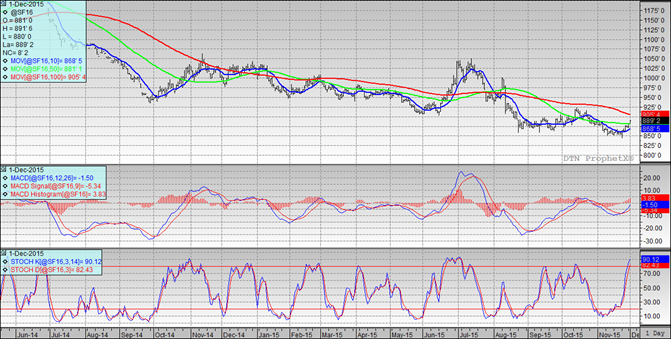

Soybeans:

All this market needed was a chance to call the new President elect in Argentina liar, liar. The failure to reduce export taxes or to devalue currency are pretty much the driving forces behind the bean rally. Then we have some Brazilian weather to help us out. It’s dry in the NE and flooding in the south. Southern flooding is bad enough that replant and abandoned acreas are now coming into play. But, their exports continue with 1.44 million mt shipped out in November vs. .18 mmt one year ago.

Technically, all three indicators remain bullish the March futures. The stochastics; however, are now in oversold territory. Nearby support has moved upward today, now at $8.85. We traded through the 50-day moving average today of $8.81 and are on our way to intersecting the 100-day moving average at $9.05. This is the level my offers would be in at. Additional selling targets are $9.23 and $9.48 on the high side. If you have basis fixed beans, we shouldn’t just forget about them until futures expiration. We should be looking at target levels that are profitable and catching this market.

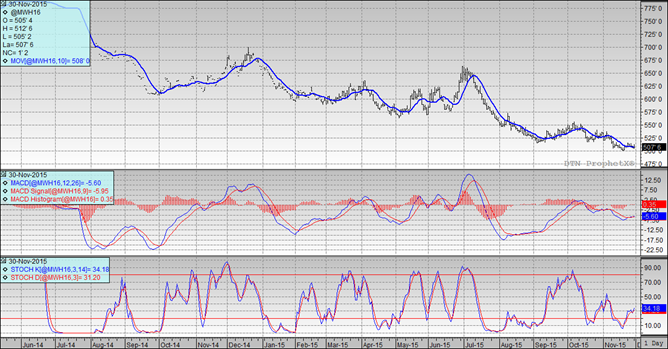

Wheat:

Light demand and huge world supplies don’t go away overnight, and really that’s all we have to trade here. So when they throw in a good day of spread action or speculative selling we need to be ready to take advantage of it. US Winter Wheat ratings were again improved last night – up 2 at 55% good to excellent.

Australia’s crop was lowered today while Canada’s was raised. Russia continues to stave off the extreme cold for the time being relaxes some fears of winter kill there.

Technically, all three indicators remain narrowly bullish the March Minneapolis futures Nearby support holds at $5.00. My selling targets have not moved: $5.13 $5.20, $5.27 and $5.34. If we can sustain a rally here we need to be ready to make some sales at $5.00 cash wheat.

Top Trending Reads: