Closing Comments

Lynn Miller

December 16th, 2015

Corn:

Devaluation of the Argentine currency was the main negative of the day. Will this lead to a full devaluation, will the black and blue market rates go away, how much will the farmer sell. A lot of talk out there about Argentine producers securing corn seed thanks to this much friendlier ag environment. In the long run, this means increased competition for the United States.

Ethanol numbers were out today, and that’s a mixed bag. The grind was the second best week since October 9th at 993 thousand barrels/day. However, stocks were once again up significantly pushing ethanol prices down and pressuring corn. Margins have also slipped to a point we may see some slowdown in the grind.

Export sales tomorrow expected between 700 – 950 tmt.

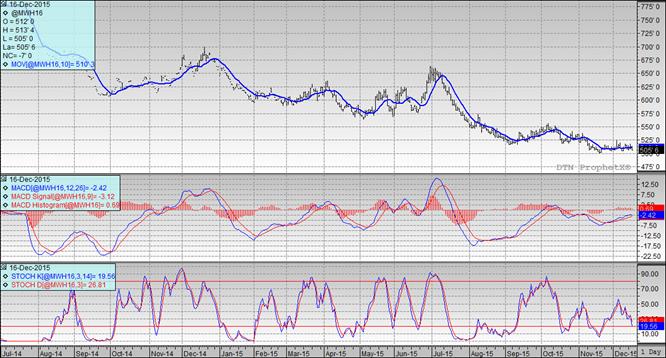

Technically, two of three indicators have turned bearish the March futures. Nearby support has once again set back to the contract low of $3.64. The MACD is the only indicator still positive and that has turned dramatically today. My selling targets would be $3.75, $3.80 (which is now the 50-day moving average level) followed by $3.94.

Soybeans:

On top of the Argetine currency devaluation, news of congressional leaders proposal to continue the Biodiesel tax incentinve as a blender’s credit (not a producer credit). This still needs to be voted on in the house and the senate; however, all expect it to pass. This took the wind out of oil sales that spilled over into beans. Now we have overpriced oil that may not get exported.

Back to the Argentina currency, the question will be when will the farmer sell? This de-valuation could put some 500+ million bushels into the market. Earliest offers we have heard today are for April/May shipment and at $0.50 discount to January US beans.

Export sales tomorrow expected between 900 – 1.3 mmt.

Technically, all three indicators remain bearish the March futures. The stochastics have run downhill quickly and now sit just off of oversold territory. Nearby support of $8.63 could very well have been broken today and the door could be open to re-challenge the contract lows at $8.44. My selling targets would still be $8.75, $8.84, $8.93 and $9.23 on the top side.

Wheat:

When Argetina pushed the piano out the upstairs window (as quoted by FC Stone) wheat had no other options than to follow corn and beans lower. The currency devaluation totally took this market’s focus off of short-covering. The reality is, they have wheat there to offer in competition with an already uncompetitive US.

Export sales tomorrow expected between 250-450 tmt.

Technically, once again two of three indicators are bearish the March Minneapolis futures. The stochastics, even though in sell mode, are fast approaching oversold. Nearby support continues to hold at $5.00. I am still serious about pricing some wheat at $5.25 futures, this is the 50-day moving average and 33% retracement. If you need to make some catch-up sales I’d try to get bushels on at $5.13, $5.17 and $5.21.

Top Trending Reads: