Closing Comments

Lynn Miller

December 22nd, 2015

El Nino is now believe to be past its’ peak, but expected to linger into spring in the US. This would imply a crop year that should be trend to above trendline yields.

Corn:

US export demand continues to be front and center with US corn offered into Isreal/Egypt $13/mt over the Ukraine and Brazil beats both our offers to China. The market also believes China will be out of the DDG market in the next 60 days.

Nestle and the Shake Shack have jumped on the cage-free egg wagon. This surprises alot of analysts as the cage-free market is only 8.5% of total US egg production. So to put such a time limit on this commitment will push the industry to convert operations resulting in more expensive eggs, higher feed consumption (due to lower feed efficiency) and longer time tables.

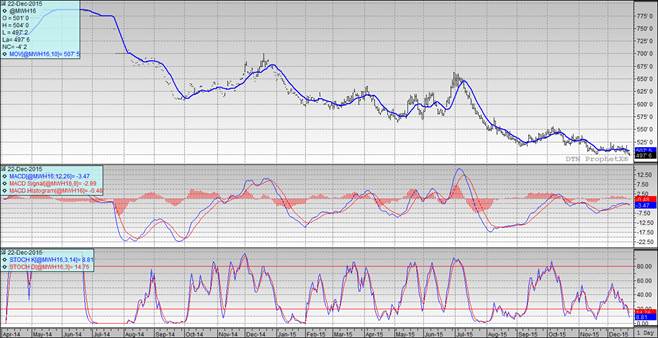

Technically, all three indicators are now bearish the March futures. Nearby support continues to sit at $3.62. Today’s price action took us significantly away from the moving average and turned the MACD bearish. My selling targets would be $3.75 and $3.80 followed by $3.94.

Soybeans:

Beans struggled with technical resistance as they ran into the 100-day moving average today. Add that to no real good story to feed the bulls and the market just drifted away.

Technically, all three indicators continue to be bullish the March futures. The stochastics are still in buy mode, but did make a significant turn today. Nearby support continues to hold at $8.84. My selling targets would still be $8.94, $9.05 and $9.24 and $9.54 if you really want to reach.

Wheat:

This poor commodity just sounds like a broken record. We are still priced to high to buy in export business, the world has a lot of wheat and there is no major weather story here to buy into.

Technically, all three indicators are once again bearish the March Minneapolis futures. The stochastics, are entering oversold territory. Nearby support was compromised today as we put in new contract lows closing at $4.98. If this level should fail it could open the door to $4.84. This market is oversold and due for a correction. My price targets now would be $5.11, $5.20, $5.27 and $5.34.

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

Top Trending Reads: