Closing Comments

Lynn Miller

November 12th, 2015

Outside factors working against us today: the Dow has fallen 1%, pressured by equities on the consensus the Fed will raise interest rates, the dollar is slightly lower and crude is down over $1 on a weekly building of stocks.

The National Weather Service is predicting El Nino will stick around, likely peaking this winter and tapering off late spring/early summer. It said the current El Nino could be one of three strongest since 1950. This could be good or bad news to market price action. A strong El Nino could hold off moisture in S. American growing regions.

Export sales were delayed – look for numbers tomorrow morning.

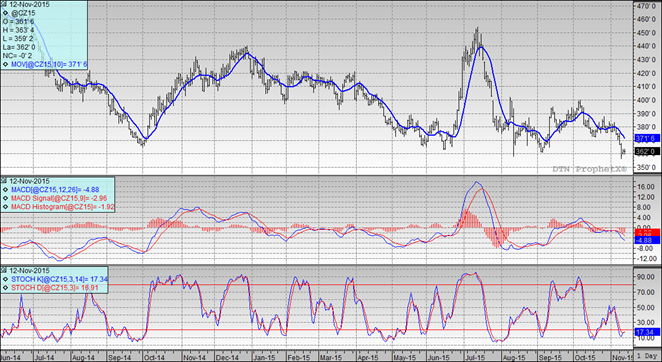

Corn:

Talk of better South American weather and slow exports are both offering resistance to prices at the moment. Weekly ethanol was out today at 982 thousand barrels/day. That’s a 1.3% increase over last week and above last year. Stocks are also up for the week and bigger than last year. Ethanol margins; however, are declining now $0.23/bu vs. $0.27 last week. Export sales tomorrow estimated between 450-650 mt.

Technically, two of three indicators remain bearish the December futures. The stochastics are issuing a buy signal. It appears that $3.58 is going to hold as support for the near term. Pricing points now would be $3.73, $3.80 and $3.90.

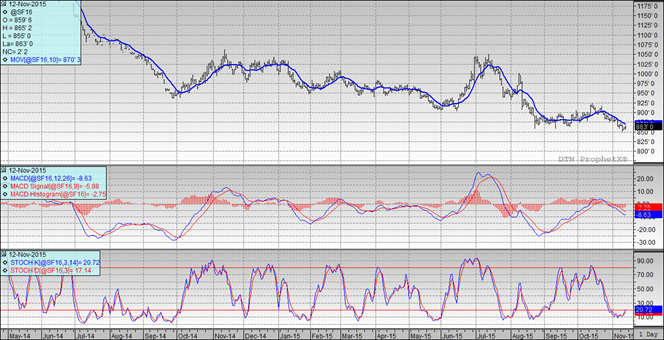

Soybeans:

End user pricing appears to be relevant today and a firmer tone continues in the cash markets to give us some support. New bean sale announced – 300 mt to China, which could have trigged some new buying. Export sales tomorrow estimated between 600-1,000 mt.

Technically, two of three indicators continue to be bearish the January futures. The stochastics are finally issuing a buy signal. $8.58 continues to hold as nearby support. My selling levels would be $8.84 and $9.03. Anything close to $9.00 futures would be sellable to me at this point.

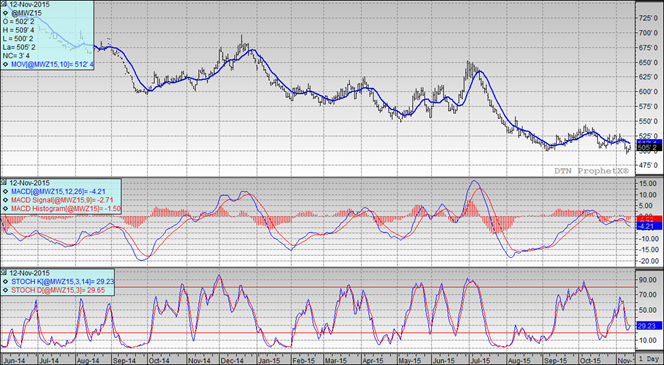

Wheat:

Talk that US prices may be getting closer to being competitive may be offering this market some support while large world supplies and timely rains in other parts of the world are offering resistance.

Technically, two of three indicators continue to be bearish the December Minneapolis futures; however, just like corn & beans the stochasitics are issuing a buy signal. $4.99 appears to once again be our nearby support level. My selling targets are now $5.16, $5.35 and $5.57.

Top Trending Reads: