Closing Comments

Lynn Miller

November 19th, 2015

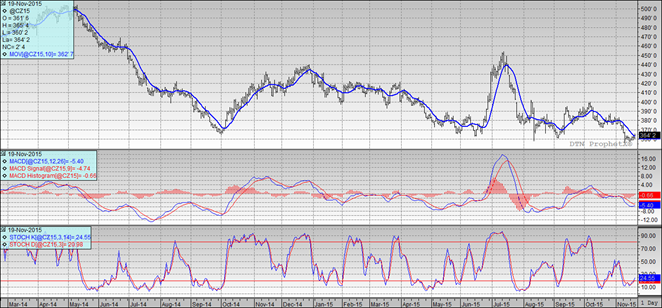

Corn:

Finally – one decent week of export sales. 779.80 tmt was the number for exports this morning, coming in at 80 tmt above expectations! Mexico was the biggest buyer. Add a lower dollar to the mix and I would have thought we’d get a better bounce, but the market knows we have a lot of corn to sell to catch up so this is just good news.

As basis continues to strengthen, producer movement is still nil. Producers don’t want to sell here, but are running out of hopes that holding will mean better prices. End users also are wondering what it will take to rally prices, and the answer is one of two things: Export demand, we need to sell it, or we will have to wait for spring and see what the market expects for yield and acres next year. Both scenario’s a gamble right now.

Technically, two of three indicators remain bearish the December futures. The stochastics in buy mode in oversold territory; however the MACD is closing the gap and we are only 2 cents off the moving average. Support continues to hold at $3.56. I would be looking to get in on any pop we might get from a technically driven rally. My offers would be in at 3.67, 3.73, 3.78, 3.83 and 3.94.

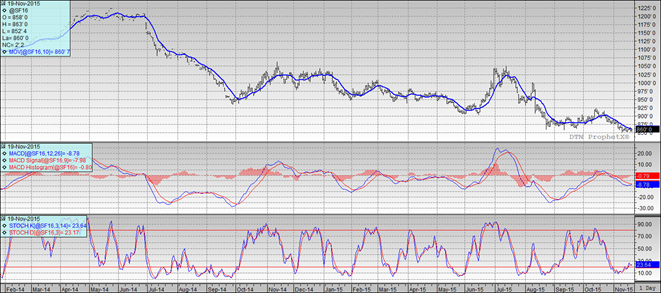

Soybeans:

I was disappointed in beans today. Better than expected export sales of 1.797 mmt (vs the trade guess of 1.0) with 1.6 mmt purchased by China and we had to battle to get 4 cents out of it.

The good weather for South America is seen to continue for the next 14 days. That takes away one bull story we had going for us.

Technically, two of three indicators remain bearish the January futures but it appears to be coming together. The stochastics are in buy mode, the MACD is coming together quite rapidly and we closed on ¾ of cent off the moving average. $8.51 continues to hold as nearby support. My selling targets now would be $8.70, 8.80, $8.90 and $8.95 and $9.05 on the high side. In an ideal world, I would really like to sell at anything close to $9.00 futures, but I’m not sure we want to wait that long.

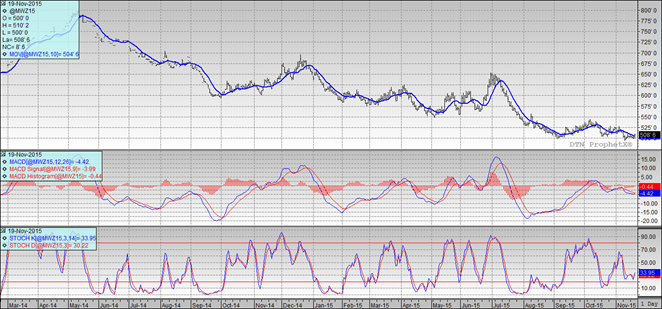

Wheat:

What a difference a day makes. Yesterday we were begging for demand and today, we sold it. Export sales came in at 721.9 tmt – way above the 400 tmt top end of the trade guess. This number did a lot more for wheat today than the good numbers did for corn as we are now within 9% of last years sales.

Weather remains favorable in the southern US; however, it is not so in the Ukraine. Poor stands and large droughted out areas are leaving them susceptible to heavy winter kill. The Ag Ministry announced it will limit Ukraine export sales.

Technically, the yo-yo continues as two of three indicators are once again bullish the December Minneapolis futures. The stochastics have issues a buy signal and we blew through the moving average today. That only leaves the MACD and it’s coming together. $4.99 continues to hold as nearby support. My selling targets would be $5.07, $5.15, $5.20 and $5.30

Top Trending Reads: