Closing Comments

Lynn Miller

November 25th, 2015

Happy Thanksgiving to each of you. Enjoy your day with family and friends and be thankful for all that is around you. (And for green markets!)

Free DP on Soybeans – effect immediately for all new deliveries. So be sure to take advantage of the nice weather for hauling!

Reminder: No overnight markets tonight. No markets tomorrow. We reopen for a short session on Friday from 8:30 – 12:05.

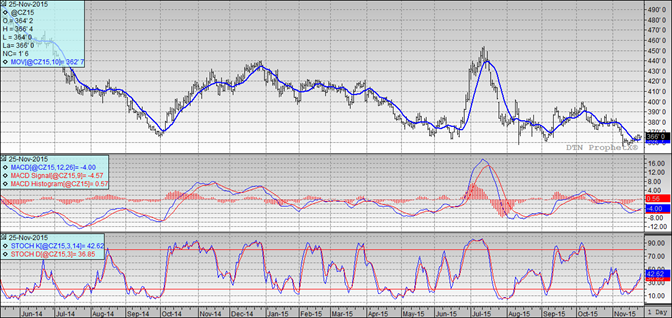

Corn:

Corn managed to close higher and at the upper end of the day’s range. The thought process on the firm close was either that corn was pulled higher with beans today or, that the market is expecting an increase in the ethanol mandate Friday with miles driven expected to grow year to year. Ethanol production was sharply higher at 1008 thousand barrels/day (this is a lifetime high) however, weekly stocks continue to rise just about as fast.

Some very modest farmer movement this week with bills beginning to come due. Basis is weakening some in the ECB, with some flow over into the WCB now. Weaker CIF bids are pressuring the Dec/Mar spread to widen.

Export sales will be delayed ‘til Friday. Expectations are 900 – 1,300 mt.

Technically, all three indicators remain bullish the December futures. Nearby support continues to hold at $3.56. My selling targets haven’t changed. I’m willing to sell bushels at $3.73, $3.78 and $3.83.

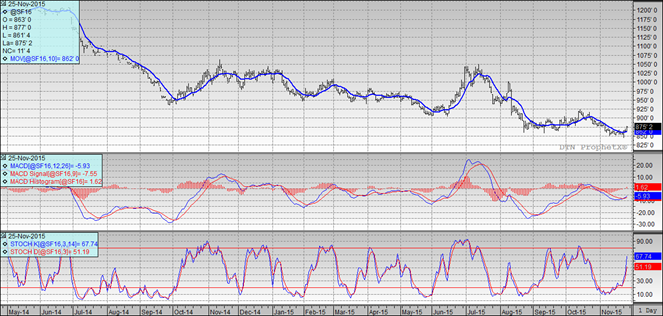

Soybeans:

A sharply higher day in the bean trade, at up 11 cents. Some credit this to follow-through technical buying others. Same anticipation here for the bio-fuels mandate where an increase would do us good. In Argentina, the new president elect has put a stop to rumors he would implement a 90 day suspension of soybean export taxes. This confirms that change there will take time.

Crush margins remain positive in the US, but about 1/3 of what they were one year ago. This could make you wonder if the crush pace can meet the aggressive USDA estimate of 17 million bushels.

Export sales will be delayed ‘til Friday. Expectations are 1,000-1,500 mt.

Technically, all three indicators remain bullish the January futures. Nearby support has moved up to $8.63 with today’s price action. My selling targets remain $8.70, $8.75, 8.85, $8.95 and $9.05 on the high side. I hope now that we are again over the $8.00 cash mark you will either consider sales or get targets working so that you don’t miss this rally. The negative factors in the market are all too eager to push up back down.

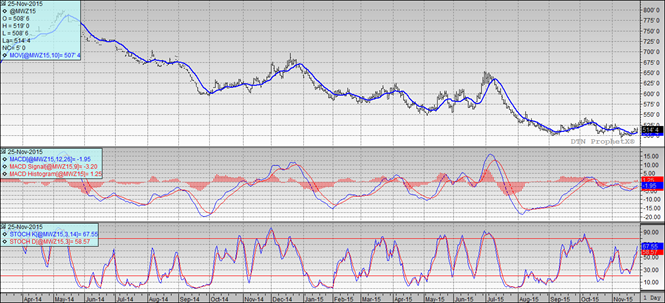

Wheat:

A nice gain in Minneapolis prices today. Most of the excitement was in spreading the front months. Egypt did get some wheat bought from France, Russia and Romania. US is priced at $221.9/mt vs $205.94 that was paid today.

There are a few concerns out there like will the flow between Russia and Turkey be disrupted w/ the current disputes or how about wheat exports from the Ukraine?

Export sales will be delayed ‘til Friday. Expectations are 400 - 600 mt.

Technically, all three indicators remain bullish the December Minneapolis future. Nearby support may have moved up to $5.14 with today’s action, but I’m not betting on a strong hold here. My selling targets are now $5.20, $5.26 and $5.45. If we can sustain a rally here we need to be ready to make some sales at $5.00 cash wheat.

Top Trending Reads: