Closing Comments

Lynn Miller

December 15th, 2015

In general we saw a steady dollar the pressured commodities today as investors brace for Wednesday’s FED meeting. Most expect an interest rate increase and that has stocks higher today. Meanwhile, crude is rebounding from yesterday’s new lows up by more than $1/barrel. Some of the hype in crude is on speculation that congress will lift a 40-year ban on US crude oil exports as part of a broader spending bill. Lifting this ban will do nothing for the global supply glut we are facing now; however, it could be a psychological driver to a short-term rally. A rally in crude will be good for corn.

Corn:

A quiet trade today, with the market struggling against resistance. China was in the news today as they start to address farm policy. Talk is they will be lowering corn prices to 1500 RMB ($6.00) per bushel, with a direct subsidy to farms to idle fragile (low yielding land). They are starting to learn from the US. Lower prices should stimulate demand and help livestock margins there, so the next question will be how long will it take the industry to respond?

Minnesota farms affect with Avian flu have been given the green light to repopulate. This is a good thing.

Technically, all three indicators remain bullish the March futures. Nearby support held today at $3.75. The stochastics are in buy mode; however, we are at the top-end of neutral territory and becoming quite choppy. My selling targets remain at $3.80 (which is now the 50-day moving average level) followed by $3.94 and $4.10 should we be able to regain positive momentum.

Soybeans:

Disappointing crush started the day at only 156.1 vs. the guess of 161.7 million bushels. Even though this was below the low end of the trade guess, the crush is still in line to meet the USDA expectation for the year.

USDA did announce a new 110,000 metric ton 2015/16 sale to China today.

South American weather is unchanged with better chances of substantial rains forecast next week. We will need to see this come to fruition in order for the market to maintain this bearish of a tone. No new news from Argentina, the trade does still believe we will see the Peso devalued, it’s just a matter of time.

Technically, all three indicators remain bearish the March futures. The stochastics have run downward and now sit just above oversold territory. Nearby support continues to hold at $8.63. My selling targets today are $8.75, $8.84, $8.93 and $9.23 on the top side.

Wheat:

Fund short covering once again the story today as the market moves towards some key resistance areas. Funds are still short an estimated 65K contracts. To extend any type of rally here we need to see our f.o.b. values drop to become competitive on the world stage. That’s been the story all along, and it isn’t changing anytime soon.

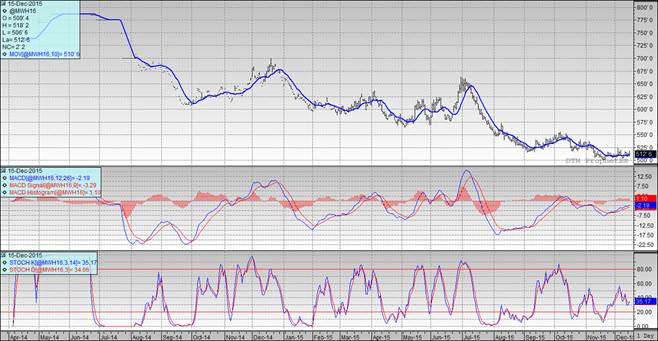

Technically, the yo-yo continues as all three indicators are again bullish the March Minneapolis futures. We did manage to close over the 10-day moving average. Nearby support continues to hold at $5.00. I am still serious about pricing some wheat at $5.25 futures, this is the 50-day moving average and 33% retracement. If you need to make some catch-up sales I’d try to get bushels on at $5.21.

Top Trending Reads: