Closing Comments

Lynn Miller

December 9th, 2015

USDA Monthly supply & demand report, pretty much a non-event today. We knew they weren’t going to light any fires, but at least they didn’t pull the rug out from under us.

Corn – 1.785 Million bu US carryout vs. 1.760 last month

Beans – US Carryout unchanged from November at 465

Wheat – US carryout unchanged from November at 911

Corn:

Underwhelming – the word of the day as far as I’m concerned. The WASDE report did nothing to give us direction. Reducing exports as expected 50 million bushels and then adding 25 million back in to corn use for ethanol, thus the 25 million bushel change. This gave the market nothing new to trade. No new news didn’t help our cause much either.

Weekly ethanol production rebounded from last week to 993 thousand barrels per day, the second highest weekly production record ever. Cattle values continue to freefall, taking margins with them. The dollar has now fallen below the lows set 5 sessions ago, and supporting the grain complex.

Rumors abound that China will be marketing their reserves 4 months ahead of schedule at a price of 1500 Yaun (equates to $234/mt – or $0.40/bu above imports value). This is a good thing, as this should not slow expected imports.

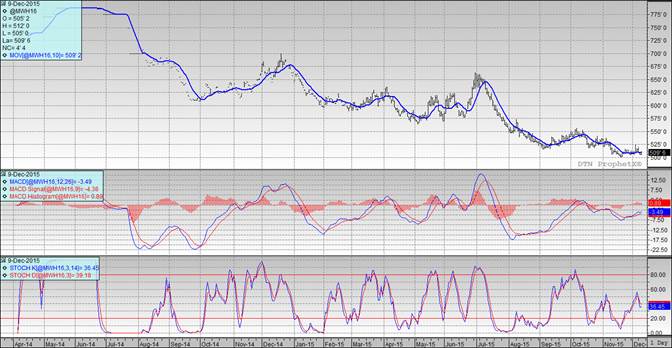

Technically, two of three indicators continues to be bullish the March. For the third day in a row we closed right on the 10-day moving average. Nearby support continues to sit at $3.64. The stochastics are in sell mode in neutral territory. My selling targets remain at $3.80, $3.85 at the 50-day moving average level, followed by $3.94 and $4.10 should we be able to regain positive momentum.

Soybeans:

No changed what so ever to the bean table today. But, they did increase demand for soyoil 200 million pounds to reflect EPA’s mandate proposal. Biodiesel margins are deeply in the red with the removal of the blender’s credit. Some models showing a loss of $0.35-$0.40/gallon.

Weather in Brazil’s central Mato Grasso area remains crucial. Without the appearance of some rains, 30% of the country’s soy belt will be considered dry. The northern half of their soy country continues to experience high temperatures, especially high night time temps.

Argentina’s new president takes office tomorrow. Hopefully we will hear some time line details regarding the currency valuation and export taxes. Stay tuned.

Technically, all two of three indicators are now bearish the March futures. The stochastics are in full sell mode. We are now significantly below the 10-day moving average; however, prior to the report we did trade up to it. The MACD is still positive; however, is now trying to come together. Nearby support has moved back once again and now sits at $8.64. Assuming you have made sales on the way up, I would be looking for $9.30 as my next target (this would be the 200-day moving average). If you missed this rally I would be looking to make catch up sales at $8.85, $8.94, $9.04 and $9.23.

Wheat:

Without any additional bearish news from the USDA today, the funds continue to cut their short positions held in Chicago. A couple highlights to the world balance sheet changes today. Australia’s production was not decreased as expected. Canada’s was increased. Ukraine exports were increased as their crop improves. India expected to plant less due to dryness, this is affecting their carryout-to-use ration which could easily fall below 10% which would add 3mmt to their needed imports.

All these are minute little things to factor into the trade. It remains a fact that there is a lot of wehat in the world and a lot of cheap wheat at that. Pay attention to the fund driven rallies we expect to see to try to get some sales on at nicer levels.

Technically, two of three indicators are once again bullish the March Minneapolis futures. We closed just above the 10-day moving average and the MACD remains positive. The stochastics are still in sell mode, but did make a dramatic tip upward. Nearby support remains at $5.00. I am still serious about pricing some wheat at $5.25 futures, this is the 50-day moving average and 33% retracement. If you are needing to make some catch-up sales my other target levels would be $5.13 and $5.21.

Top Trending Reads: