Closing Comments

Lynn Miller

November 10th, 2015

Closing Comments Lynn Miller November 10th, 2015

Well, the USDA has spoken, and we have gotten direction. It’s not the direction we all wanted and are hanging in there for, but we have to play the cards that were dealt none the less.

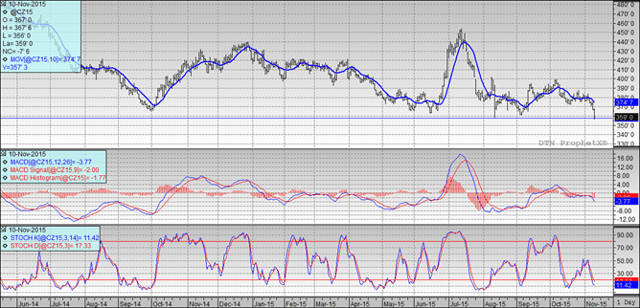

Corn: The USDA report is basically the story of the day, so let’s talk about it. They got us on all sides, literally. First they got us with yield. We were expecting something in the line of 168.4 and they gave us 169.3. This was due to the Western Corn Belt where 7 or 18 states had record ever yields. They got us on corn use for ethanol. Yeah, we haven’t been making the 100 million bu a week on the grind, but we have been up there pretty steady since February (give or take a week here and there), but they lowered it 75 million bushels. Why? Well, it appears we had a good Milo crop and they feel we will grind Milo instead of corn. And lastly, they got us on exports. They lowered export demand 50 million bushels from 1850 to 1800. What really got us where the ‘retroactive’ changes to Chinese demand! They reduced China 4 mmt for 2013, 17 mmt for 2014 and 4 mmt for 2015. Transalation: 15/16 Carryout is raised 24 mmt. This change blindsided me, even though we know China has huge stock piles of corn they should be feeding. The only thing they did that was expected was to increase corn use for feed, well dah if we have this much corn of course it should be cheaper to feed. Technically, all three indicators are once again bearish with today’s lower price action. Well, we made the move to $3.58 in short order today, trading through it even, but managed a close above it. Let’s hope this level will hold for now. All things considered corn hung in there way better than it should have today. Yes, we ran away from the moving average; however, the stochastics held in there. Pricing points now would be $3.73, $3.80 and $3.90.

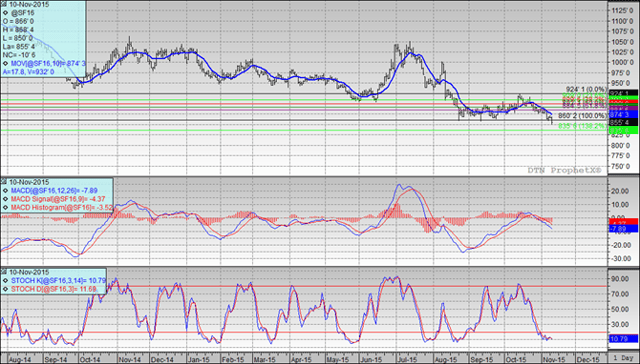

Soybeans: The USDA beat us up pretty good in beans today too. Trade was expecting a yield near 47.5, we got handed a 48.3. This takes the crop to 3,981 million bushels. (an increase of 93 million bushels). They did help us out a little with this: Increased crush million bushels and increased exports from 1.675 to 1.715. The net effect of everything was a 40 million bushel increase in expected carry out, with an ending number now of 465. Malaysian currency collapsed on the overnight, which discounted Palm Oil to SoyOil even more. Three states in Brazil are considering export taxes, Mato Grosso, Goias and Tocantins considering 12% tariff. Argentina is running away from the idea. Technically, all three indicators continue to be bearish the January futures. The stochastics can’t seem to commit to a direction and want to issue a buy signal in oversold territory. Since we took out the $8.57 support level today, the next move lower could be to $8.35. My selling points have now moved with the bad news today. I’m looking at $8.84 and $9.00. Anything close to $9.00 futures would be sellable to me at this point.

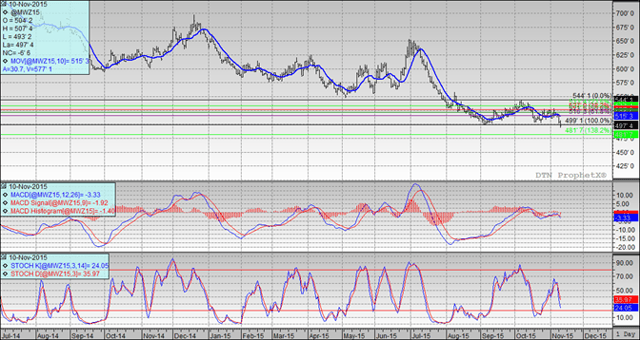

Wheat: Well, the obvious was pointed out today. The carryout keeps growing (now 911 vs. 861 last month) and we can’t sell anything (exports were reduces 50 million bushels to 800). This creates the highest stocks to use ratio for a November report since 1987! Australia’s crop was reduces 1mmt with probably another 2mmt to take away. EU wheat production was increased 2mmt. On the weather front: the southern US is in a better moisture position than last year, a warmer Ukraine ins slowing dormancy and improving their stands while Souther Russia is expecting rains. The market now needs to decide just what you do with a nearly billion bushel carryout and no domestic or foreign demand to really speak of. Technically, all three indicators are drowning in bearish sentiment in the December Minneapolis futures. The $4.99 support level could not hold us today and the door has been opened for a fall to $4.81. My selling targets have changed. Now I’m looking at $4.99, $5.16 and $5.27.

|

Top Trending Reads: