Closing Comments

Lynn Miller

November 13th, 2015

Do you suffer from friggatriskaidekaphobia? What is this tongue- twister you say? Well its fear of Friday the 13th. Research says, it affects 17 – 21 million Americans.

Friday the 13th’s bad luck was present in nearly all areas of the market today – crude was down, stocks were down and our commodities fought to keep from falling out of bed. But then there was the dollar that is finding way too much strength in hopes the Fed will increase interest rates next month. All of these factors were working against us today.

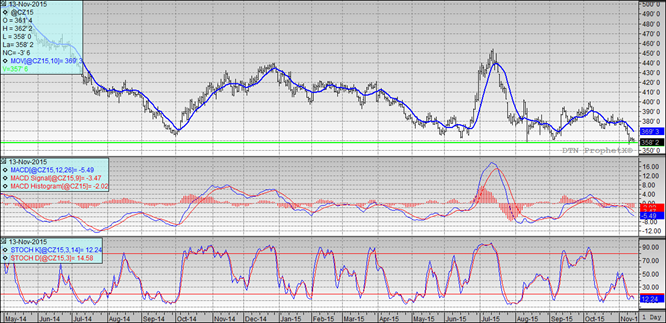

Corn:

Weekly export sales and Informa’s acreage guess for 2016 did very little to stem buying interest today. Export sales were 618,600t, on the higher end of the guess 450-650. YTD corn sales are running 30% behind last year, shipments 28% behind last year. Brazil intercepted some S. Korean business with values undercutting the US by $0.20/bushel. Informa reduced corn plantings to 90.1 million acres (down from 90.8 last month, but still higher than this past year)

Funds were credited with selling 10,000 contracts today. (Ouch)

Technically, all three indicators are once again bearish the December futures. The stochastics are once again in sell mode in way oversold territory. The onslaught today wasn’t able to but the $3.58 support line, but man did it try. This market right now is not feeling real friendly. If your needing to make sales I would probably be looking at smaller sales, with more intervals to try to capture every needed penny. We all hope this market will give us a break, but since July 1st it just hasn’t happened. My targets right now would be $3.74, $3.80, $3.85 and $3.90.

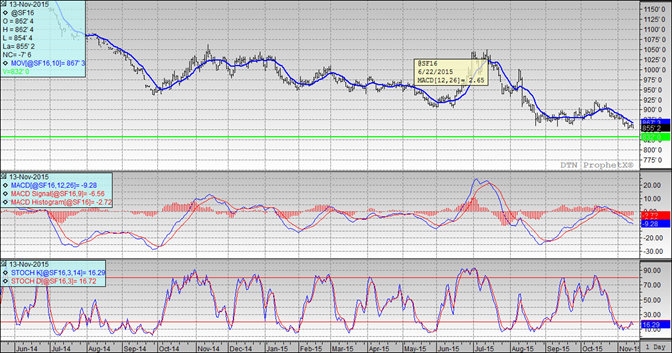

Soybeans:

I’m having trouble totally getting a read on this market. Export sales today were above trade estimates at 1.297 mt. Year-to-date sales at 29.1 vs. 36.6 last year; however, shipments are running 13.4 vs 12.6 last year. So really, we at least have export demand here which is better than we can say for corn & wheat.

Informa’s planted acres guess for 2016 wasn’t very friendly at 85.3 million. That’s up from the 83.9 figure last month and up from this year. I guess, when you can’t make money with any commodity, you pick the one you might lose the least on. I sure hope that’s not where this is going.

Technically, all three indicators are again bearish the January futures. The stochastics are confused in oversold territory, not really knowing what to do. The $8.58 support line was taken out tonight opening the door for move lower to $8.32. If waiting this out doesn’t sound like a good idea to you some selling targets would be $8.80, $8.90 and $8.95. In an ideal world, I would really like to sell at anything close to $9.00 futures.

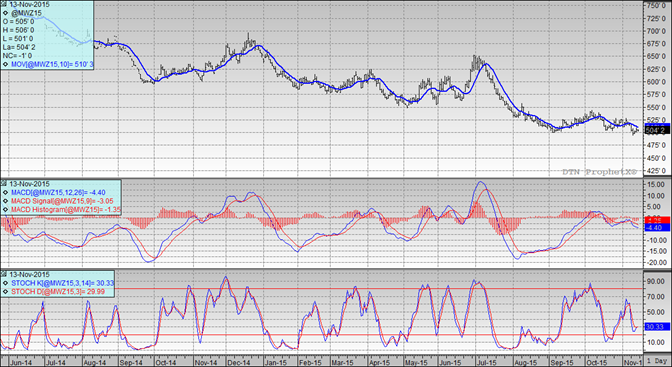

Wheat:

I am starting to wonder if it’s appropriate to just put SSDD in this area (Same ‘stuff’ Different Day). It all boils down to there is a lot of wheat around the world and there is no longer any significant weather threat for us to play.

Export sales today were 226,700, pretty much middle of the expected range (150-350). The sales pace is running 17% behind last year. Lead destination for the sales that were made are the Philippines and Mexico. Informa lowered planted acres for all wheat next year to 53.5 million vs. the 54 million last month.

Technically, all three indicators are once again bearish the December Minneapolis futures; however, the stochastics are perched for a buy signal even though they are in neutral territory and we are not really running away from the moving average. Technically, Minneapolis wheat hasn’t just given up yet. $4.99 has continued to hold for the nearby support level. My selling targets are now $5.16, $5.28, $5.35 and $5.57.

Top Trending Reads: