Closing Comments

Lynn Miller

November 18th, 2015

So, because the fall was littered with talk of El Nino (a warming of the pacific ocean) and the expected droughts (as in S. America) are not happening – I want to talk about it now. According to Drew Lerner from Worldwide Weather, the El Nino pattern has peaked or is peaking right now. One after effect of an El Nino – is… you guessed it La Nina, a cooling of the ocean. The La Nina phenomenon brings with it dry, hot weather and reduced moisture. If La Nina was to move in, it would be bullish for grains as it could possibly bring US production issues.

Would I bet my crop on a weather pattern to come next year – well no, but the point is we are just now past harvest. There is a lot of time for things to change or stories to develop. Unless you are needing cash flow, panic selling right now may not be in your best interest. Set targets so the pricing can work for you, and let them work, let them fill so the sales are made on what rallies we see.

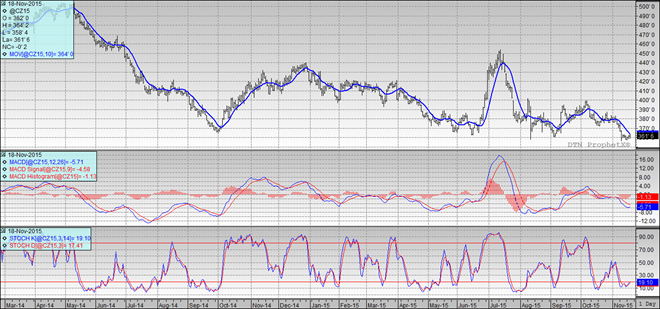

Corn:

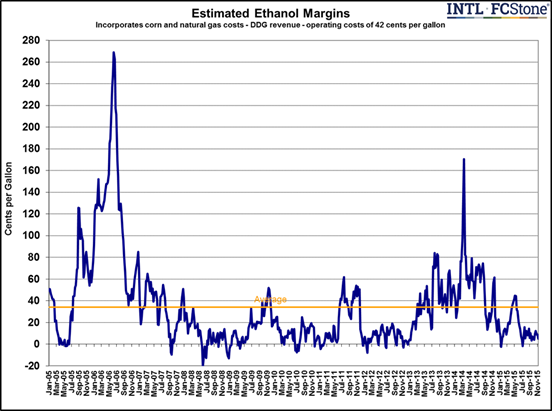

This market spent the majority of the day in the red, but successfully battled it’s way back to unchanged at the end of the session. Big win in my book for the circumstances. Ethanol usage was out today. Production dropped to 975 thousand barrels/day, but week over week stocks keep building and demand keeps dropping. Then there’s margins – which are not stellar as they struggle to stay positive.

Technically, two of three indicators remain bearish the December futures. The stochastics in buy mode in oversold territory; however the MACD has turned upward and we are closing in on the moving average. So, even though the days price action was not anything to talk about, the technical held up solid for now. Support continues to hold at $3.56. I would be looking to get in on any pop we might get from a technically driven rally. My offers would be in at 3.67, 3.73, 3.78, 3.83 and 3.94.

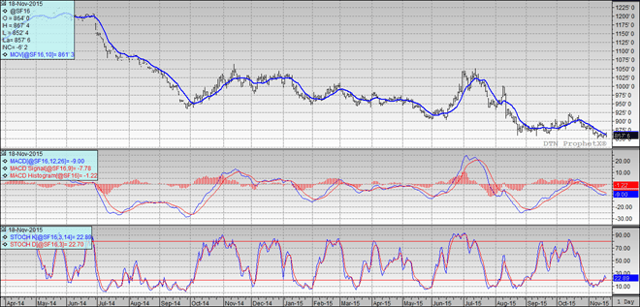

Soybeans:

A firm open in beans couldn’t hold up. There may have been some bearish news to dot the session, but really somethings are not that bad – oh, other than the nice soaking rains in S. America, that really did burst a bubble today.

Export sales due out tomorrow. The expectation is 1 mmt vs. last year’s 483 tmt. This sales pace is expected to fall off seasonally from here on out; however, at the current time the PNW is the best world bid, under cutting Brazil this week by $0.11/bushel.

Technically, two of three indicators are once again bearish the January futures by the thinnest of margins. The stochastics are signaling to buy and the MACD is coming together; however, we couldn’t hold values above the 10-day moving average. $8.51 continues to hold as nearby support. My selling targets now would be $8.70, 8.80, $8.90 and $8.95 and $9.05 on the high side. In an ideal world, I would really like to sell at anything close to $9.00 futures, but I’m not sure we want to wait that long.

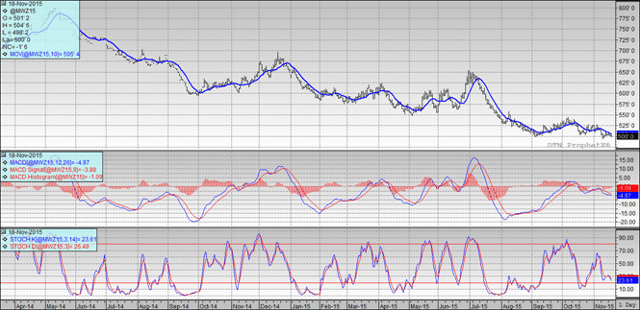

Wheat:

Wheat just couldn’t hold its own today. The news hasn’t changed. Qe can’t sell wheat, and we’ll be reminded again in the morning when export sales are expected to be a meager 200 tmt. The trade is keeping an eye on the FSU weather. Their winter planting was partially rescued by recent rains and warm weather, but it is not ‘caught up’ enough to withstand a normal winter. So without heavier snowfall than normal, the trade is starting to anticipate winter kill.

Technically, all three indicators are once again bearish the December Minneapolis futures. $4.99 has continued to hold for the nearby support level, but man we tested her today. This market needs some kind of story to give it life – or better yet, let’s just stimulate some demand while we are down here and give us something to buy into. My selling targets would be $5.07, $5.15, $5.20 and $5.30

Top Trending Reads: