Closing Comments

Lynn Miller

December 4th, 2015

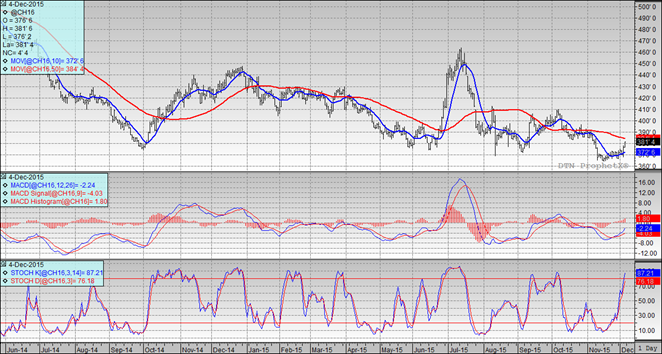

Corn:

Another day higher in corn, and closing near the high-end of the range as funds work to cover some of their 100,000 contract short position. When the dollar broke yesterday, it ran this market through some technical barriers. Rumor is the funds are trying to square some of this up prior to year-end, buying 13,000 contracts today. If this is the case we need to take advantage of it.

USDA supply and demand is out next Wednesday. The market is coming to the conclusion the majority of the tables will remain unchanged. Carry out is estimated at 1768 vs 1760 last month. Some adjustments to feed, exports and industrial use should stay small.

Argentina has reduced their export tax on corn.

Technically, all three indicators continue to be bullish the March. Nearby support has moved to $3.75. The stochastics have entered overbought territory. My next real selling target is $3.85 the 50-day moving average level. Other selling points would be $3.94 and $4.10 should we be able to sustain a rally.

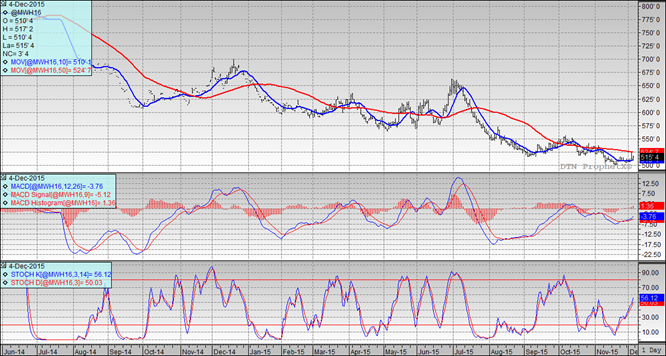

Soybeans:

A positive close for the 5th consecutive day brings cash at NCFE up $0.34 for the week. Values are rallying on speculation that a producers credit for biodiesel plants is a far better possibility than one week ago. Senator Grassly introduces the measure today – now we wait.

The bill is designed to limit imported oil for biofuel and should increase US demand for soyoil.

The sentiment of the market has appeared to have changed from bearish to mildly optimistic. South American weather will be a key as well as what happens with currency and export taxes in Argentina

Technically, all three indicators remain bullish the March futures. The stochastics continue to hold in over bought territory. Nearby support should now be at $8.92. Since we traded through the 100-day moving average today, my next major selling point is $9.30, the 200-day moving average. Additional selling targets are $9.47 and $9.71 if we can sustain a rally here.

Wheat:

There are two theories to the sustained higher prices in wheat. One is that wheat is simply being pulled along w/ Corn and we get to reap the benefits, the other is that the funds are trying to trigger short managed fund stops. Don’t let the fact that world supply is abundant and the chart trend remains down slip away as we see small gains. Be prepared to make sales when you have a chance to capture some ups.

Frances wheat is starting to enter dormancy with a good to excellent rating of 98%. Relations between Russia and Turkey remain unstable. Russia has said they will not limit wheat imports; however, the Ukraine is eager to pick up the slack should that happen.

Next week’s USDA report is suspected to be unchanged.

Technically, all three indicators remain bullish the March Minneapolis futures. The stochastics appear to be comfortable in buy mode here. Today’s price action may have moved support to $5.13. I am still serious about pricing some wheat at $5.25 this is the 50-day moving average and 33% retracement. This also nets us $5.00 cash wheat at Craven/Bowdle/Northville.

Top Trending Reads: