Closing Comments

Lynn Miller

December 7th, 2015

Fun Worthless Fact of the Day.

Did you know, Frosty the Snowman aired for the first time on this date in 1969?

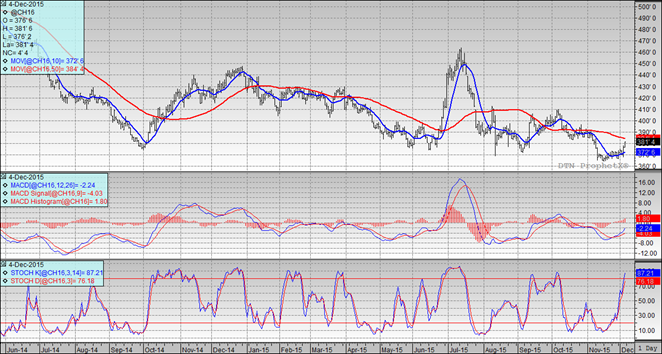

Corn:

Values today have taken away nearly all of last week’s gains as beans pulled us down since Corn can’t find its own story to run on. Cattle limit lower today on heavier weights and higher production. Export inspections were relatively week at 491 tmt vs. 535 last year. Funds were seller of between 9,000 and 14,000 contracts today.

Ethanol margins have gone negative. US vs. Brazil corn costs are even.

In the new Dunkin Donuts says they will only serve cage-free eggs by 2025 and crate-free pork by 2022. Up go production costs. The Chicago Mercantile Exchange says it will only allow domestically born and raised cattle to be delivered against its contracts effective December 18th.

Technically, two of three indicators continues to be bullish the March. We closed today right on the 10-day moving average so we are technically vulnerable. Nearby support has returned to $3.64110. The stochastics are the real negative here having entered overbought territory. After today’s price action my selling targets are $3.80, $3.85 at the 50-day moving average level, followed by $3.94 and $4.10 should we be able to regain positive momentum.

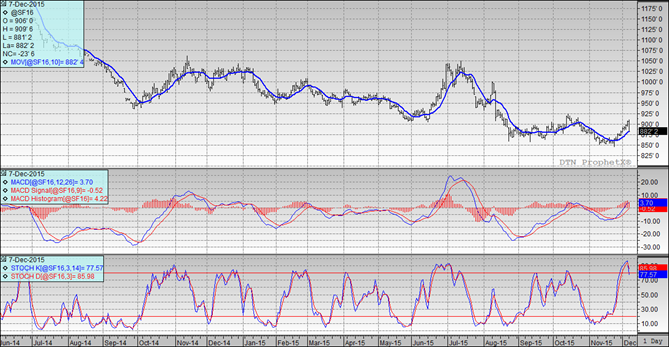

Soybeans:

Sharp sell-off in beans on news the new Argentine President will press for normalization of the country’s currency exchange as early as the 14th of this month. Eventually this will affect corn sales/plantings, but up front the main effect will be beans. The black market rate there is 15 to 1 USD, whereas the official rate is a suppressed 10 to 1. In normalizing the black market vs. free rate would result in an explosion in prices equaling 52% appreciation. The export tax would not need to be removed to prompt a surge in sales.

Exports were 1.72 mmt vs. 2.2 mmt last year. Funds were sellers of 12,000 bean contracts today.

Technically, all two of three indicators remain bullish the March futures. The stochastics have tipped dramatically back into neutral ground. And we closed today right on the 10-day moving average. On top of that we put in an outside day lower that could very well be signaling a return of the downtrend market we have become accustomed to. Nearby support has moved back to $8.74. Assuming you have made sales on the way up, I would be looking for $9.30 as my next target (this would be the 200-day moving average). If you missed this rally I would be looking to make catch up sales at $8.85, $8.94, $9.04 and $9.23.

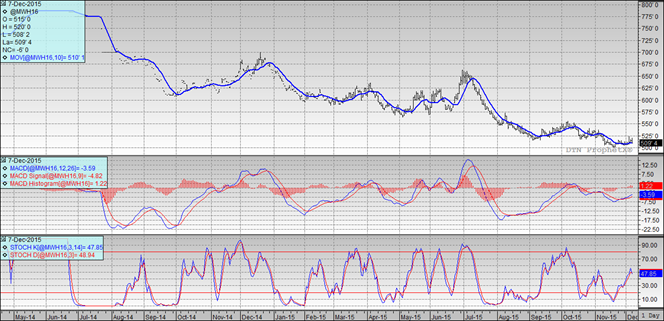

Wheat:

Values managed to be positive most of the session before succumbing to the pressures of beans. Export inspections once again under performed at 225 tmt vs 270. Shipments to-date now lag 15% behind last year.

Most expect the USDA will have to trim exports again on Wednesday with cheaper world valued taking US business. Like Russia, their currency continues to fall vs. the US keeping them the better seller. The rebound in the US Dollar didn’t help the wheat market at all today.

Technically, two of three indicators are now bullish the March Minneapolis futures. We closed below the 10-day moving average and the stochastics have crossed over to issue a sell signal. All we have hanging on right now is the MACD. On top of all that, we put in an outside day lower here as well. Not so sure it has as much bearing in a market that is lacking direction. Nearby supporst has moved back to $5.00 with today’s losses. I am still serious about pricing some wheat at $5.25 futures. this is the 50-day moving average and 33% retracement. This also nets us $5.00 cash wheat at Craven/Bowdle/Northville. If you are needing to make some catch-up sales my other target levels would be $5.13 and $5.21.

Top Trending Reads: