Closing Comments

Lynn Miller

December 2nd, 2015

Outside markets have been dramatic today and could pressure us tomorrow. Crude is down over $1.00/barrel under concerns of large supplies. US crude stocks have risen by 1.2 million barrels in the past week. Then there’s the dollar, which is working on a 12 ½ year high on the strong ADP employment survey and expectations the Central Bank of Europe will boost monetary stimulus measures tomorrow.

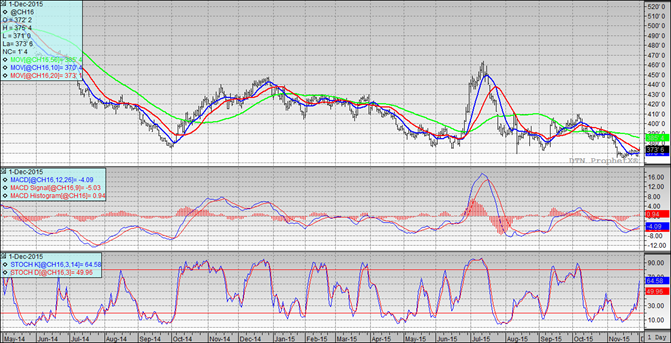

Corn:

Lack of any new fundamental news and ethanol numbers that were anything but stellar kept values drifting lower. Ethanol production was off 52,000 barrels per day from last week at 956K barrels/day and stocks continue to rise on shaky margins.

The trade is expecting another poor week of export inspections at 650-800 tmt. Brazil’s FOB advantage over US sourced corn has disappeared. Let’s hope this boosts some export business in coming weeks.

Technically, all three indicators are bullish the March. We saw an outside day higher yesterday in this March contract, which could be signaling a change in trend. Nearby support continues to hold at $3.64. Now that the bid has changed to the March, my selling targets are $3.75, $3.82, $3.87 and $3.92. You can see below that we once again traded through the 20-day moving average (green line). The next goal, maintain momentum, would be to trade to the 50-day moving average at $3.85.

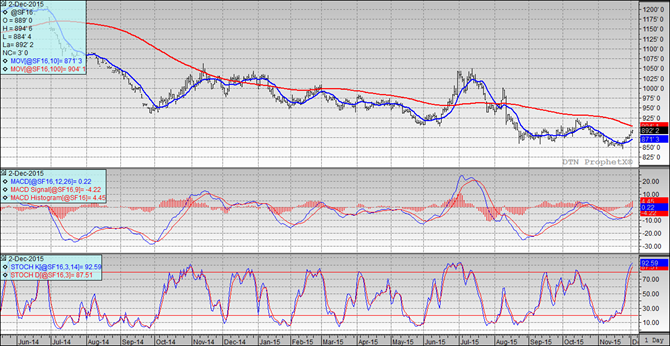

Soybeans:

Oil share buying and fund short covering kept beans higher today. Concerns of a wet Rio Grand DeSol and Parana Brazil also on the trades radar. Maybe we can start to forget that the US has a large bean crop and start to build in some weather premium as Brazil conditions are becoming less than ideal. The trade is still waiting to see what the new presidency will mean for export taxes and currency in Argentina.

Export inspections anticipated between 800 – 1,100 mt.

Technically, all three indicators remain bullish the March futures. The stochastics remain in oversold territory. Nearby support held today at $8.85. My next major selling point would be at the 100-day moving average (red line) of $9.04. Additional selling targets are $9.23 and $9.48 on the high side.

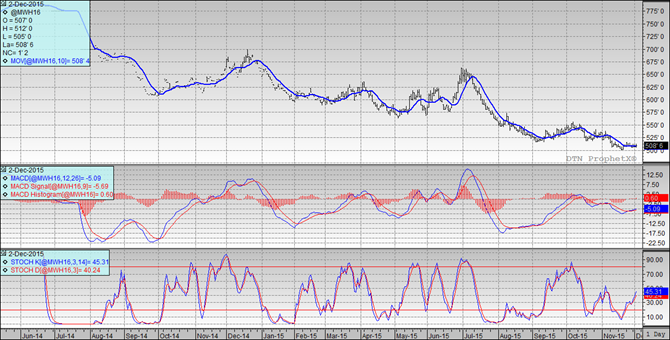

Wheat:

The steep rally in the dollar continues to weigh heavy on wheat as it keeps us out of the world export market. Right now, it’s cheaper to send Soft Wheat to Mexico from France than from the US Center Gulf. Meanwhile, Argentina is reminding us the world has a lot of wheat as they announced they have 350 million bushels of wheat to sell.

Technically, all three indicators remain narrowly bullish the March Minneapolis futures. The stochastics appear to be comfortable in buy mode here. Nearby support continues to hold at $5.00. My selling targets have not moved: $5.13 (which has now been our high for three days in a row) $5.20, $5.27 and $5.34. If we can sustain a rally here we need to be ready to make some sales at $5.00 cash wheat.

Top Trending Reads: