Lynn Miller

Closing Comments

Lynn Miller

November 24th, 2015

Total disappointment on my part that there was zero follow through on the key reversals we say yesterday. Although, none of the price actions today totally voided the signal either. Just because, I’m going to blame this one on Turkey having the guts to shoot a Russian war plane out of the sky last night and then kill one of the pilots after they ejected. You just know there isn’t anything else fundamentally negative out there … (cough, cough)

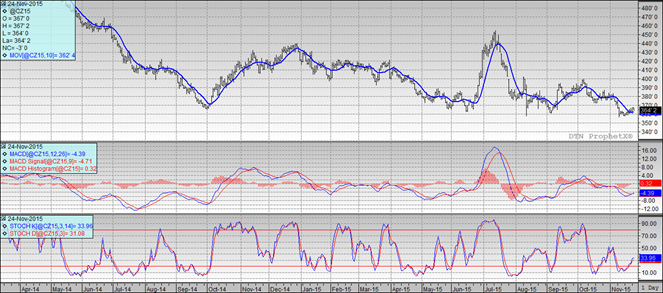

Corn:

Poor export demand and poor ethanol margins were the headliners causing us the major grief today. Eastern Corn processors are rumored to be slowing grind in light of negative margins. This is bad for basis levels as they have been the main drivers the last few weeks.

To add insult to injury, the USDA released their farm sector profitability forecast today. Net farm income is expected to decline 38% from 2014. No big surprise here with the value of crops and equipment continuing to fall. Grain and oilseed cash receipts are expected to decline 8.7% while cost will fall 2.3% (first drop in costs since 2009). The expectation is to also see land values state to decline – about 1.6% this year.

Technically, all three indicators are bullish the December futures. Nearby support is now back at $3.50 since we couldn’t hold above $3.66 today. My selling targets are still $3.73, $3.78 and $3.83.

f

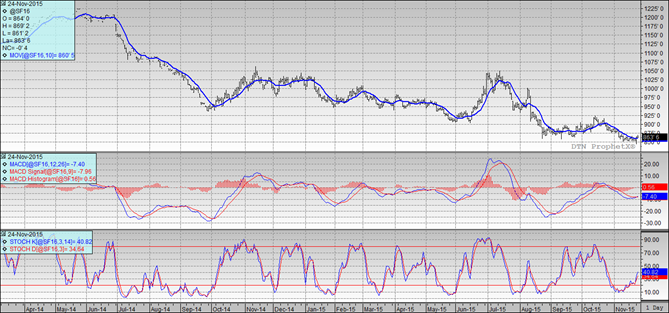

Soybeans:

While the Argentina presidential election is still capping some upside potential here, Macri is finding he has some obstacles like: a smaller margin win than expected, a minority coalition in congress and a dedicated opposition to slow his policies. So change there will take time. Meanwhile, in Brazil, their currency continues to strength, not at 3 month highs against the US Dollar.

Then there’s the Chinese export game in beans. It appears China is keeping us hand to mouth here staying current with its shipped vs. sales ration which could mean they expect to shift to South American beans earlier than normal. If this would happen, USDA could be Overestimating demand by 75-100 million bushels.

On the bright side – the seasonals suggest soybeans tend to rally the day before and after the Thanksgiving holiday.

Technically, all three indicators remain bullish the January futures. Nearby support returns to $8.50 with a close below $8.63 today. My selling targets remain $8.70, $8.75, 8.85, $8.95 and $9.05 on the high side. I would be willing to let go of some beans at $8.00 cash the way this market has been treating us.

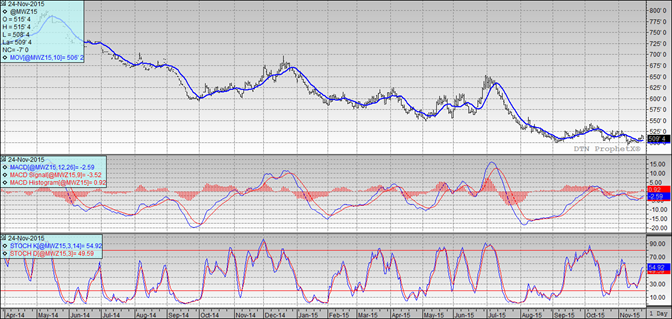

Wheat:

Wheat conditions were improved for the 4th or 5th straight week as the south continues to get nice moisture that took the wind out of the market’s sales. Declining open interest in front of first notice may have triggered some long liquidation.

Export sales will be delayed to Friday due to the holiday. On that note, tensions between Russia and Turkey may be shifting export demand to the U.S. Since Russia has supplied the majority of Turkey’s wheat and natural gas prior to today’s incident.

Technically, all three indicators remain bullish the December Minneapolis future. Nearby support has returned to $4.99 with a close below $5.14. My selling targets are now $5.20, $5.26 and $5.45. If we can sustain a rally here we need to be ready to make some sales at $5.00 cash wheat.

Exports inspections this morning expected to be good for beans again near 70 million bushels, ho-hum for corn around 25 million and average for wheat at 12 million.

Top Trending Reads: