Closing Comments

Lynn Miller

December 3rd, 2015

After 12 ½ year highs yesterday, the Dollar is on shakey ground today, selling off more than 217 points for the day. Why? Most of the credit goes to a market that was overly bearish the Euro currency ahead of the European Central Bank’s (ECB’s) reveal of the new easing policy released today. The European Central Bank president, Marion Draghi, on Thursday unveiled new policy-easing measures that fell short of dizzy expectations. The main lesson for investors: pay less attention to central banks. This big of break would totally encompass the gains we say across the board today without any more bullish news.

Something to remember, this sudden drop in the dollar may not stay and it doesn’t change that fact that there is just a lot of grain in the world which in the long term could continue to weigh on prices. Please be diligent and take advantage of rallies when we see them!

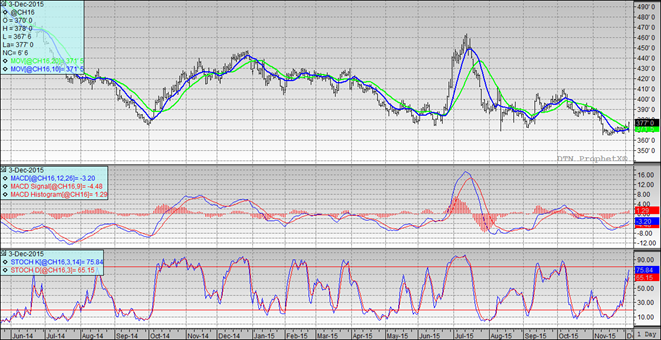

Corn:

The fact Europe did not cut interest rates far enough and talk the the global non-food/energy inflation may be turning up for the first time in 15 years.. that gave us something to trade today. Funds were credited with buying 7,000 contracts today.

So yesterday we talked about Brazil finallyl being even to the US, instead of the cheapest place to source corn. With the break in the dollar today, the US should be the cheaper bid.

Exports today were 499.4 tmt vs 1170 last year. Commitments running 25% behind last year and 21% behind the USDA expected pace.

Technically, all three indicators are bullish the March. We posted yet another outside day higher as this contract went screaming though the 2-day moving average and closed near the high side of the trade range. Nearby support could very well have moved up to $3.75 if it can hold tomorrow. My next real selling target is $3.85 the 50-day moving average level.

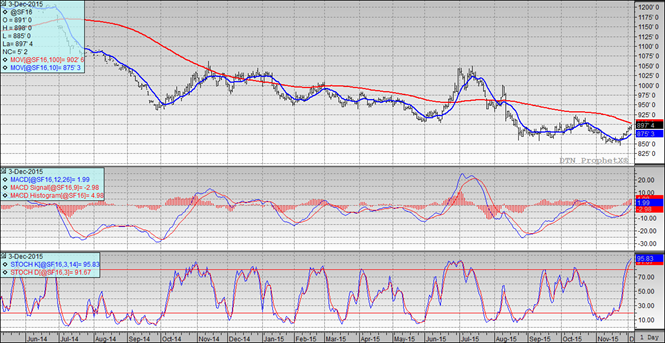

Soybeans:

Beans took a while to get rolling today, but when they did we managed to close near session highs which is good from the concept of follow through in the overnight. The break in the dollar may have also triggered short covering here with the funds thought to have bought 6,000 contracts.

President elect Macri in Argentina came under pressure from soy processors today. As they reminded him of his campaign promise to lift restrictions for imports from Brazil, Uruguay and Paraguay. Doing so would provide competition to local farmers and keep prices in line with world values. It would also probably prompt early domestic sales ahead of their pricing deadline

Export sales today were 878.3 tmt vs 1179.7 one year ago. Commitments continue to run 21% behind last year.

Technically, all three indicators remain bullish the March futures. The stochastics remain in oversold territory. Nearby support held today at $8.85 or did we move it up to $8.93? My next major selling point would be at the 100-day moving average $9.03. Additional selling targets are $9.23 and $9.48 on the high side.

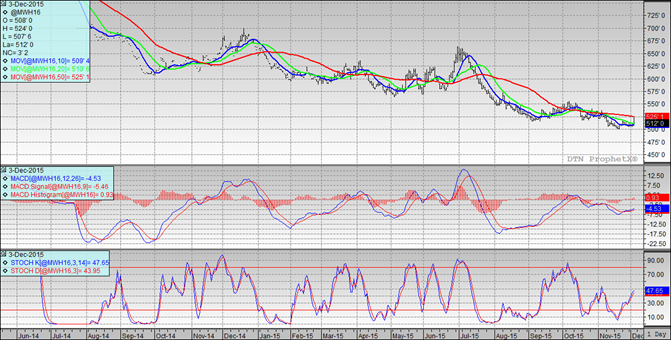

Wheat:

Wheat managed to reject yesterday’s lows and soar for a while during the session as selling the dollar was good for commodities in general. Funds were thought to cover 9,000 of their large short today. Look for the potential for some follow-through tomorrow.

The lower dollar should mean increased world competiveness; however, the Russian Ruble managed to drop against the dollar, keep Black Sea offerings cheapest. Export sales today were 392.2 tmt vs 319.2 last year. We still lag last year by 15%.

Technically, all three indicators remain bullish the March Minneapolis futures. The stochastics appear to be comfortable in buy mode here. Nearby support continues to hold at $5.00, however we closed just off the next support level of $5.13. Right now I would be serious about pricing some wheat at $5.25 this is the 50-day moving average and 33% retracement. This also nets us $5.00 cash wheat at Craven/Bowdle/Northville.

Top Trending Reads: