Closing Comments

Lynn Miller

November 27th, 2015

Free DP on Soybeans – effect immediately for all new deliveries. So be sure to take advantage of the nice weather for hauling!

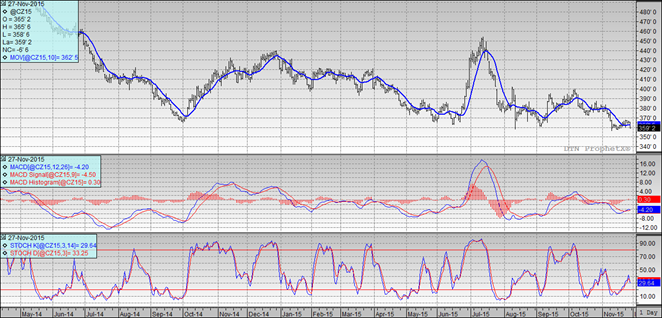

Corn:

Corn traded 4-5 lower most of the session with general commodity weakness over powering good exports. Weekly exports came in at 2.04 mmt, above the trade guess. Ethanol margins remain pressured with energy weakness today (crude was down $0.90 at one point). Bigger downside potential exists if ethanol margins turn bad enough to slow production.

Technically, two of three indicators are now bearish the December futures with on the MACD holding on to the bull-side by just a little bit. Nearby support continues to hold at $3.56. My selling targets haven’t changed. I’m willing to sell bushels at $3.66, $3.73, $3.78 and $3.83.

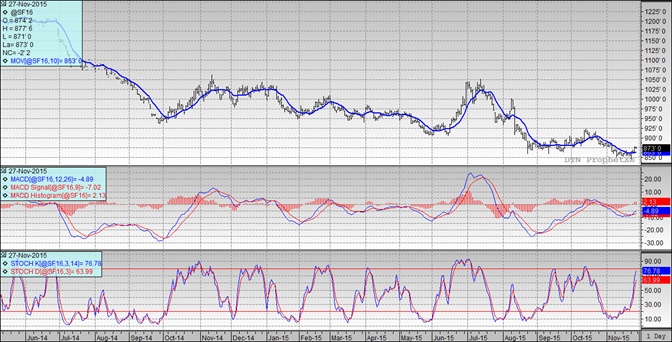

Soybeans:

Beans traded mixed the majority of the session seeing some commercial support after decent export sales. Exports came in at 1.17 mmt.

Remember we noted the key reversal here on Monday night? Well, that upside momentum remains in play. Since we managed a close over the 20-day moving average ($8.67) at $8.73 we now have two closes over the 20-day may bring in chart buying Sunday night.

Technically, all three indicators remain bullish the January futures. Nearby support $8.63 held throughout today’s session. My selling targets remain $8.70, $8.75, 8.85, $8.95 and $9.05 on the high side.

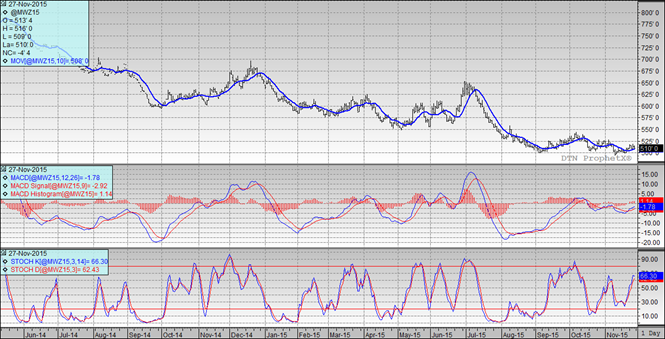

Wheat:

Wheat is just a commodity that is going to struggle. A stronger US dollar keeps the trade focuses on lesser demand. US weekly exports continue to confirm fears as the numbers were once again below expectations at 304mt. Weather conditions are improving in the US as well as Russia.

Technically, all three indicators remain bullish the December Minneapolis future after today’s session. Nearby support holds at $5.05 with $4.99 below that. The stochastics are tipping downward in neutral territory. My selling targets are now $5.12 $5.20, $5.26 and $5.45. If we can sustain a rally here we need to be ready to make some sales at $5.00 cash wheat.

Top Trending Reads: