Closing Comments

Lynn Miller

November 20th, 2015

South Dakota Holiday tomorrow – Opening East River Deer Season.

You all hunt safe – and get a big one!

Corn:

Another 2-sided trade today that managed to end near unchanged. Farmer selling remains absent as the futures refuse to rally. The trade is already looking forward and expecting at least two more weeks of light sales due to strong competition and the upcoming holiday.

Since the deadline to roll contracts is fast approaching, let’s take a look at some of the factors affecting that spread. December Open Interest is at an all-time high, this lends to the question who is short futures? With basis levels this narrow is appears the short December futures are out of position and if the basis continues to narrow the best thing a shipper can do is stay long and force delivery. This should cause the spreads to keep tightening to help encourage commercial sales. If this would start to force the spread even narrower, that is lost money to you guys holding December futures contracts. Deadline to get these rolls done is next Wednesday. You might be a head a couple penny’s to get it done sooner than later.

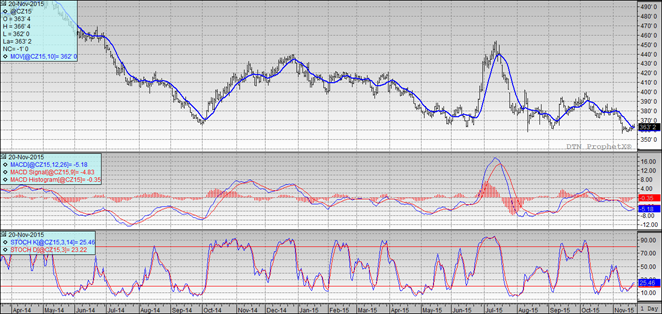

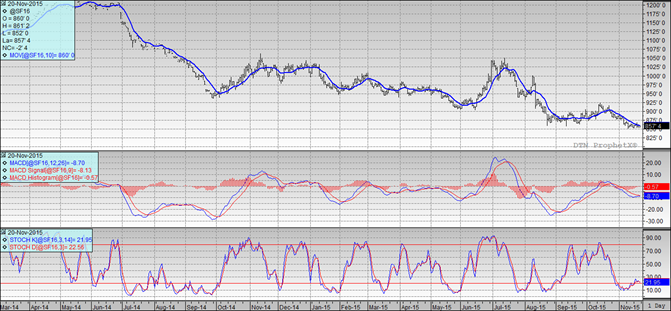

Technically, two of three indicators are now bullish the December futures. The stochastics are in buy mode and we managed a close over the moving average; however the MACD is still closing the gap. Support continues to hold at $3.56. I would be looking to get in on any pop we might get from a technically driven rally. My offers would be in at 3.66, 3.73, 3.78, 3.83 and 3.94.

Soybeans:

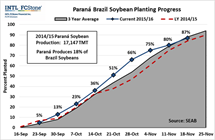

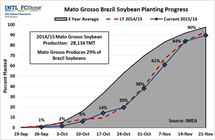

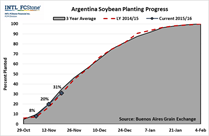

Favorable weather in South America continues to be a negative to the bean market, but to put it in perspective the real lagging problem is Argentina where they have only planted 33% of their expected bean crop. Some of the hesitation here has been waiting of the presidential election (which takes place tomorrow) and not solely poor planting conditions. Brazil is once again forecast for decent rains.

Brazil’s currency strengthened to a 2 ½ month high against the US Dollar, that will take away some of their advantage. USDA announced a 120tmt sale to unknown (probably China). Other than that, sales announcements have been relatively slow this week, leading the trade to think we will get lower numbers in next week’s reports.

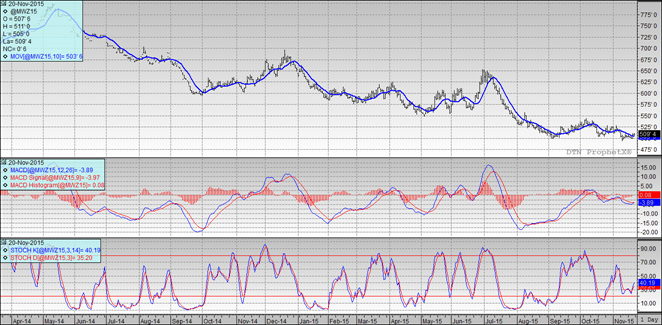

Technically, all three indicators are now in bearish mode for the January futures, so much for “coming together”. $8.51 continues to hold as nearby support, if this would take another mover lower we are probably looking at about $8.32. My selling targets now would be $8.70, 8.80, $8.90 and $8.95 and $9.05 on the high side. In an ideal world, I would really like to sell at anything close to $9.00 futures, but I’m not sure we want to wait that long.

Wheat:

A choppy market today ended unchanged in our little corner of the world. All eyes are on the spread action right now with the Dec/March spread continuing to narrow. It ended the day inverted ¾ of cent. If you are sitting on Basis Fixed Spring wheat – this might be your chance to get it rolled without costing you.

US values continue to be low enough for the time being to buy in some much needed export business. We still have a ways to go ($18/ton) to take business away from the FSU though.

Argentina’s leading presidential candidate see wheat acres doubling to 8 mln hectare in the next two years with the implementation of his new ag policies.

Technically, two of three indicators remain bullish the December Minneapolis futures today. The stochastics are in buy mode and we traded the whole day above the moving average. All that’s left is for the MACD to come together. $4.99 continues to hold as nearby support. My selling targets would be $5.07, $5.15, $5.20 and $5.30. If this move gives us $5.00 cash wheat, I think we need to be making some sales!

Top Trending Reads: