Closing Comments

Lynn Miller

January 6th, 2016

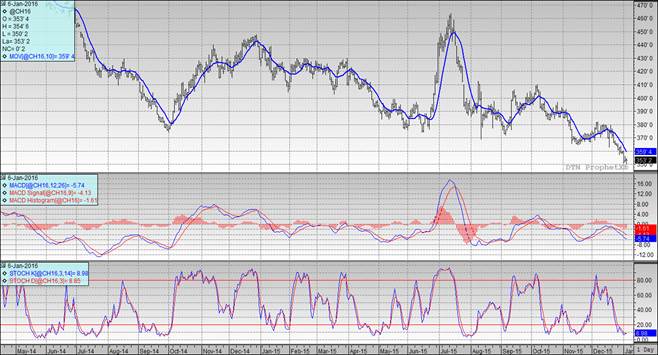

Corn:

Ethanol numbers were out this morning 996 thousand barrels/day. That’s a weekly grind of 104.58 million bushels; however, stocks are back on the rise and margins continue to be on the defensive. Export sales out tomorrow with the trade looking for 400-600 mt vs. 705 last week.

Informa today DROPPED the world corn crop 1mmt due to the significant drought in S. Africa. They also reduced the expected corn crop in Argentina to 22 mmt.

Technically, all three indicators continue to be bearish the March futures. We continue to fall away from the moving average and the MACD is edging wider. The stochastics want to issue a buy signal, but just are not quite there. Nearby support continues to hold at $3.48. My selling targets would be $3.62, $3.66, $3.70, $3.75, $3.82 followed by $3.92.

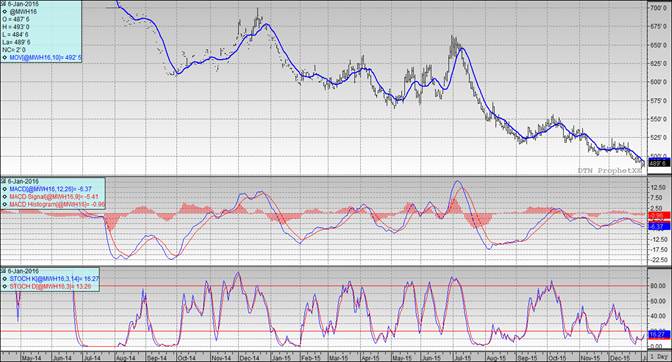

Soybeans:

Talk China was pricing futures today kept beans supported. The question now is $8.50 a level of significant support? Informa left S.American estimates unchanged with Brazil at 101.4 mmt and Argentina at 58.5 mmt. Export sales will be out tomorrow and the trade is looking for 400-700 mt vs 478 last week.

Technically, two of three indicators continue to be bearish the March futures. The stochastics have issued a buy signal and we managed to trade up to the 10-day moving average(although closed off that level). We did have an outside day higher today, granted, not may indicators have held much strength, but this could signal a start to an uptrend. Nearby support continued to hold today back at the $8.47 level established on November 23rd. My selling targets would be $8.72, $8.80, $8.88, $8.95 then $9.12 if you really want to reach.

Wheat:

Wheat managed small gains today despite the funds increasing their short position. World supplies remain high, lack of exports and continually improving 2016 crop conditions keeps this market at bay. Even though all these things reflect the current market, the increasing short of the funds leaves wheat vulnerable for bounces on either positive economic news or unexpected weather stories.

Technically, two of three indicators remain bearish the March Minneapolis futures. The stochastics are still in buy mode in oversold territory, we managed to touch the 10-day moving average at our high today and the MACD has turned upward. The charts here also show an outside day higher that may help initiate some additional short covering. Nearby support continues to hold at $4.82. My price targets now would be $5.10, $5.20, $5.28 and $5.39.

Top Trending Reads:

Topics: Grain Markets

- A Visual History of Google Algorithm Changes [Infographic]

- Can a Career in B2B Marketing Be Fulfilling? [SlideShare]

- A Sampling of the Sexiest Business Blogs on the Internet