Closing Comments

Lynn Miller

January 8th, 2016

Since news is thin at best today, and I get tired of sounding like Pete and Repeat, I’m just going to touch in general on the markets. Domestic basis levels stay firm as famer selling remains nill. US stocks were mixed despite higher Chinese stocks. US jobs report was better than expected (watch out interest rates?). Dollar was slightly higher with a good jobs report and crude was mixed as it battles huge supplies vs. mid-east tensions.

The funds continue to be record short in all commodities, leaving the door open for a short covering rally as we come into Tuesday’s Dec 1 stocks report and monthly Supply & Demand. Since market reactions are quick and really tough to grab on report day, it would be a good time to get a target working to cover any knee-jerk reactions that could be in your favor.

With weather offering nothing in the way of support right now most expect this market to trade neutral to lower.

Corn:

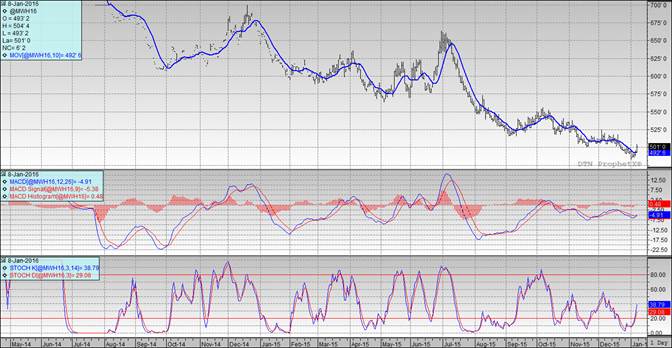

Technically, two of three indicators have turned bullish the March futures. The stochastics are in buy mode and we finally managed to trade up to the moving average. Only thing left to turn would be the MACD and it made a swift move upward today so we are on the right track. Nearby support continues to hold at $3.48. My selling targets would be $3.62, $3.66, $3.70, $3.75, $3.82 followed by $3.92.

Soybeans:

Technically, two of three indicators have now turned bullish the March futures. The stochastics continue to be in buy mode and we finally blew through the moving average. Only lagging indicator is the MACD and that is coming together. Nearby support continued to hold at $8.47. My selling targets would be $8.75, $8.82, $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

Technically, all three indicators are now bullish the March Minneapolis futures. Nearby support continues to hold at $4.82. My price targets now would be $5.10, $5.20, $5.28 and $5.39.

Top Trending Reads:

Topics: Grain Markets

- A Visual History of Google Algorithm Changes [Infographic]

- Can a Career in B2B Marketing Be Fulfilling? [SlideShare]

- A Sampling of the Sexiest Business Blogs on the Internet