Closing Comments

Lynn Miller

January 11th, 2016

Another quiet news day leaves us with nothing new to talk about. The dollar is still strong enough to keep us out of the world market as other currencies fall comparatively. World stocks are huge and weather has yet to provide a good story. And, crude oil continues to fall.

On the other hand, tomorrow is the December 1 stocks and monthly supply and demand report. So if nothing else, we will have something to trade a little bit tomorrow. Funds were obviously not shy about extending their short positions today ahead of the report, so let’s look at what the trade is expecting and what history has to tell us.

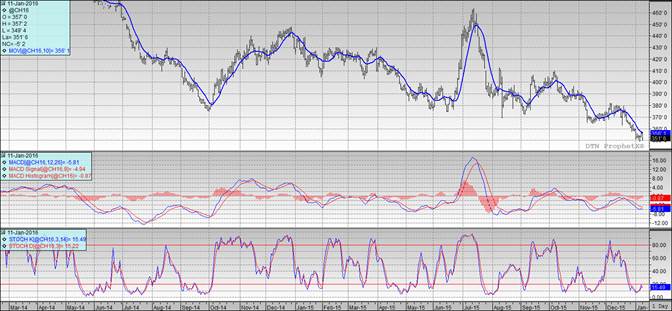

Corn:

Export sales today were 22 million bushels vs. 20 last year. Talk of cheap South American feed wheat and Blue Light specials out of the Black Sea could reduce final US exports even more.

As far as what to expect from the report tomorrow:

Most feel final crop yield could be higher than November.

5 of the last 9 years Dec 1 stocks were below the average trade guess.

Technically, only one of our three indicators remains bullish the March futures today. We moved significantly away from the moving average and the MACD remained flat; however, the stochastics are still in buy mode and in oversold territory. Nearby support continues to hold at $3.48. My selling targets would be $3.62, $3.66, $3.70, $3.75, $3.82 followed by $3.92.

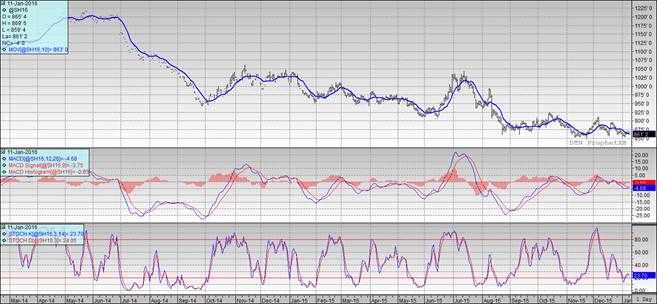

Soybeans:

Weekly export sales were 46 million vs. 68 last year. Many feel increased competition from South America will limit US sales from this point forward.

As far as what to expect from the report tomorrow:

In 6 of the last 9 years, final crop was bigger than the November estimate.

In 7 of the last 9 years Dec 1 stocks were below the average trade guess.

Many feel US carryout will be increased this year due to lesser demand.

Technically, all three indicators are once again bearish the March futures. The stochastics continue to near neutral waiting for a reason to buy in. We spent the day above the moving average to close just below it; however, the MACD is still trying to come together. Nearby support continued to hold at $8.47. My selling targets would be $8.75, $8.82, $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

Weekly exports were 14 million bushels vs. 9 last year. Funds re-sold the 6,000 contracts they bought on Friday to take away last weeks gains.

As far as what to expect from the report tomorrow:

In wheat the biggest numbers will be 2016 winter wheat acres. 7 of the last 8 years USDA has been lower than the average trade guess.

If you can believe it, even today’s poor price action kept Minneapolis Wheat’s technical pretty much in order as all three indicators continue to be bullish. Nearby support still sits at $4.82. My price targets now would be $5.10, $5.20, $5.28 and $5.39.

Top Trending Reads:

Topics: Grain Markets

- A Visual History of Google Algorithm Changes [Infographic]

- Can a Career in B2B Marketing Be Fulfilling? [SlideShare]

- A Sampling of the Sexiest Business Blogs on the Internet