Closing Comments

Lynn Miller

January 13th, 2016

One concern I hear coming from the USDA report yesterday is the decrease in planted acres. USDA shows all major crops covered 307.0 acres. 2014 total planted acres reached 313.6 that’s nearly a 4 million acre loss. And, they say we planted 3 million less wheat acres so far. Now we have a shortage of 7 million acres. Do you think the American farmer will plant less acres in 2016?

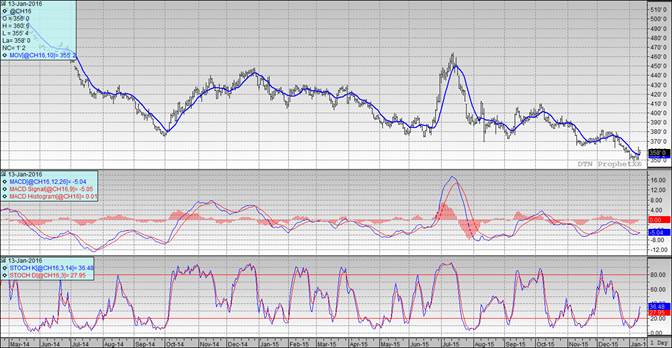

Corn:

Corn futures slightly higher today, but appearing that lower energy prices are muffling the market. Ethanol number out today, production was once again higher than previous weeks and stocks are growing even though margins are shrinking.

Export sales out tomorrow morning estimated between 400 – 650 mt vs. 253 last week.

Technically, all three indicators can finally be called bullish the March futures. Nearby support has moved up to $3.56 with today’s price action as we managed a close of $3.58. My selling targets haven’t changed. I would still be willing to part with bushels at $3.62, $3.66, $3.70, $3.75, $3.82 followed by $3.92.

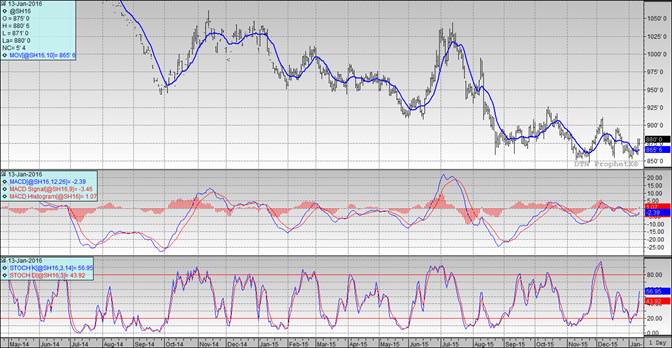

Soybeans:

I understand they are having some loading difficulties in S. America that maybe pushing Chinese demand back to the US. This is probably the majority of what supported our prices today.

Export sales out tomorrow, expectation is 900 -1,300 mt vs. 639 last year.

Technically, all three indicators remain bullish for the March futures. Now we wait for this market to tell us to sell in order to get the most out of this recent rally. Nearby support has moved up once again to $8.75. If I was sitting on a lot of beans that needed to move, I would be willing to sell here at $8.75, mostly because I’m not a good gambler and second because I know how fickle this market has been recently. Targets above this level would be $8.82, $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

Wheat managed nice gains yesterday that trickled into the day session on some short covering. But when the dollar turned lower today so did the wheat trade. World wheat prices failed to follow the US higher to offer its own resistance today.

Export sales tomorrow expected to be between 150-350 mt vs. 76 last week.

Technically, all three indicators remain strongly bullish the Minneapolis March futures. The stochastics are fickle buggers, and usually the first to signal. Today’s action has the RSI at about 68, which is approaching overbought. Nearby support still sits at $4.82. My price targets now would be $5.10, $5.20, $5.28 and $5.39.

Top Trending Reads:

Topics: Grain Markets

- A Visual History of Google Algorithm Changes [Infographic]

- Can a Career in B2B Marketing Be Fulfilling? [SlideShare]

- A Sampling of the Sexiest Business Blogs on the Internet