Closing Comments

Lynn Miller

January 14th, 2016

Corn:

A basically unchanged market that teetered either side of unchanged was what we got today as demand stay stagnant and no we have no real supply threat out there to give us momentum.

Export sales this morning came in at 669,200t vs the tradeguess of 400 – 650,000t, so not too shabby. USDA did announce a 102,100 mt sale to Mexico today. Poet announced its plans today to add 25 million gallons per year in plant capacities across South Dakota, Iowa and Michigan plants.

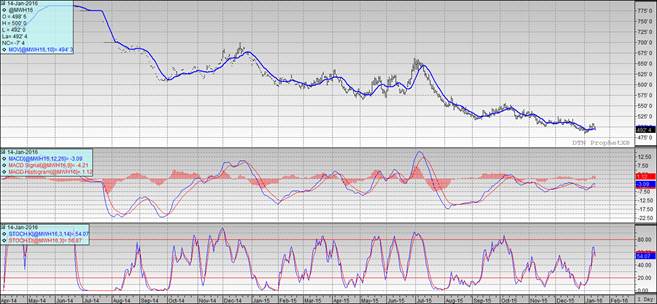

Technically, all three indicators continue to be bullish the March futures. Nearby support maintained at $3.58. I would still be willing to part with bushels at $3.62, $3.66, $3.70, $3.75, $3.82 followed by $3.92.

Soybeans:

January futures expired today, going off the board as high as $9.00, now we sit back and see if the March contract will challenge that level. South American weather continues to be seen as favorable the next 10-days.

Export sales came in at the middle of the trade guess at 1.127 mt (estimates were 0.9-1.3mt)

NOPA crush numbers will be out tomorrow with the trade looking for 157.8 million bushels vs 156.1 in November.

Technically, all three indicators remain bullish for the March futures. Now we wait for this market to tell us to sell in order to get the most out of this recent rally. The stochastics skyrocketed today and are quickly approaching overbought territory. Nearby support continues to hold at $8.75, but is testing $8.82 on the close. If I was sitting on a lot of beans that needed to move, I would be willing to sell here, mostly because I’m not a good gambler and second because I know how fickle this market has been recently. Targets above this level would be $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

Wheat was on the defensive nearly all day. Loss of acres isn’t enough to override the lack of export demand and large US stocks. Export sales came within the trades expectations at 274,700t. Jordan is tendering for 100,000 tons of hard milling wheat of optional origin.

Technically, two of three indicators have turned bearish the Minneapolis March futures with only the MACD lagging. We closed just below the moving average and as predicted, the stochastics were the first to signal sell. Nearby support continues to hold at $4.82. My price targets now would be $5.00, $5.10, $5.20, $5.28 and $5.39.

Top Trending Reads:

Topics: Grain Markets

- A Visual History of Google Algorithm Changes [Infographic]

- Can a Career in B2B Marketing Be Fulfilling? [SlideShare]

- A Sampling of the Sexiest Business Blogs on the Internet