Closing Comments

Lynn Miller

January 15th, 2016

Corn:

Talk that US Corn is becoming more competitive in world markets was the only spark we needed today to get us a fairly decent gain. With little in any fresh news to trade, the thought of improved exports was welcome. This alone could have scared the extremely short funds into covering some risk coming into a three-day weekend. Then you have reluctant farmer selling to help keep basis markets firm.

South Africa’s Ag Minister reiterated the dire need to import corn (maize) in their drought stricken environment. The need could be between 5 & 6 million tons.

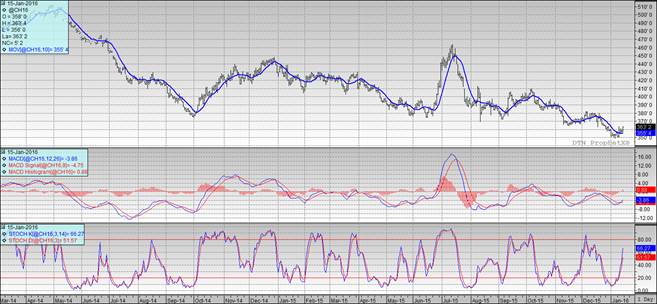

Technically, all three indicators continue to be bullish the March futures. Nearby support has crossed over and should now sit at $3.61. Next sales targets would be $3.66, $3.70, $3.75, $3.82 followed by $3.92.

Soybeans:

No fresh news to trade in beans kept the focus on the big picture. There were overnight deliveries of meal, weak NOPA crush numbers and no changes to South American weather were all forefront on the trader’s minds. Couple that with the overall strength of the dollar and large US stocks and we don’t have much to add value today.

Technically, all three indicators remain bullish the March futures even after today’s poor prices. Now we wait for this market to tell us to sell in order to get the most out of this recent rally. The stochastics are sitting at 79, right at the overbought area. The MACD is not ready to back off and we remained over the moving average. We need good news Tuesday to keep some upward momentum. Nearby support continues to hold at $8.75 after failing to close over $8.82. My selling targets are still $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

I am certain that there had to be some short-covering going on today to keep wheat higher in midst of no good news. All though the wires were relatively quiet, there was talk that Argentine wheat supplies were now making their way into the US. 2 cargoes to be exact, due into the Wilmington, NC prot. European wheat futures fell to new contract lows, again, this will keep the competition on for world wheat supplies.

Technically, two of three indicators are bullish the Minneapolis March futures with the MACD in buy mode today. We closed above the moving average with the stochastics confused. Nearby support continues to hold at $4.82. My price targets now would be $5.00, $5.10, $5.20, $5.28 and $5.39.

Top Trending Reads: