Craig’s Closing Grain Market Comments

January 05, 2015

Watching the markets the past few sessions I have been reminded of French philosopher Baudrillard who once observed, "Truth is what we should rid ourselves of as fast as possible and pass it on to somebody else. As with illness, it's the only way to be cured of it. He who hangs on to truth has lost." This kind of resonated with me because when it comes to the market there can be many truths. The truth is that we have great demand from China. The truth is we have historically large carry-outs. With competing truths we tend to embrace the truth that represents what we want to have happen and often that leads to poor results so, at least when it comes to markets, old Baudrillard may be on to something. I suppose that I should add the disclaimer that at least in my opinion, when applied to a holistic view of “TRUTH” I think Baudrillard and his observation are full of bovine extract.

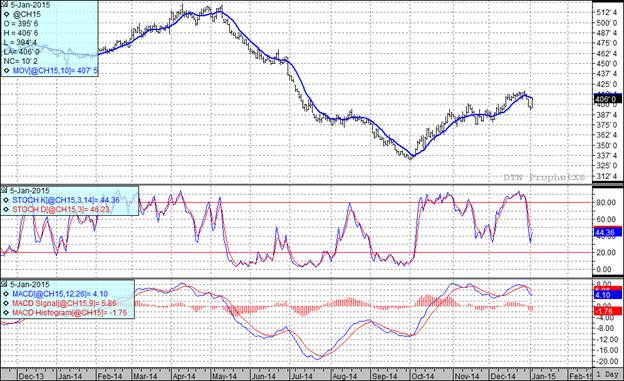

Corn:

The fund giveth and the fund taketh away. Last week we saw the funds sell 17,000 contracts of corn and today they reversed course and were buyers of 10,000 contracts for the session.

We did have some news today as the weekly export inspections were out showing 21.217 million bushels inspected for export last week. That was less than the bottom end of trade guesses but had no impact on today’s price as profit taking and position evening ahead of next week’s USDA report took us higher. At the end of the day this still looks like a sideways market and I would expect that we will remain range bound until some fresh news either inspires or depresses the traders.

All three of my technical indicators are bearish. At the end of the day we are still trading in a sideways range. Between now and the January report we may very well go back and test the recent high at $4.17 and of course we still have the gap that we would need to move up to $4.26 in order to fill. If we get in the $4.17 to $4.26 range it will probably be a good selling opportunity.

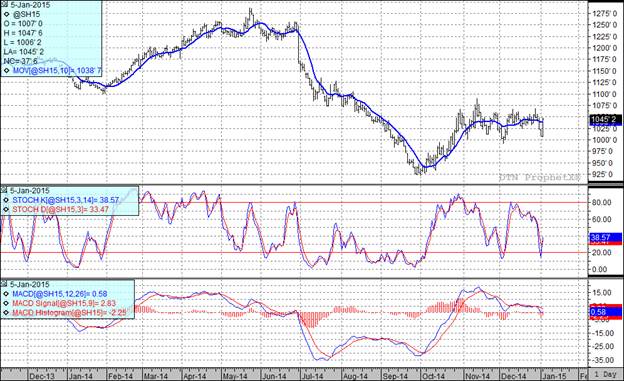

Soybean:

Weekly exports came in at 51.679 million bushels, at the top end of trade guesses. In addition to this we had a new sale to China announced and the crush margins in China are also improving which is positive. On the weather front I have had some traders tell me that southern Brazil is too wet while in north eastern Brazil there are drought concerns. With good business and weather concerns the trade had no trouble shaking off the higher dollar and moving sharply higher for the session. On the rally we did see an increase in selling by the Brazilian farmers but with the funds being buyers of 9,000 contracts for the session I think it may be reasonable to expect that they may have more buying power. Do not be surprised if the March futures get back into the upper $10.60’s while the November futures could take a shot at $10.45.

I looked at my technical indicators today and found myself humming the old Meatloaf song, “Two out of three ain’t bad.” I am probably the only guy in the continental United States who looked at a soybean chart today and thought of Meatloaf but such is the state of my mind today. I guess what I am saying is that with today’s close, two of my three technical indicators are now back into the bullish camp and as Meatloaf once sang, two out of three ain’t bad. Now, as far as the technical indicators go, I suppose I could write all night; But that ain't gettin us nowhere; I told you everything I possibly can…

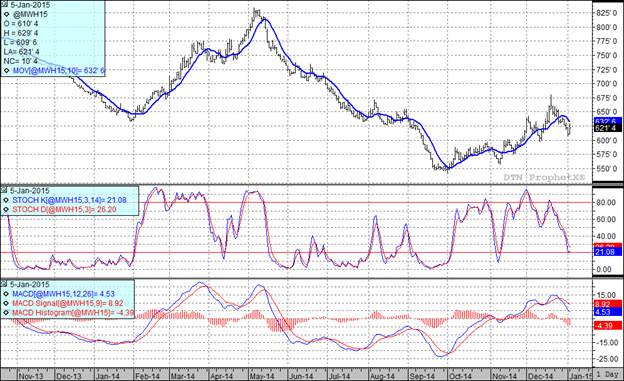

Wheat:

Weekly export inspections for wheat came in at 12.964 million bushels, towards the top end of trade expectations. Decent demand coupled with fear of winter kill in USA HRW country and Russia gave the market the support it needed today to post a nicely higher close.

In spite of today’s sharply higher close all three of my technical indicators are still currently bearish both the Kansas City and Minneapolis March futures.

Top Trending Reads:

- Grain Outlook for 2015

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

- Market Insider from the Farm and Ranch Guide

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

North Central Farmers Elevator - 12 5th Ave. Ipswich, SD - 605-426-6021.