Craig’s Closing Grain Market Comments

January 06, 2015

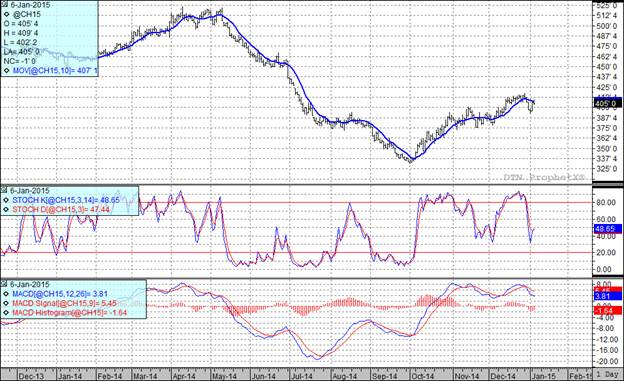

Corn:

We traded in a very tight range today and ended up slightly lower for the session. Early on in the session the news that drought could hurt second crop corn in South America coupled with some fund buying had the market a bit higher. As the day wore on so did the ability to muster any bullish enthusiasm, thus the lower close. Late morning Informa came out with a shot at projecting what the January 12 report will give us to trade. I was surprised to see them peg harvested acres at 83.5 million which is up 400,000 acres from what was reported by the USDA in their December report. They had the national average yield figured in at 172.7 bu/acre which is a little less than the last USDA guess of 173.4. This gave them a total production of 14.425 billion bushels or 18 million more than the USDA showed in the December report. I also saw an article by Bloomberg today which reported the average trade guesses for the January 12 report. Traders have a range of guesses on the national average yield which runs from 171.3 to 176.5 bu/acre. This in turn leads to total production guesses which run from 14.171 to 14.543 billion bushels. The average trade guesses are 173.4 bu/acre with total production of 14.342 billion bushels.

Two of my three technical indicators are bearish. At the end of the day we are still trading in a sideways range. Between now and the January report we may very well go back and test the recent high at $4.17 and of course we still have the gap that we would need to move up to $4.26 in order to fill. If we get in the $4.17 to $4.26 range it will probably be a good selling opportunity.

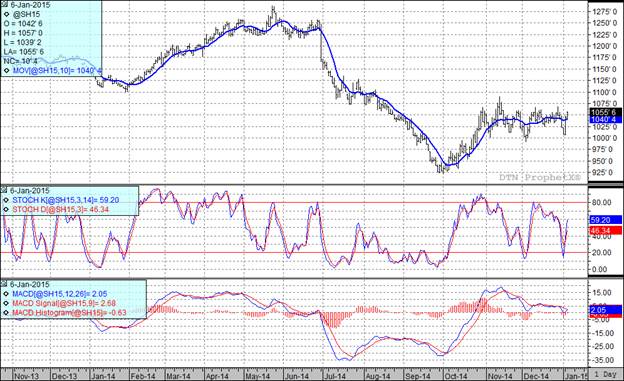

Soybean:

We had a good old fashioned weather market today. The two week forecast is still for above normal temperatures and, as you can see on the following map, below normal precipitation. That helped give courage to the bulls today as we posted another nicely higher close.

The domestic news seemed friendly today as well with many traders talking about an expected reduction in harvested acres when the January 12 report is released. Informa tends to disagree with that mindset as they left harvested acres unchanged in their report today. In fact what they offered us was a very slight tweak of the USDA’s December report. Informa came in with a projected national average yield of 47.6 bu/acre, up 0.1 bu/acre from the last USDA number. This took total production to 3.969 billion bushels or 11 million more than the USDA had in the December report. If the Bloomberg survey is to be believed the rest of the trade is clustered in that same as well with the average trade guess being a national average yield of 47.7 bu/acre and total production of 3.962 billion bushels. If we sustain this current rally into January 12 and then come out with those types of numbers I will bet my next child that the market will trade lower.

In spite of strong markets the past couple of sessions my MACD has not turned bullish although the other two indicators have. This still appears to be a range bound market so I would anticipate that unless we get some real fresh news this rally will peter out in the $10.60 to $10.70 range basis the March futures. I would also suggest that $10.45 basis the November futures might not be a bad place to make some new crop sales if we get the opportunity.

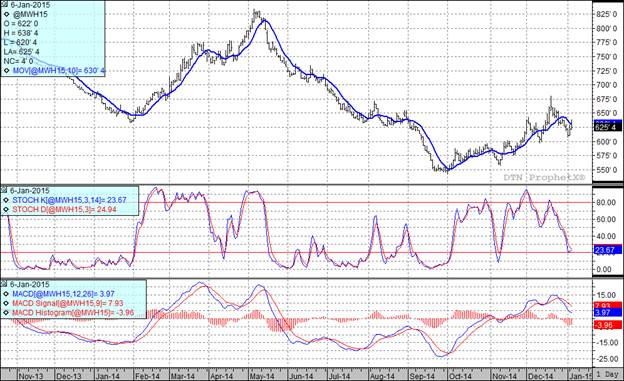

Wheat:

Concern over the cold weather both here and abroad have helped fuel the recent rally. It is interesting to note that even though the USDA is not currently releasing crop condition reports some states issued winter wheat condition ratings Mondayafternoon. As compared to the last numbers released on November 24th, the good to excellent rating in Kansas dropped from 61% to 49%; Nebraska dropped from 61% to 57%; South Dakota dropped from 69% to 58% and Illinois dropped from 56% to 24%. The crop in Oklahoma saw ratings remain unchanged at 54% good to excellent. These result s seem to be in line with the general consensus among wheat traders that 10 to 25% of SRW has been exposed to some level of winter kill. On top of that fear you can toss the rumor that China may be in the market for a few cargoes of USA wheat and you can see why we traded higher for the session.

The other piece of news today that I found real interesting were the export numbers for Ukraine. As you know, the conflict between Ukraine and Russia has had traders nervous that we would see Ukrainian exports curbed sharply. The simple fact is that between July 1, 2014 and Jan 6, 2015 Ukraine has exported a total of 19.6 MMT of grain. That compares to 19.9 MMT last year. Of this amount we see that they exported 8.2 MMT of wheat, 7.6 MMT of corn and 3.6 MMT of barley.

Oddly enough, in spite of a couple of higher closes this week all three of my technical indicators are still currently bearish both the Kansas City and Minneapolis March futures.

Top Trending Reads:

- Grain Outlook for 2015

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

- Market Insider from the Farm and Ranch Guide

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

North Central Farmers Elevator - 12 5th Ave. Ipswich, SD - 605-426-6021.