Closing Comments

Lynn Miller

January 4th, 2016

I was asked this weekend why I have nothing good to say about the markets. I wish there was something, anything out there to grab to put a positive spin on things. So I took a look today at what might be a bright spot. And all I got was that we are poised for a Turn-Around Tuesday tomorrow with all commodities being grossly over-sold. So let’s hope we get something to make us feel better about what we do. I suspect most rallies for now will be technically driven, so if you need to make sales be paying attention. At least until the change they game with the stocks report January 12th.

Corn:

Export inspections were not good today at 13 million bushels vs. 21 last year. Combine this with concerns about China, Middle East tensions, slow US exports and increased farmer selling and what you have are the makings for a stressed market. And it showed today as we put in new lows once again. Oh, then we have news from Brazil that last month’s exports were 6,267 mt vs. 3,405 last year – that’s nearly double, UGH.

Technically, all three indicators continue to be bearish the March futures. The stochastics are in deep oversold territory, but no real indication they want to turn around yet. Nearby support continues to get pushed lower with new contract lows, sitting at $3.48 currently. My selling targets would be $3.56, $3.66, $3.70, $3.75, $3.82 followed by $3.92.

Soybeans:

Well, it rained in South America, so there goes that positive we have all been waiting for. I also heard today that they are starting to combine in S.America as well, which is earlier than normal. Combine these with poor export demand and a strong dollar and, well it’s not a real rosy picture.

Export sales this morning were 52 million bushels vs. 52 ly.

Technically, all three indicators continue to be bearish the March futures. Nearby support has slipped once again, now at $8.47. My selling targets would be $8.72, $8.80, $8.88, $8.95 then $9.12 if you really want to reach.

Wheat:

Weaker global financials and strong dollar kept wheat futures at bay today and funds uninterested as they added to already record net shorts. Lack of a weather story anywhere around the world is not helping. Not that I wish ill will on anyone, but we need something to trade.

Weekly exports were respectable at 13 million bushels vs 13 last year, but season today we are lagging by 12%.

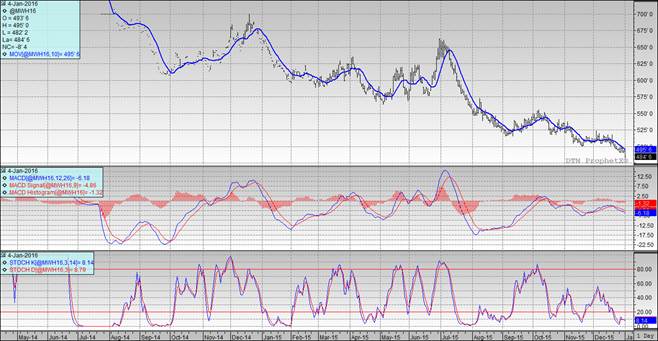

Technically, all three indicators are remain bearish the March Minneapolis futures. Just as in corn, nearby support continues to set back as we put in new contract lows, now at $4.78. My price targets now would be $5.00, $5.20, $5.28 and $5.34.

Top Trending Reads: