Craig’s Closing Comments

April 1, 2015

Corn:

We are soon going to be focused on production in this country and I suspect that in the coming days this market will live and die with each new weather forecast. Today that conversation seemed to revolve around the continuation of rain into next week throughout much of the Delta delaying planting. On the other hand field work could start in portions of the Midwest next week as conditions look warm and dry.

In terms of actual demand news today we were a little limited. The weekly ethanol report showed 99.96 million bushels of corn ground to produce ethanol last week. To hit the current USDA number we need to average 100.126 million bushels per week so we fell slightly short of the needed number this week.

The funds bought about 10,000 contracts during today’s session.

At the present time two of my three technical indicators are bearish both the old and new crop futures.

Soybean:

This market featured additional short covering in the wake of yesterday’s report. Heading into yesterday’s report the conventional wisdom was that we would be heading lower. Yesterday’s report seemed to wound if not kill that idea. If we extrapolate yesterday’s March 1st stocks number it would seem to indicate that we may end up with ending stocks of 360 million rather than the 385 million posted in the March 10 report.

At the present time all three of my technical indicators are bullish both the old and new futures.

Wheat:

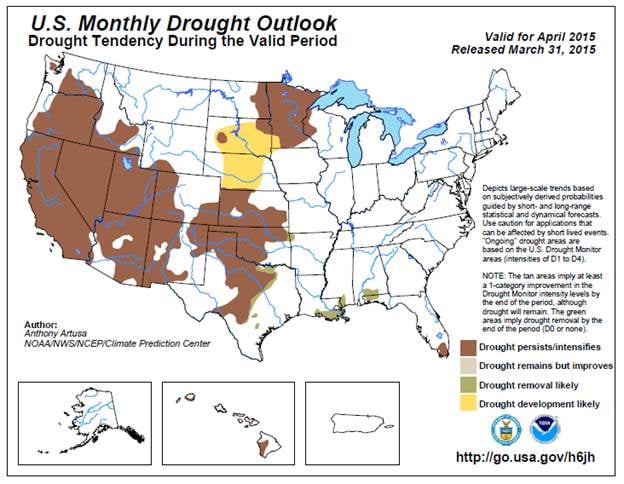

Yesterday’s report really didn’t hold any surprises for wheat. I believe what we have at play right now are some weather concerns. We have a fresh set of weekly crop conditions reports coming out for wheat on Monday. Last week we saw deterioration in the HRW crop and with the continuation of dry weather in the Plains many traders fear that the crop will continue to see worsening ratings.

At the present time all three of my technical indicators are bullish both the Kansas City and Minneapolis July futures.

Top Trending Reads:

- Grain Outlook for 2015

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

- Market Insider from the Farm and Ranch Guide

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

North Central Farmers Elevator - 12 5th Ave. Ipswich, SD - 605-426-6021.