Craig’s Closing Comments

April 2, 2015

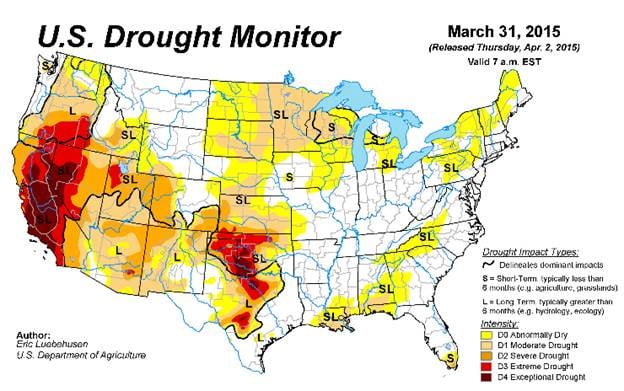

I ran the monthly drought outlook yesterday and am following it up today with the freshly released weekly drought monitor. I know it is very early and of course we have that old adage about “plant in the dust and the bins will bust” but with reduced acres of corn and a nervous trade this could be a volatile summer if the rain doesn’t come through on a regular basis.

Corn:

Funds and weather seemed to provide a bullish spark today. Funds were net buyers of around 5,000 contracts on the session as they covered short positions. Weather was a factor today as well with planting delays due to excess moisture in the Delta and drought related fears in the Western Corn Belt has some traders speculating that we could see more acres shift to soybeans.

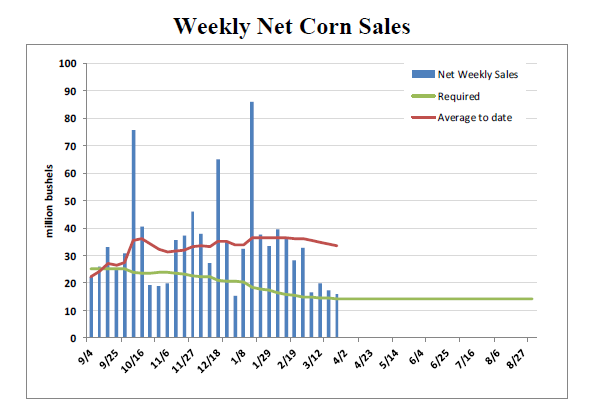

Weekly export sales came in at 16 million bushels for the week. That is down from past weeks and puts us at 82% of the projected annual sales for the year.

At the present time two of my three technical indicators are bearish both the old and new crop futures.

Soybean:

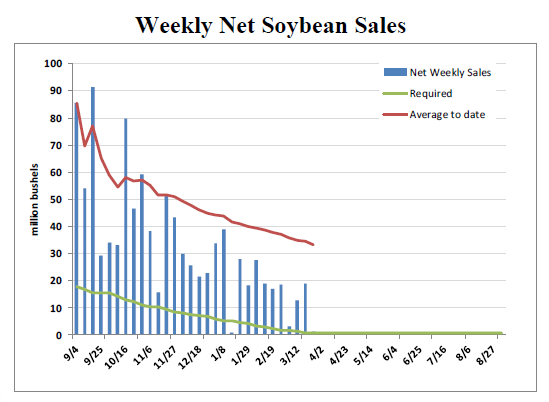

Weekly export sales came out this morning at a paltry 1.01 million bushels for the week.

Of course, we only need to average 350,000 bushels per week to achieve the USDA’s projection. I would bet that we will see them raise the projected annual exports number when the April 9th report comes out.

With disappointing weekly exports we didn’t really have anything to feed the bull so after the past couple of sessions higher this market seemed to run out of steam. We also saw the funds come in as sellers today. In fact, for the session, the funds sold an estimated 4,000 contracts of soybeans.

At the present time all three of my technical indicators are bullish both the old and new futures.

Wheat:

The most interesting thing that I saw in the wheat market today was that yesterday the CFTC charged Kraft Foods Group and Mondelez Global LL with wheat price manipulation. The companies bought $90 million of wheat futures in late 2011, with no intention to take delivery of the wheat and as part of a plan to draw down physical wheat prices. The companies pocketed more than $5.4 million as the market shifted prices in reaction to the massive position. I know it is hard to believe that anyone would ever try to manipulate prices but by golly there it is.

In international news I see that Russian Prime Minister Dmitry Medvedev, has asked his ministers to submit proposals by April 15 regarding a possible extension of the wheat export tax beyond its current end date of June 30. The conventional wisdom had been that the export tax was not going to be extended so I suspect that news helped push prices higher today.

The market was also aided by drought concerns. We will get a fresh set of crop condition ratings on Monday but the conventional wisdom is that the crop is continuing to deteriorate.

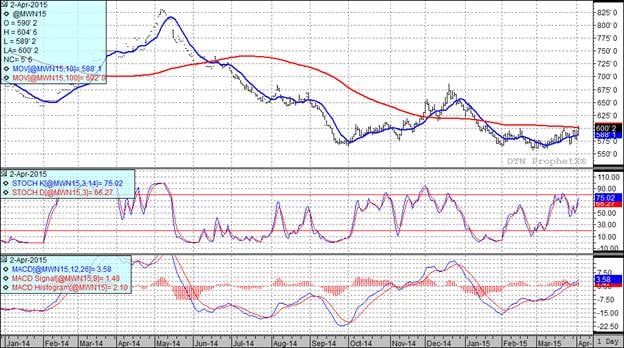

At the present time all three of my technical indicators are bullish both the Kansas City and Minneapolis July futures.

y futures.

Top Trending Reads:

- Grain Outlook for 2015

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

- Market Insider from the Farm and Ranch Guide

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

North Central Farmers Elevator - 12 5th Ave. Ipswich, SD - 605-426-6021.