Craig’s Closing Comments

April 6, 2015

Corn:Although corn ended the day with minus signs it wasn’t a horrible day. We kicked off the day with the weekly export inspections report which, at 40.459 million bushels, was above the top end of the range of trade guesses.

The market was also aided today by talk about the planting pace of the crop here in the USA. We continue to see the Delta experience delays as a result of wet weather while in the Midwest we are seeing rains this week but warmer and drier weather next week could help farmers pick up the planting pace.

Pressuring prices today were ideas that the April 9 stocks report will reflect an increase in stocks. The March report gave us a projected carry-out for 2014/15 of 1.777 billion bushels and the average trade guesses heading into this month’s report is that we will see a carry-out of 1.857 billion bushels. The range of guesses is currently running from 1.75 to 1.999 billion bushels. While anticipation of Thursday’s USDA report was perhaps the largest bearish factor today the market was also pressured by a USA dollar that was moving higher today as well.

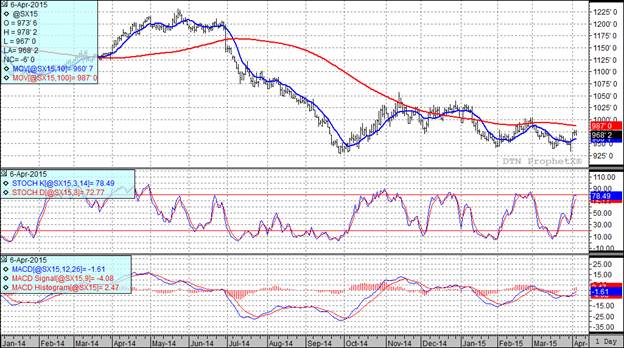

At the present time two of my three technical indicators are bearish both the old and new crop futures as we continue to trade in what is essentially a sideways pattern.

Soybean:

Weekly export inspections came in at 20.754 million bushels. This was at the low side of the range of trade estimates and reflects the continuing switch of export business from our shores to those of South America.

Speaking of South America we can’t lose sight of the fact that they are in the process of harvest an all-time record crop and are currently experiencing very good harvest weather in which to get the crop out of the field.

As we head into Thursday’s USDA report the general consensus seems to be that we could see the USDA increase the beans being consumed by crush as well as bumping up the export numbers a bit. As a result of that the average trade estimate for old crop bean carryout is 369 million bushels versus the 385 million bushels that was posted in March. The range of trade guesses runs from 339 to 391 million bushels.

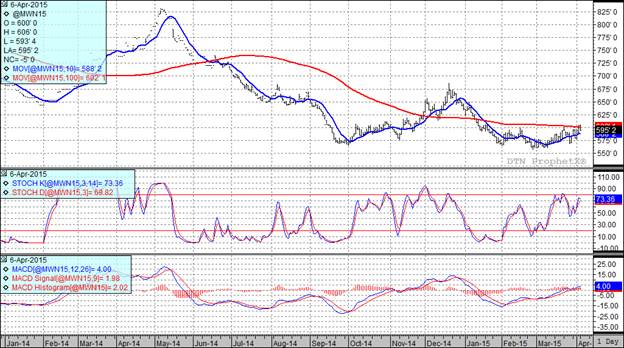

In spite of getting beat up by today’s price action all three of my technical indicators remain bullish both the old and new futures at the present time.

Wheat:

I received this picture from a friend who works in an orphanage in India with the following comment: “Today we start our wheat harvest--lots to celebrate! Everybody grab a knife and get to the field!” I guess we have a lot to be thankful for. I really don’t see this harvest program working real well in our country.

Wheat took a pounding today as parched portions of HRW country got a drink and more rain is forecast for the HRW country this and next week, although some of the already seriously dry areas may get missed.

It wasn’t just portions of drought stricken areas in our nation that got some relief as we also saw Russia and Ukraine receive beneficial rains with more expected this week. Speaking of the Russians, I see that SovEcon is now pegging the June 30th Russian wheat stocks at 15.0 MMT. This compares to stocks that have run in the 9-10 MMT range in past years. It is hard to view that news as anything but negative to prices.

Heading into the April 9th report the average trade estimate for all wheat stocks is at 694 million bushels versus 691 million bushels in the March report.

After the close we had the first official USDA crop conditions report for the year. The winter wheat crop is rated 44% good to excellent versus 35% in that category a year ago.

At the present time all three of my technical indicators are bullish the Minneapolis July futures while two of three are currently bullish the Kansas City July futures.

Top Trending Reads:

- Grain Outlook for 2015

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

- Market Insider from the Farm and Ranch Guide

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

North Central Farmers Elevator - 12 5th Ave. Ipswich, SD - 605-426-6021.