Craig’s Closing Comments

April 7, 2015

As you can see on the following chart, the dollar traded sharply higher today and that in turn put price pressure on the grains.

Corn:

Very limited news today. As noted yesterday the trade is expecting that Thursday’s report will reflect an increased carry-out which of course is not positive for prices.

Kind of hand in hand with that notion was talk once again today about the slow export demand. In fact I heard a rumor today that China may be looking to Mexico to supply them with sorghum in place of corn from the USA.

Yesterday’s crop condition and planting progress reports didn’t report anything for corn but we did have a few states release numbers. In Texas corn planting is 37% complete versus the five year average of 50%, Louisiana is 67% complete while normally 93% of the crop would be in the ground. We should see the USDA give us firm planting progress numbers starting with next week’s report.

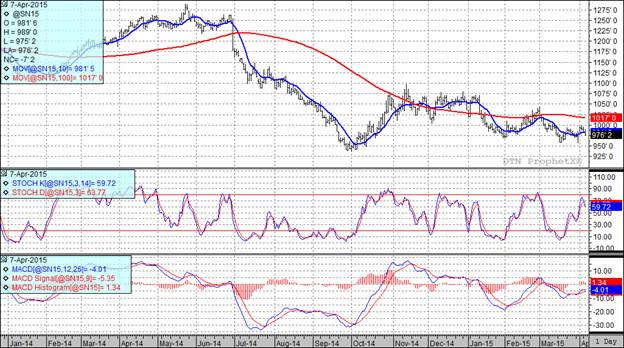

Today’s price action was just bad enough to turn all three of my technical indicators bearish for both the old and new crop futures.

Soybean:

Beans traded lower today on favorable weather conditions for the Argentine soybean harvest and continued weakness in soybean meal. The stronger dollar also added pressure to prices. The trade recognizes that Thursday’s report will in all likelihood reflect a reduced USA soybean carryout but many traders are of the opinion that smaller USA carryout will be overshadowed by a record South American crop.

Speaking of South America I see that Dr. Cordonnier has increased his South American bean estimates. In Brazil he added 0.5 MMT to the crop estimate which pushes it to 93.5 MMT. In Argentina, he added 1.0 MMT which takes his projected harvest to 58.0 MMT. In doing so he commented that yields in Argentina are “off the charts.”

We are seeing slow farmers selling in those nations with Safras indicating that the Brazilian farmer has sold 50% of their bean crop versus the five year average of 64% that we would expect at this point in the harvest. The crop in Brazil is currently about 75% harvested.

Today’s price action has turned two of my three technical indicators bearish both the July and November futures at the present time.

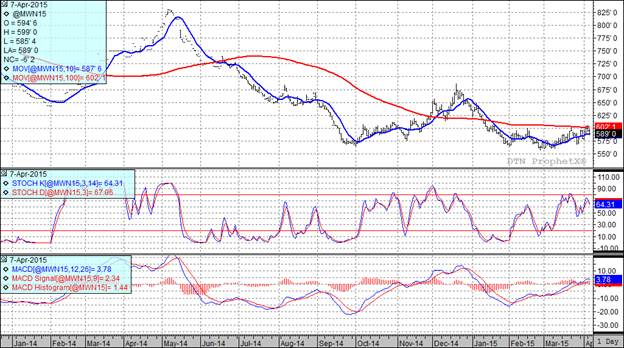

Wheat:

The wheat traders were focused on the following bullet points today:

1) Improving chances for moisture in HRW country.

2) Better than expected overall winter wheat conditions rating in yesterday afternoon’s report.

3) Improving weather conditions in the Black Sea area, i.e. Russia and Ukraine.

4) A strong USA dollar making us less competitive in the export market.

There is nothing bullish in that list and thus the market was treated like a goat in a game of Buzkashi. I will send an official NCFE cap to the first person that can tell me what the game of Buzkashi is and what role the goat plays in the game. (Crap, this sounds like a bad 7th grade social studies quiz.)

At the present time two of my three technical indicators are bullish the Minneapolis July futures while two of three are currently bearish the Kansas City July futures.

Top Trending Reads:

- Grain Outlook for 2015

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

- Market Insider from the Farm and Ranch Guide

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

North Central Farmers Elevator - 12 5th Ave. Ipswich, SD - 605-426-6021.