Craig’s Closing Comments

April 14, 2015

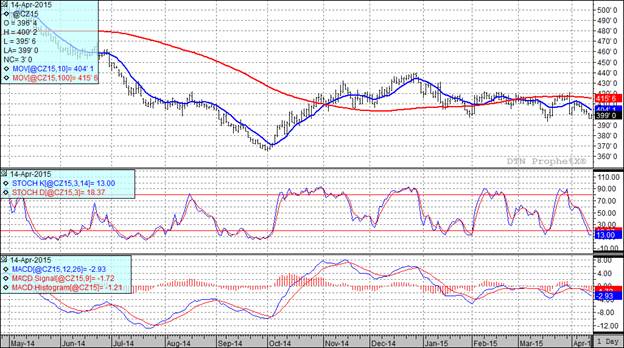

Corn:

We are in the midst of what for the most part is a weather market. Looking at the weather forecasts for the next 7 to 10 days it appears we will continue to see the wet pattern for the Delta and Southeast. In the meantime the Corn Belt forecasts call for dryer weather in the west with wet conditions in the eastern Corn Belt. In other words pretty much what we have been experiencing.

Looking around the fruited plains we see that for the most part the cash markets remain firm due to the lack of producer selling.

Looking to South America I see that Dr. Michael Cordonnier has left his corn estimates unchanged, pegging the Brazilian corn crop at 75 MMT and the Argentine corn crop at 23 MMT. That compares to the last USDA report which had those crops at 75 MMT and 24 MMT respectively.

All three of my technical indicators are currently bearish for both the old and new crop futures.

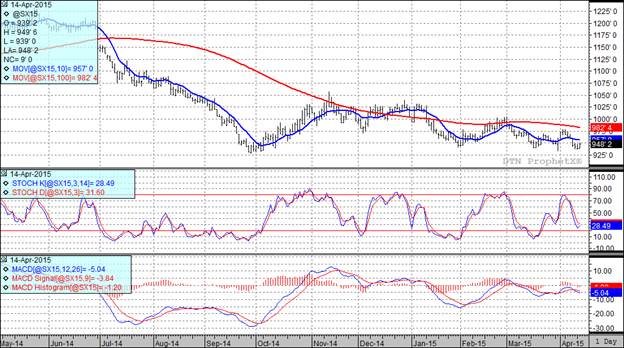

Soybean:

We probably experienced a correction in an oversold market more than anything else today. When yesterday’s lows held we saw some buying develop and this was also assisted by a weaker dollar. In spite of the weaker dollar today it should be noted that USA soybeans remain uncompetitive in the world market with beans from South America being the lowest priced.

We will get the NOPA crush numbers for March tomorrow. The average trade estimates for that report are looking for soybean use to be 155.3 million bushels, with a range of guesses running from 150.5 to 159.5 million. In March 2014 the usage number was 153.8 million bushels.

In South American news I see that Dr. Michael Cordonnier left his soybean estimates unchanged. He is estimating the Brazilian soybean crop at 93.5 MMT and Argentine soybean crop at 58 MMT. The April USDA pegged those crops at 94.5 MMT and 57 MMT respectively.

In spite of today’s stronger close all three of my technical indicators remain bearish both the July and November soybean futures.

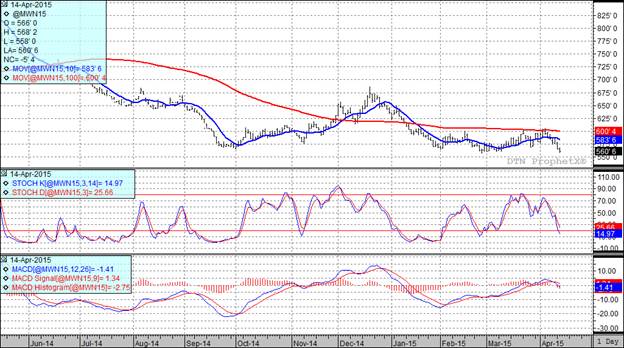

Wheat:

Wheat was really a pretty straightforward story today. The facts appear to be as follows:

We have spring wheat planting moving forward at a rapid pace with dry conditions while in winter wheat country they have beneficial moisture in the forecast. Now toss in the fact that we have ample supplies of wheat worldwide and that the USA is uncompetitive in the export market and you can see why we traded lower once again today.

I did run across a report that may give some comfort to the bulls in this market. Yesterday the Australian Bureau of Meteorology stated that they see a 70% chance of an El Nino emerging prior to June. If this occurs it should bring below average late winter and spring rainfall over eastern Australia and above average temperatures. That may be enough to heat this market up, especially if the rains stop falling in HRW country.

At the present time all three of my technical indicators remain bearish both the Minneapolis and Kansas City July futures.

Top Trending Reads: