Closing Comments

By Lynn Miller

April 16, 2015

These are the days I wish my imagination and worldly knowledge were a good as Craig’s and I could tell you wild stories about my slow cousin Jimmi or the bug eating habits of our friends across the ocean; however, I am not so gifted. So you are left w/ my impression of the market once again today – it’s like watching gophers in the pasture on a nice spring day. The irritating little buggers are chewing up your pasture, making it rough to drive in and all you see is their little heads up and down, up and down. Not much of a feel good there. You would really think that we would get something, anything to light a fire, even if temporary.

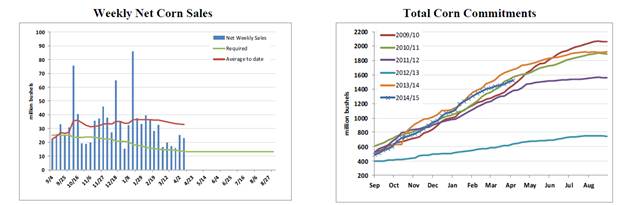

Corn:

With little to trade out there, the biggest news of the day was the export numbers. Released this morning, Corn sales were 23.2 million bushels old crop and 1.1 new crop. Both were at the higher end of estimates. With 4 ½ months left in the marketing year we aren’t doing as bad as it feels. We need to sell 17 million bushels of corn each week to reach the USDA estimate.

Other news for the day would be mixed. The Rosario Grain Exchanged raised their corn estimate for Argentina from 23.5 to 25.7 mmt. Corn planting is making significant progress in areas of the country that haven’t been seeing much rain, like Iowa and Illinois. We are hearing rumblings that corn could be 50% planted in Illinois by the weekend with some done and others that haven’t turned a wheel. Rain is in the forecast for the corn belt this weekend. And, the USDA announced a flash sale of 108 tmt of Sorghum to unknown this morning.

Technically, all three indicators remain bearish the old and the new crop; however, the stochastics have made a sharp move upward and the MACD is trying to come together. We could very well be perched for some technical buying. Currently support sits at $3.72 in the May with resistance levels of $3.82, $3.92 and $4.05 respectfully. Might not be a bad idea to put a target order or two in for the upside just in case we get a bounce.

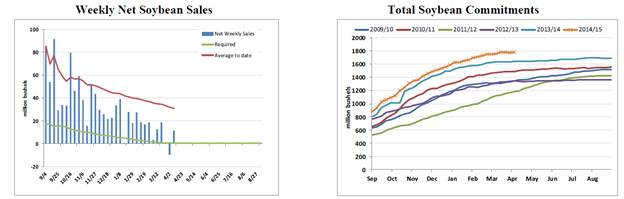

Soybeans:

Just as in the corn the main news of the day was exports, which were a mixed bag. First they amended last week’s cancelations from 6.5 million bushel to 10 million. That was bummer. Then this week’s sales came to the rescue at 11.5 million bu of new sales in the old crop and 8.3 new crop. This is good news since this is the time of year we expect small numbers.

A few other things that were no the radar today include Rosario Grain Exchanges new crop estimate, up another million bushels to 57mmt. Leaping the USDA’s estimate and proving once again that big crops just get bigger. Wet conditions there continue to slow harvest, but farmer sales off the combine continue to be strong. We are hearing there is a record amount of beans on boats headed from South America to China.

Technically, all three indicators have turned bullish the May futures on the close today. If you still need to price some binned or dp bushels I would be looking at targets at $9.93, $10.13 and $10.32 respectfully. As far as the new crop goes, 2 of three indicators are currently bearish with the Stochastics the only on indicating a buy signal. If I was to look at putting in targets for new bushels I would be at $9.75 and $10.00 respectfully.

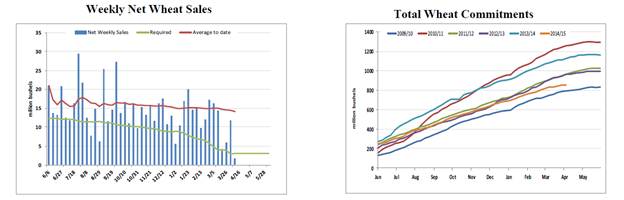

Wheat:

Wheat continues to be the poor kid that just can’t catch a break. Just as things are getting dry enough to help the market, weekend forecasts come out and tell us that we should see some good rains in Wheat country this weekend. It sounds like the Russian export tax on wheat should be lifted in June assuming winter wheat conditions don’t change substantially.

And then there were exports. 1.8 million bushels of old crop and 4.1 new. A new marketing year low on old crop wheat, so that didn’t help us either.

Technically, nearby wheat remains in deier straights. All three indicators continue to be bearish, hard bearish for both the Minneapolis and the Kansas City markests. The trade had closed considerably below the previous day’s low for 4 sessions in a row. We are trading well below the 10-day moving average, the MACD continues with downward momentum and the stochastics have now reached a 4 on the oversold side. I would really like to say this market is simply due for a bounce, but we all know the market doesn’t care what it owes anyone. If you are watching the Minneapolis, current support sits @ $5.04. If we could find anything to change the direction of this market we would be watching for resistance at $5.54.

Top Trending Reads: