Craig’s Closing Comments

April 20, 2015

On this day in 1889 Klara and Alois Schicklgruber welcomed a bouncing baby boy into the world that they named Adolf. As a young boy little Adolf wanted to be a priest but eventually turned to politics where he was Time’s Man of the Year (1938) and nominated for the Nobel Peace Prize (1939). As a politician he was very progressive. He was a vegetarian and created law's against animal cruelty. He also led the first public anti-smoking campaign in modern history.

Not all was sunshine and roses however as he only had one testicle and suffered chronic flatulence. In fact he took 28 different drugs to try and keep the flatulence under control. In spite of having a gas problem he believed he was attractive to women, so he remained single for political gain.

Interestingly enough his dad changed the family name from Schicklgruber to Hitler in 1877 or else the world would know him as Adolf Schicklgruber instead of Adolf Hitler. It makes me wonder what would have happened if Hitler had eaten a good rib eye instead of Brussel sprouts. My hunch is that he wouldn’t have had as much gas and without Hitler and gas the world would be a different place today.

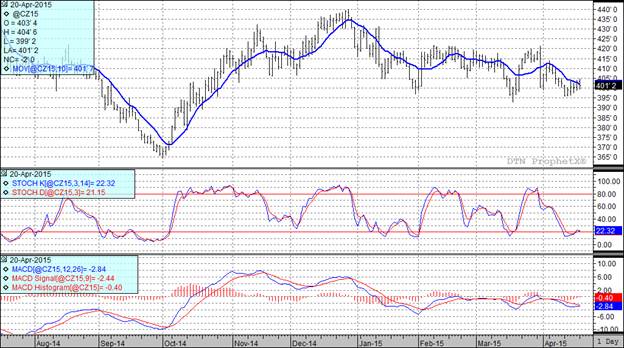

Corn:

We had kind of a blah day today. The corn market traded lower on the perception that we had good weather conditions over the weekend. Helping to put pressure on the corn market was a higher dollar. We had good weekly export inspections. They checked at 42.1 million bushels versus the 34.9 million bushels per week that we need to export to achieve the USDA’s projection. Weather may give us a bump this week with traders starting to talk that the cool weather expected for much of this week could slow down planting because the soil temperatures are cool. Might be grabbing at straws but that is the talk.

After the market closed we received the weekly USDA Planting Progress report. The trade was looking for the crop to be 12 – 14% planted. The five year average for this point on the calendar is for 13% of the crop to be planted so today’s number of 9% planted was slightly surprising to traders.

With today’s close two of my three technical indicators remain are bullish the July futures while two of three are bearish the new crop December futures.

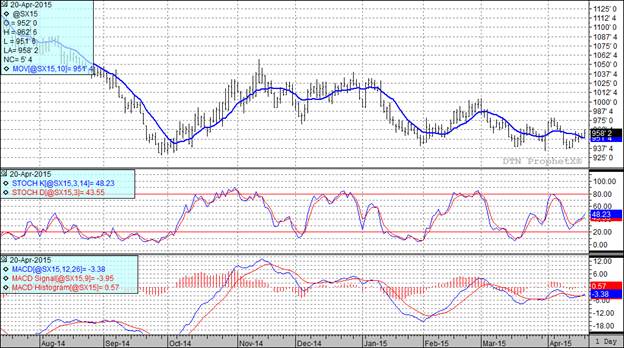

Soybean:

Beans had a stronger day as they had some left over strength from Friday’s NOPA crush report. That strong report is also leading traders to conjecture that we will see ending stocks revised downward in the May USDA S&D report.

While the market traded higher not all was lollipops and ponies. The weekly export inspections were expected to be in the vicinity of 10 million bushels so the actual inspections of 5.4 million were disappointing. They were also less than the 5.9 million bushels that we need to average to hit the USDA’s annual export projections.

Moving forward we may see beans find some support on the idea that the overall good planting conditions will lead to less acres being switched from corn to beans.

In South America we are seeing harvest delays in Argentina as a result of wet weather conditions in that nation. We are also picking up some talk of a possible resumption of the truck strike in Brazil which would be friendly.

At the present time all three of my technical indicators are bullish both the July and November soybean futures.

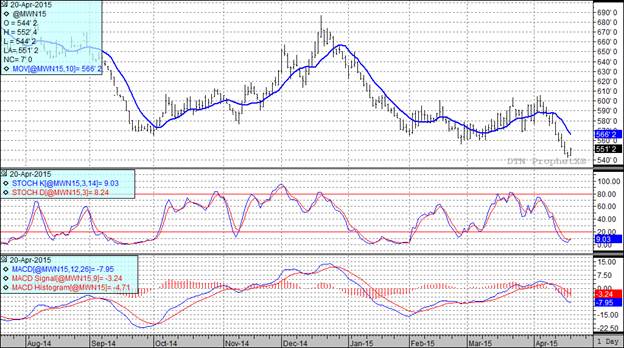

Wheat:

Weekly export inspections were a solid 20.7 million bushels versus 17.8 million bushels that we need to average each week to hit the USDA annual projection. The trade was expecting weekly exports to check in at 15 million so this was a slightly bullish surprise.

After the close we had the planting progress and crop condition reports. The winter wheat crop was unchanged from last week at 42% good to excellent. A year ago at this point the crop rated at 34% good to excellent. In spring wheat the crop was reported 36% planted. The five year average is for 19% of the crop to be in the ground at this point so we are really seeing the impact good planting conditions thus far this year.

At the present time all three of my technical indicators are bearish the Kansas City futures while two of three are bearish the Minneapolis July futures.

Top Trending Reads: