Craig’s Closing Comments

April 21, 2015

In the past few weeks it seems that hardly a day has gone by without the H5N2 avian influenza virus being found in another flocks of turkeys. We have mentioned it in this space the past few weeks but have never put it into context. Since this outbreak we have destroyed a little over two million birds, mainly turkeys. That is a lot of birds and can certainly have an impact on local situations. On the other hand, turkey production in the USA averages around 235 million birds a year and currently production is running roughly 4% ahead of last year. When viewed from that perspective the loss of two million birds is probably not enough to have a significant impact on the overall market.

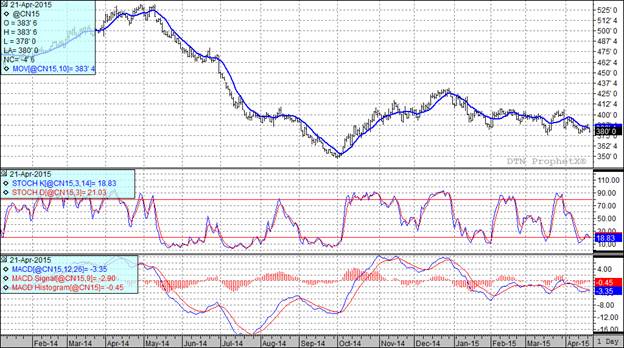

Corn:

The planting progress report yesterday showed less corn planted than what the trade had been expecting but in spite of that the market traded lower today on the perception that while corn plantings have been slowed by cold rainy weather conditions, they are expected to pick up again next week. We should see rain delays in the Delta area continue this week but then look for a dry weather pattern forming the next couple of weeks so the planting pace should really pick up steam.

In South American news I see that Argentina plans to issue another 2.3 MMT of corn export licenses, we already face a very competitive export market and this will probably just put more pressure on it.

With today’s close all three of my technical indicators are now bearish both the July and December futures.

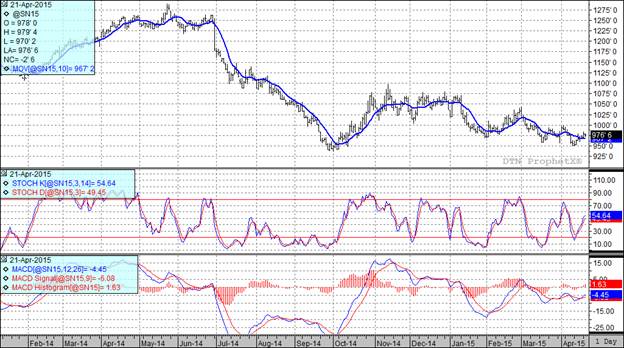

Soybean:

Soybeans got hit with a few pieces of less than bullish news that kept pressure on the market today. First it was announced that additional cases of bird flu had been detected. On the heels of that we were presented with increased production ideas for South America and then topped that off with the idea that the discussions that are planned for tomorrow should finally bring resolution to the fear of the truckers strike in Brazil flaring back up. Finally, while we have been seeing delays in the Argentine soybean harvest improving weather conditions should minimize the delays. Harvest progress is currently at 45% in Argentina and it is expected that harvest activity should pick up by the end of the week or next week at the latest.

At the present time all three of my technical indicators are bullish both the July and November soybean futures.

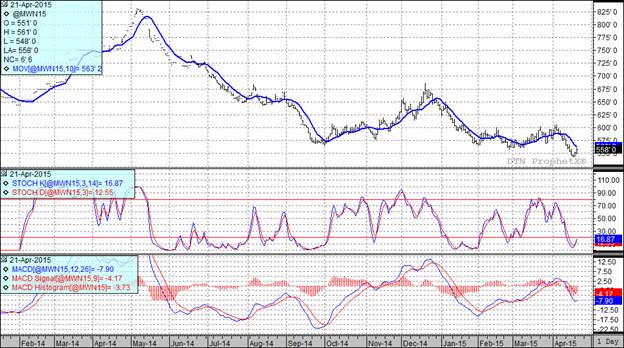

Wheat:

Today may have been a dead cat bounce more than anything else. The funds have what is near a record short in the Chicago futures and today we saw them in taking some profits off the table.

Looking at the domestic situation we see a very fast planting pace for HRS while in HRW country crop conditions are stabilizing and are expected to improve this week after recent rains. We have more rain forecast for the Southern Plains this week so that should keep pressure on the wheat market.

Viewed from a world perspective we see that world supplies remain ample so that probably means tough competition in the export markets and again would argue for addition price pressure in the wheat market.

At the present time two of my three technical indicators are bearish both the Minneapolis and Kansas City July futures.

Top Trending Reads: