Closing Comments

Lynn Miller

April 22, 2015

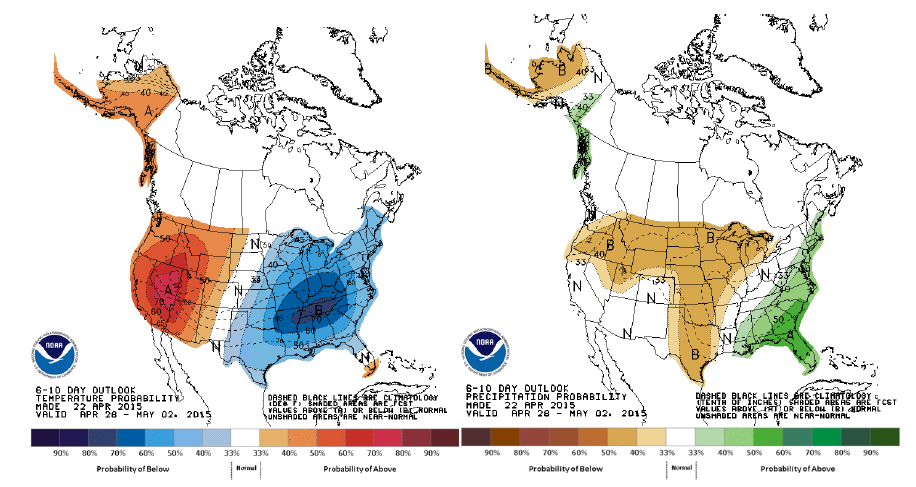

These two maps pretty much sum up what we will see the next two weeks. Yup, you guessed it, probably going to see markets to continue on the defensive. Below average rain fall and normal/below average temps will keep the planting window open and progress moving along.

Corn:

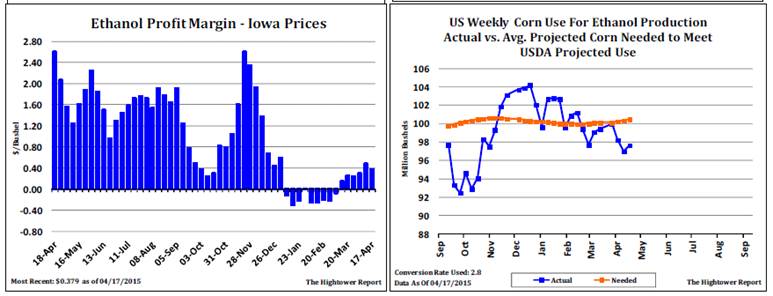

The big news of the day was ethanol production, and that wasn’t much of a game changer. Weekly numbers were up from last week at 903 thousand barrels/day with the total bushels crushed for ethanol at 97.65 million. Since the USDA increased corn for ethanol in February we have yet to reach the number needed to meet this projection.

Though things seem to be really hum/drum out there, we do need to keep our eye on a few things. Like the planting window, right now we are in good shape nationwide, therefore, offering resistance. Corn around the world remains discounted to the US thanks to our strong dollar, and other countries that have large supplies also bearish for the time being. Farmer holding, right now is supportive. With little grain ready to come to town, basis levels are steady to narrowing – but this could change should everyone start to clean out the bins and make room for next year. All of these scenarios are moving targets that can change quickly.

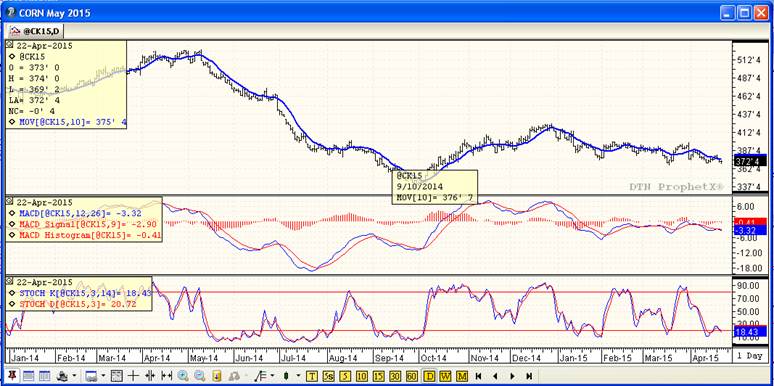

Once again, technically all three indicators are bearish both the old and new crops. In the May contract we ended the day right above support at $3.72 1/2. We continue to hold range bound between $3.67 and $3.98. If we do hold above support I would be looking at targeting binned bushels around $3.82.

Soybeans:

Beans continue to trade lower on large S American stocks and the impact of bird flu on meal demand. Although, as Craig touched on yesterday, the impact of Bird Flu could very well be disproportionate thanks to the lack of fresh news in the market.

A few other things that could be influencing the market include:

- Brazilian harvest near 90% complete w/ aggressive farmer selling, the bulk of this crop is available to the export market.

- Brazilian truck strike – there is a threat there looming; however, with harvest nearing completion and good stocks at the ports I expect this to be small.

- Argentina’s harvest 33% complete, ahead of last year – yields remain strong.

- Then there’s Iowa – now banned by Mexico for import of frozen poultry/poultry products. Mexico is the largest poultry market for the US.

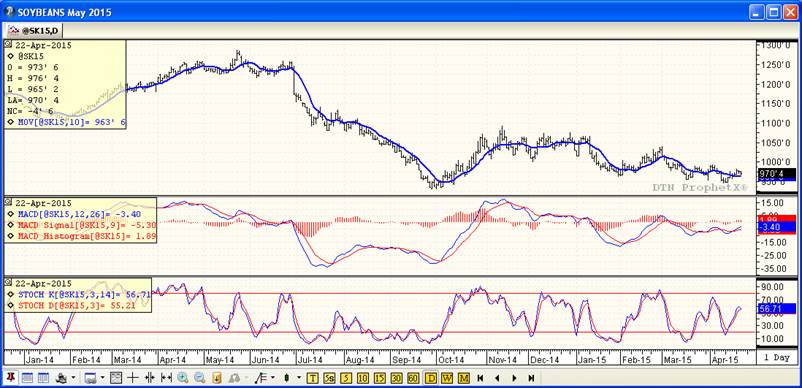

Technically, all three indicators remain bullish the May futures, even after the negative price action of the last two days. If you still need to price binned or dp bushels I would be looking at targets at $9.90, $10.10 and $10.30 respectfully. I still don’t see much out there in the market to support a major change in trend, so be ready to take advantage of ups that we do get. As for the New Crop – 2 or 3 indicators are currently bullish. I would continue to hold out for $9.75 in the November futures.

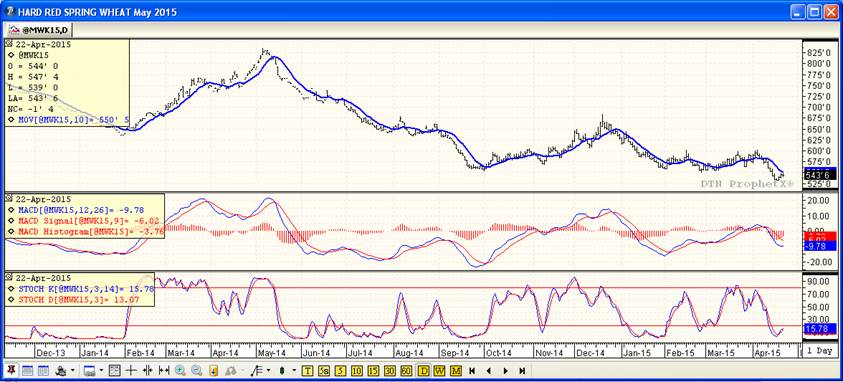

Wheat:

Once again we did not have much news in the wheat market. Improving weather and moisture conditions in winter wheat regions is keeping the pressure on. Wheat continues to struggle on the low side of the 2015 trading range and large world supplies and poor US demand are not helping. It appears that the recovery in corn late session did help Wheat come up off of it’s lows.

Tomorrow we should see some export numbers and stats Canada numbers, at least there will be something to trade. Spring Wheat planting continues at a rapid pace and may lead to more planted acres, but at whose expense? Most likely, corn.

Technically, two or three indicators are currently bearish the nearby Minneapolis and Kansas City markets. The stochastics are issuing a buy signal, the MACD is turning upward and we are approaching the moving average. Does all this mean we could see a technical correction and some short-covering? I’m not sure, but if we do get a chance I’d be looking to put a price on binned bushels at $5.90 and $5.85 respectfully.

Top Trending Rea

ds: