Closing Comments

Lynn Miller

April 23, 2015

No new news on the fundament front to speak of today, again. I’m starting to feel like a broken record.

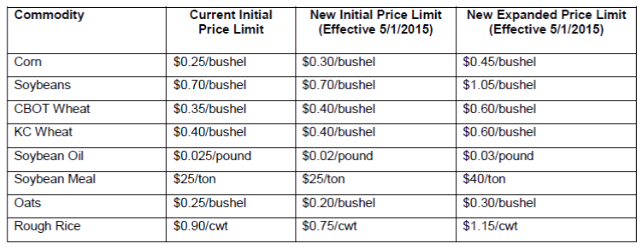

Once again the CME has reviewed the markets and made changed to our price limits. Both Initial and Expanded. These new values go into effect on May 1st.

Corn:

At one point today I swear I saw corn trading to the plus side and when I looked later, we had lost it all to close near session lows and back into contract low territory. Export sales were supportive today at 867,900t old crop with the trade guess 400-600,000. This was a pleasant surprise seeing how the trade had been talking down export sales vs. ramped up competition. We have corn planting offsetting farmer holding to basically keep us in a holding pattern at the moment. Then we have option expiration tomorrow which could be dictating some trade action. Funds are currently 270 million bushels short in options.

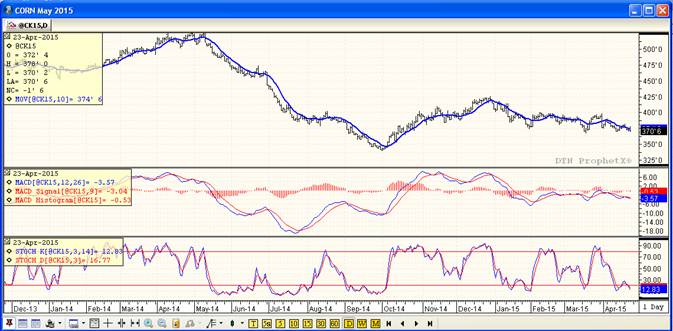

Once again, technically all three indicators are bearish both the old and new crops. In the May contract we failed to hold the support line of 3.71 ¾. Instead we closed just below that at 3.70 ¾. We continue to hold range bound between $3.67 and $3.98. These levels aren’t rocket science – we have some margin of error in here. So we could hold this level, in which case I would be looking for $3.82 and $3.92. However, if we proceed to lose ground, we are probably headed for $3.39.

As for the new crop, all three indicators remain bearish, but support at $3.93 has been holding. Here’s hoping we can maintain these levels for the time being.

Soybeans:

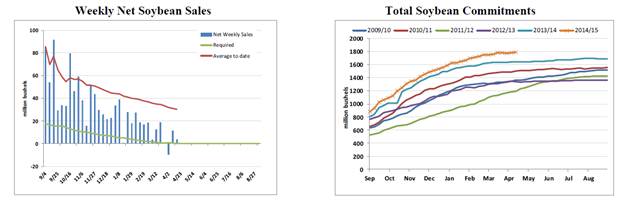

The entire soy complex traded firmer today closing just off session highs. Weekly export sales today looked pretty light on paper, but where within trade estimates at 102,100. At this pace we only need to average 4,000 tons a week to meet the USDA number so be looking for that to be adjusted if we don’t start to see some larger cancellations.

Stats Canada was out with Canola and bean acres today. Both are seen lower than trade estimates and lower than one year ago. To offset that, we had the Argentine Ag Ministry upping their bean crop estimate. We are also keeping an eye on New Crop sales which are way behind last year. Brails’ truckers are once again on strike, starting tonight. We don’t expect this to have much for legs as to its effect on the market.

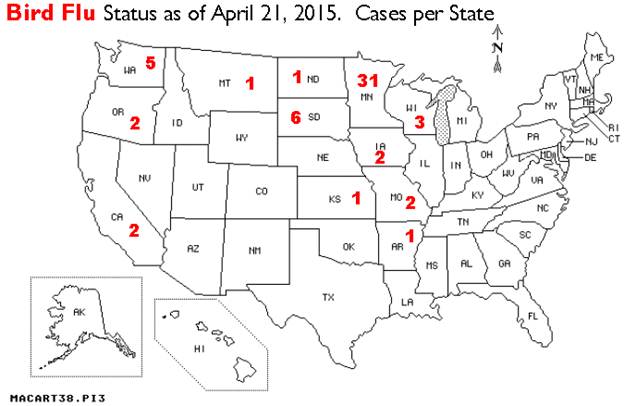

The Avian (Bird) Flu has now struck 44 individual farms in Minnesota alone. That is affecting more than 2.6 million birds in just that one state. As you can see on the map, this is pretty isolated to Minnesota at this time.

All three indicators continue to remain bullish the May futures. I’m not real sure what’s out there to sustain this rally, but I’ll take it. If you still need to price binned or dp bushels I would be looking at targets at $9.90, $10.10 and $10.30 respectfully. As for the New Cropm, all three indicators are currently bullish with today’s trade action. Hold tight with orders at $9.75 for new crop futures, if we can get enough of a rally to fill this level we will look at $9.90 or $10.00 as the next targets.

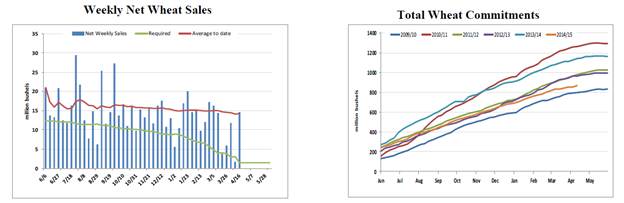

Wheat:

We saw a mixed bag in the wheat world today. To start out we had nice, nice export numbers: 397,500 versus estimates of 0-100,000. Not to shabby of a start, but when you put it into perspective and look at the very few days left in the wheat year, it’s probably not enough to help us out much. Global stocks and competition remain fierce.

Stats Canada pegged acres at 24.8 million compared to a trade guess of 24.2 and 23.835 last year.

Technically, two or three indicators continue to be bearish the nearby Minneapolis and Kansas City markets. However, there is nothing out there that says we are in more trouble today than yesterday. The stochastics are issuing a buy signal, the MACD is turning upward and we managed to trade through the moving average, although couldn’t close above it. I’m still not sold we will see a technical correction, but I would be ready for it just in case. I’d be looking to put a price on binned bushels at $5.90 in the Minneapolis and $5.85 in the Kansas City.

Top Trending Reads: