Closing Comments

Lynn Miller

April 24, 2015

Risk Off – that appears to be the theme of the day as no one is willing to carry much risk into a weekend. Good weather will mean good planting and recent rains have wheat traders looking for improved conditions.

The grain complex just seems to be working from the lyrics of a bad country song lately. Nothing seems to make things better, not even good export numbers. What’s next – running momma over with a darned old train?

On the day funds have been sellers of 5,000 beans, 7,000 corn and 3,000 wheat.

Corn:

This market is feeling the pressure of another big US crop, especially as we hear stories of early planting and know that the weather is giving everyone a good window to getter done. But, there is still a big spread between guesses as to yield ranging from 158-170. Some weather guys are still looking for the NW corn belt to turn dry in June. Stories like this will keep the traders attention and could very well turn this into a weather market after planting.

Cattle on feed report will be out at 2 this afternoon. Many are looking for a decline in April numbers just as the say in March when placements were down 5 ½% with yards hesitant to bring in pricey calves on eroding margins.

Then there’s China. Today they are talking about a 3% increase in corn acres. This would require Bejing to move some of their massive stock piles. They now hold 150 million tons or an 8 months’ supply.

Yup, you guessed it, all three indicators are bearish both the old and new crops. Tough day in the May as we closed on the low side of yesterday’s range and then went down from theres closing at the low of the day. It appears at this time that it is a safer bet will go lower before we go higher in the short term. Support at the moment sits at $3.39, matching the contract low set in late September. However, we are currently heavily oversold with the stochastics at only 8. This could give us some torque for a technical correction.

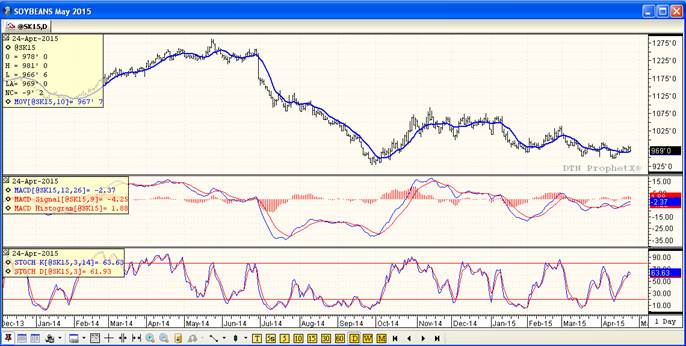

Soybeans:

The good planting window, estimates of higher SA supplies, lower US demand are all offering resistance in this market. Now we have Governor Dayton in Minnesota asking for a disaster declaration due to the bird flu epidemic there. This will keep it foremost in trader’s minds.

This market just doesn’t seem to have enough fundamental strength to sustain the upside we have seen the past couple days. We are extremely vulnerable right now to sell-off pressure as planting progress accelerates. The Brazilian truck strike could be a point of some support, but I don’t advise you buy into it. The strike will probably be short lived with little export interruption and we will be quickly refocused on supplies.

After today’s price action I was sure we were in for some changes technically, but I am quite surprised to pass on that all three indicators continue to remain bullish the May futures. The stochastics are quiet shaking but in neutral ground. I’m not sold that we have a lot of support for upward price action, but I would be happy to see $9.90 and to get some bushels sold there.

Wheat:

There is just nothing new out there to talk about in the realm of Wheat. I don’t want to say it’s like a vacuum, but darned close. The highlights continue to be large world supplies, better US crop outlooks and poor, poor export demand.

Yesterday’s rally was driven by surprisingly good export numbers, but fund selling remains active while weak shorts are now pretty much sitting on the sidelines while open interest continues to decline.

The only brighter spot I can find today is that higher crude prices are helping the CRB rebound and this in turn could draw some index buying interest.

Technically, all three indicators are now bearish the nearby Minneapolis We are once again knocking on the door of contract lows at $5.32 with today’s close of $5.35. If this level can prove to hold we should see some sort of correction; however, if it fails we would be looking to $4.73 for the next level. I’m still not sold we will see a technical correction, but I would be ready for it just in case. I’d be looking to put a price on binned bushels at $5.90.

Top Trending Reads: