Closing Comments

Craig Haugaard

April 29, 2015

I want to kick things off today by looking at the dollar. Over the past few months we have spent time talking about the negative impact that the strong dollar has on commodity prices. With that in mind it is interesting to try and read between the lines of today’s Federal Open Market Committee meeting. In the March meeting they indicated that an interest rate hike in April was unlikely which led many analysts to believe we would see an interest rate hike in September. In today’s meeting they left the interest rates unchanged but also removed any calendar references from the post-meeting statement. One analyst that I spook to is of the opinion that the FOMC may not be in a position to increase the federal funds rate until 2016. A delayed interest rate hike from the Fed would be bullish for stock index futures and bearish for the U.S. dollar. That, of course, is where it starts to impact us. If we see the dollar start to weaken it may have a positive impact on commodity prices. As you can see on the following weekly continuation chart this week has given us a sharp break in the value of the dollar.

Corn:

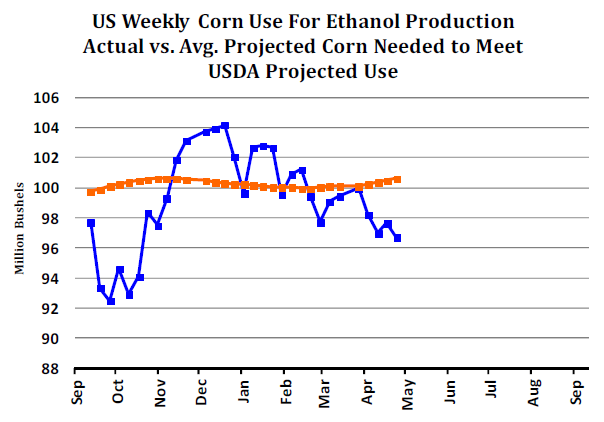

The weekly ethanol report was released this morning and it was disappointing. In the past week 96.705 million bushels of corn was used in the production of ethanol. That means that we now need to average 100.657 million bushels per week for the remainder of the crop year to achieve the USDA usage projection. The following chart nicely illustrates where we are at currently with the blue line being actual bushels per week and the golden line being what is required.

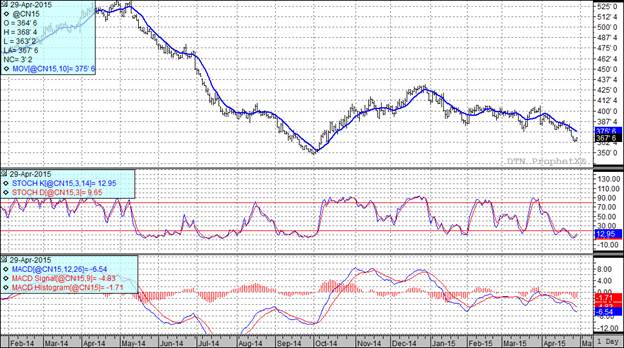

The weaker dollar offered support to corn but any gains that offered were at least partially offset by good weather and a rapid planting pace. It looks like we should have good planting weather across the Corn Belt for the next three or four days before we see rains move through the central and eastern portions of the Corn Belt.

At the present time two of my three technical indicators are bearish both the July and December futures.

Soybean:

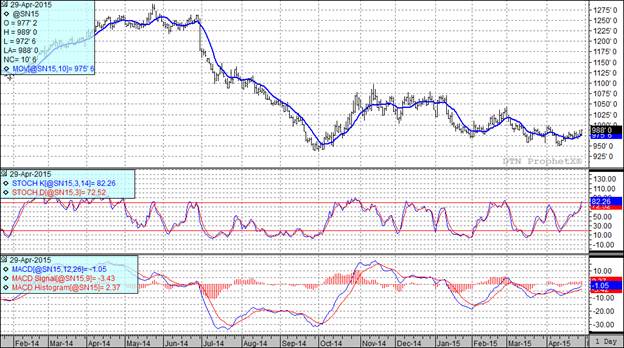

We had a nice mix of technical triggers as well as fundamental news pushing this market today.

On the fundamental side the past planting pace has traders assuming that you will just keep rolling with corn and thus we may see a reduction in bean acres.

While that was supportive probably the bigger story is in Argentina where, as Reuters is reporting, Argentina's main grains port of Rosario was paralyzed by an open-ended wage strike by boat captains needed to help dock incoming cargo ships. The captains of small vessels that take river pilots out to meet incoming grains ships are demanding higher wages. The pilots need them to get them to the cargo ships where they then

board the cargo ships and guide them to their berths in Rosario. According to Reuters, the union representing the boat captains says the strike will continue until its wage demands are met. In the meantime, ships entering Rosario's port area are dropping anchor along the Parana River to wait until this is resolved.

At the present time all three of my technical indicators are bullish both the July and November soybean futures. It should also be noted that we closed above the 50 day moving average which also triggered some buying action.

Wheat:

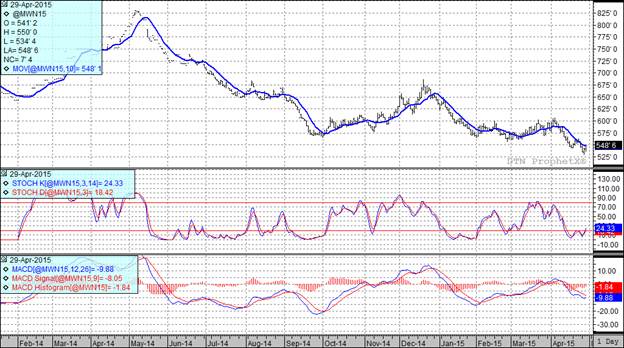

After pressing down to levels not seen since 2010 yesterday we saw some short covering today as traders question how much more downside there really is at this point.

Domestically, I don’t think there is anything out there that we didn’t talk about yesterday. Spring wheat planting is still moving forward at a rapid pace with the trade anticipating that over 80% will be reported as planted when next Monday’s Planting Progress report is released. I know we discussed this yesterday as well but there continues to be some concern over disease and insect pressure in portions of HRW country. Next week’s crop tour should reveal if these concerns are legitimate or not.

In international news it looks as if Russia’s export tax will expire on July 1st. Domestic prices in that nation have been under pressure as growing conditions have been favorable and crop production prospects are looking good.

Today’s price action was enough to get two of my three technical indicators to turn bullish for the Minneapolis July futures while in the Kansas City July futures two of three remain bearish at the present time.

Top Trending Reads: