Closing Comments

Lynn Miller

May 1, 2015

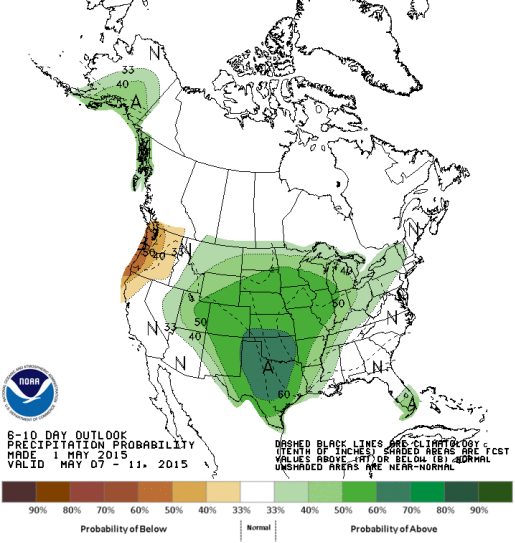

Global celebrations of the May Day holiday kept markets relatively quiet and the trade volume below average. Since I can’t find much good news on a beautiful Friday (exactly everything a trader sees as reason to sell going into a weekend). I thought I would give some hope, at least to the idea, that we might get some rain. According to NOAA, we have a 60% chance of receiving above average moisture over the next 6-10 days.

Corn:

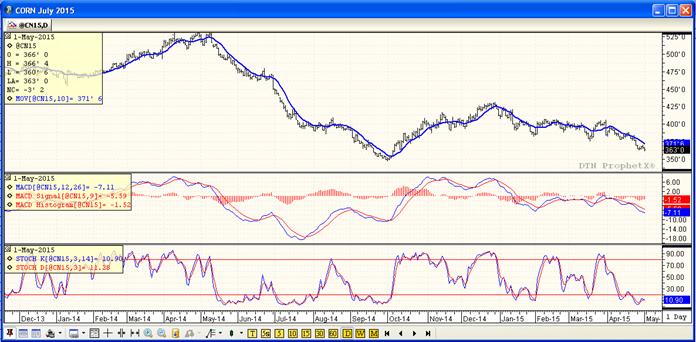

A general lack of fresh news kept corn on the defensive as the market looks to Monday’s planting progress numbers to provide some nearby direction. With weather being nearly ideal and planting progress cruising along with it’s hair on fire this market really can’t catch a break. Most are looking for planting progress Monday to be better than 50% complete vs 19% last week and 29% last year. Then there’s ethanol, right now experience their widest margins of the calendar year with many anticipating better grind rates as we move forward.

Technically we still have a triple dose of bad news with all indicators currently bearish. The stochastics are in oversold territory, while the MACD appears to be neutral and we continue to trade below the moving average. Right now our main support in the July is the $3.46 contract low that was put in the 1st of October. If we could get the makings of a technical correction I would be looking for $3.79, $3.89 and $3.99 respectfully.

We are looking at the same picture in the New Crop with the main level of support @ $3.64. I still believe (for no real good reason) that the market is wanting to consolidate here, so I hopeful we won’t test the contract lows. Be ready for a technical correction. I would be watching the areas of $3.93, $4.02 and $4.11

Soybeans:

Favorable weather, an early and fast planting pace and poor technical performance all contributed to today’s weakness in beans. Many farmers either have or will be switching directly to soybeans as their corn planting finishes in a race to get the crop planted ahead of next week’s promising weather forecast. Argentina continues to deal with the unrest of multiple labor groups but it appears all sides have agreed to meet next week to attempt to find a resolution. Keep posted for updates on Monday.

Brazilian farmers have sold roughly 61% or their crop compared to 69% last year. Some major catch up was done earlier in the week. Bird flu continues to dominate the headlines with more reports in Iowa. Cash markets were mainly steady/better as US farmer selling has been light.

Technically the picture in beans is not a whole lot prettier than corn. All three indicators are currently bearish as of the close. We traded from the lower side of yesterday’s range straight down, closing near the session low today. Probably not a real good sign, but some weather over the weekend might change perspectives come Monday. Should this market find a reason to turn around we need to be ready to pull the trigger at about $9.97 on the upside. This is a point of major resistance and is going to be a hard level to break.

Pretty much the same situation in the New Crop, we are looking at support of $9.28 and major resistance at $9.77. Those with orders in at $9.75, they still look to be a pretty good place to be for the time being, be patient.

Wheat:

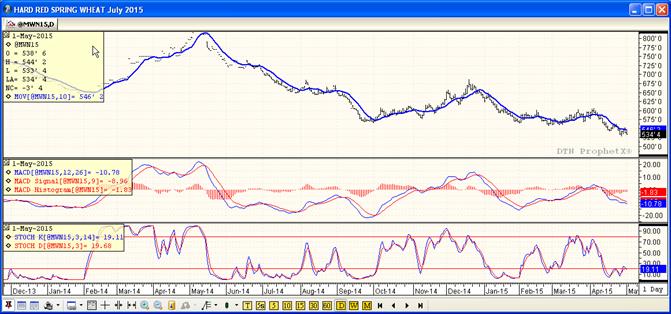

US wheat futures followed yesterday’s weakness with general lack of conviction throughout the day. With only negative factors to go on, weakness in row crop markets and a higher dollar all offered resistance that the wheat markets really don’t need right now. Overall, the producer is not engaged – at all. Crop progress is expected to show stable to better winter wheat conditions; however, focus will quickly shift to boots on the ground as scouts tour KS and adjacent states through midweek. Spring Wheat planting is expected to be over 80% complete.

Some talk now that Russia may be considering a floating export tax on wheat that could be adjusted weekly based on world prices, etc. This talk, though scary, is probably not going to have much influence on the current direction of prices.

And, technically, the broken record continues. I am trying so very hard to find something positive in these charts and the good news for the short-term is really pretty slim. Again, all three technical indicators are bearish the nearby with the market closing just off of recent support at $5.28. This is the new contract low that was just put in on 4/28. If we could see a technical bounce I would be looking to price binned bushels at $5.89.

The nearby Kansas City is a little better with the Stochastics in oversold territory signaling a buy. We closed here just off the contract low of $4.90at $5.00 today in a tight range. $5.72 would probably be the number I am holding out for at this point should we see a correction to the upside.

Top Trending Reads: