Closing Comments

Craig Haugaard

May 4, 2015

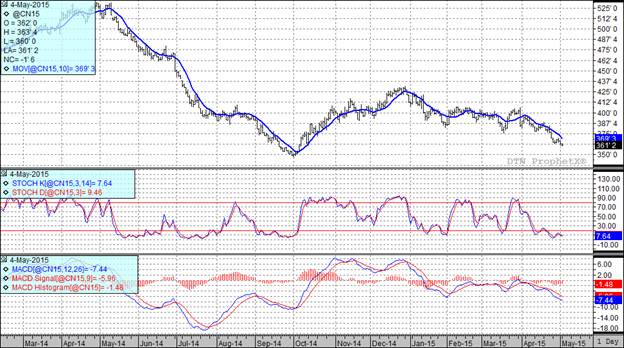

Corn:

Corn continues to have no friends. With excellent planting weather across most of the Corn Belt last week the trade was looking for this afternoon’s planting progress report to reflect a rapid planting pace and the price action reflected that. After the close that expectation came to fruition as corn planting was reported at 55% complete compared to 38% on average. Emergence is running slightly behind the five year average coming in at 9% versus the 12% average.

Not all was gloom and doom as export inspections checked in at 41.4 million bushels. That was better than the top end of the range of estimates. We now need to average 33.5 million bushels per week for the rest of the marketing year to hit the USDA export target of 1.8 billion bushels.

As one would expect given the price action funds were sellers of roughly 4,000 corn contracts in today’s session. They now have on their largest net short position in over a year.

At the present time all three of my technical indicators are bearish both the July and December futures.

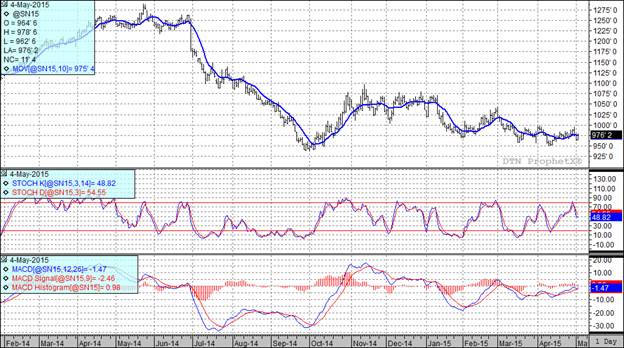

Soybean:

Beans posted a higher close today. Interestingly enough a portion of the rally was driven by the thought that soybean acres may decrease as a result of the corn planting going so well. Speaking of planting speed, today’s planting progress report has bean planting at 13% complete which is ahead of the five year average pace of 9% for this point on the calendar.

The export inspections report showed that 6.3 million bushels were inspected for export last week. That was the 3rd smallest number of the marketing year but right on pace with the kind of exports we need to have to hit the USDA’s annual export projection.

We did see a little news out of South America today with some reports this afternoon that workers at Argentina’s Rosario port are threatening to launch a strike at midnight. Speaking of South America I also saw a report from Safras that Brazil’s bean harvest is essentially complete.

The bottom line of all the above fundamental news was that we saw short covering by funds the soybeans as well as end user pricing which created today’s rally. For the session funds were net buyers of 8,000 bean contracts today.

At the present time two of my three technical indicators are bullish the July futures while two of three are bearish the November soybean futures.

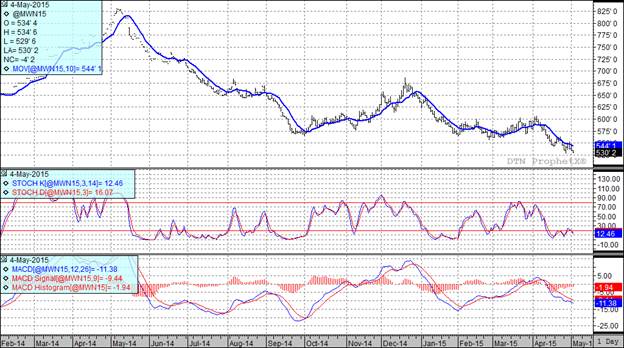

Wheat:

We didn’t have much news today and what we did have tended to be negative.

Weekly export inspections came in at 12 million bushels which was the lowest number we have seen in five weeks. With four weeks to go in the wheat marketing year we need 18.4 million bushels per week to reach the USDA export forecast for 880 million bushels.

After the close the planting progress and crop conditions reports came out. They showed HRW wheat conditions improving by 1% in the good to excellent category to 43%. A year ago they were at 31% good to excellent. The planting progress report reflected the great spring conditions with HRS seeding 75% done versus the five year average of 40%. Of the wheat that has been planted 30% has emerged which is also well ahead of the five year average of 16%.

We continue to hear talk that Russia will drop their wheat export tax. When it eventually happens it will probably have no impact since it is so widely expected.

The Wheat Quality Council HRW tour begins tomorrow so if there are any problems lurking in that crop we should hear about it later this week.

At the present time two of my three technical indicators bearish the Kansas City July futures while all three are bearish the Minneapolis July futures.

Top Trending Reads: