Closing Comments

Craig Haugaard

May 5, 2015

If this doesn’t sum up the way these markets have made me feel the past few weeks I don’t know what does.

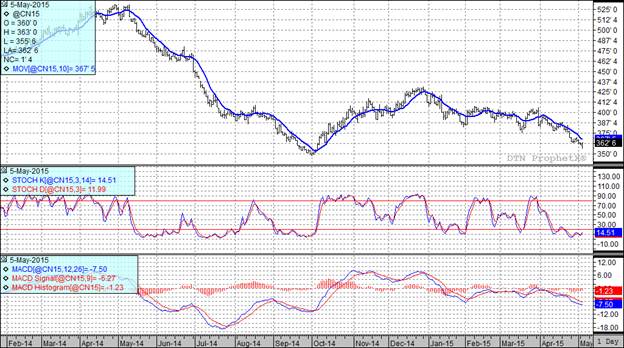

Corn:

With good weather for planting corn once again spent most of the day being pummeled by the bears. Then as it looked as if we were going to post yet another lower close the corn market seemed to get a breath of life. I am not sure what triggered it exactly but I do know that traders looking at yesterday’s planting progress report are noting that in the south there are still about two million acres to be planted and some traders are of the opinion that as much as a million of that will not get planted to corn. That may have accounted for the late rally and the stronger close.

The only other news that I saw today was a fresh Informa report. Nothing in that report was bullish as they raised the world 2014 crop by 6 MMT due to better yields in Brazil. They also popped up their world estimate for 2015 by 4 MMT as a result of better numbers coming out of Brazil and China. Speaking of Brazil I see that Safras raised their second corn crop planted acreage estimate to 23.1 million acres, up 17% from last year! They expect a record second corn crop at 52.8 MMT. This could bring Brazil’s total corn crop to almost 83 MMT versus the USDA’s most recent estimate of 75 MMT. A year ago they had production of 80 MMT.

At the present time two of my three technical indicators are bearish both the July and December futures.

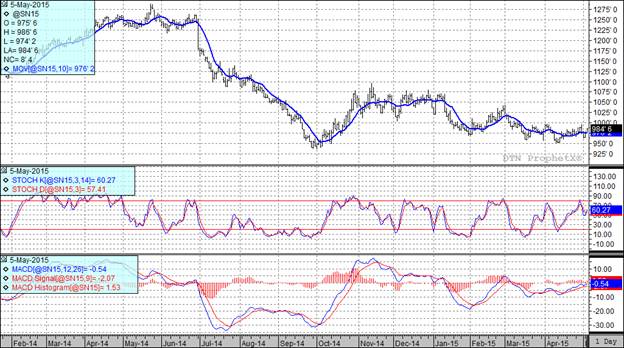

Soybean:

The story in beans seems to be unchanged as uncertainty over whether strikes will occur in Argentina continues to be supportive to beans. Assisting in the rally was a rumor that the Chinese were buying soybean oil.

We did have the Informa report today. In that report they pegged the total world soybean production for 2015 at 316.5 MMT. Using their rear view mirror they placed 2014 production in Brazil at 94.5 MMT while factoring in Argentina at 59.0 MMT. The last USDA numbers had Brail at 94.5 MMT and Argentina at 57.0 MMT.

At the present time all three of my technical indicators are bullish both the July and November soybean futures.

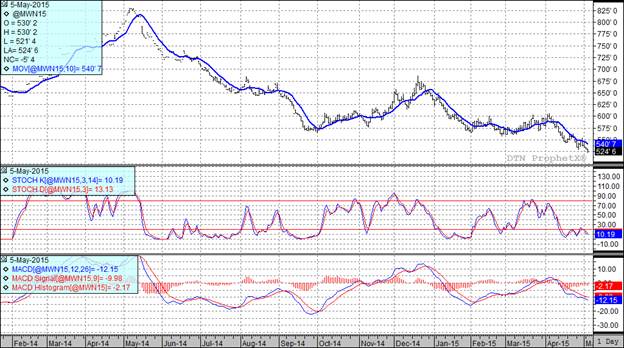

Wheat:

A little more news than normal in the world of wheat today.

In the export world today we saw 120 TMT of wheat trade with Romania and Russia splitting the business. It was interesting to see that USA wheat was fairly competitive; in fact it appears as if it was freight costs that kept us from being in the midst of the action.

Speaking of exports the wheat world got a little more negative news today when Russia’s Ag Ministry called for the lifting of the wheat export tax early on May 15th. It was to run through June so this gets them back in the game faster than the trade had been expecting. I also heard rumors that a new export tax formula would be implemented July 1st. Nothing further on that so we will see what develops.

In Informa’s report today they are projecting that world wheat production will hit 718.6 MMT in 2015. Looking at the domestic numbers, Informa is projecting the 2015 US winter wheat crop at 1.486 million bushels, down from their previous 1.497 million bushel estimate.

Speaking of winter wheat, the winter wheat tour kicked off today and the early reports are indicating that they are seeing stripe rust in the fields. We should have more information tomorrow.

At the present time all three of my technical indicators are bearish both the Minneapolis and Kansas City July futures.

Top Trending Reads: