Closing Comments

Craig Haugaard

May 8, 2015

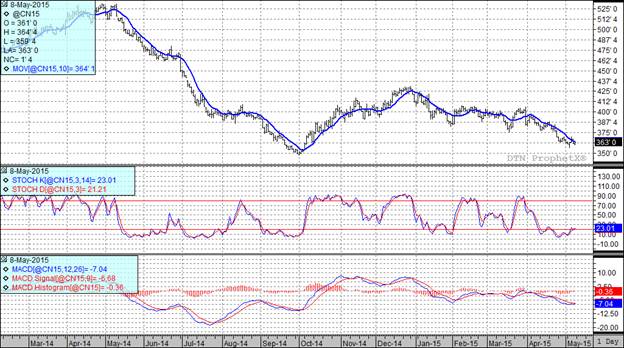

Corn:

The corn market was about like running on a tread mill all week. After a lot of emotional ups and downs from the market we ended the week with July corn futures unchanged while the December futures were down a couple of cents.

As the week came to a close the topic of greatest conversation was next week’s USDA report. As we saunter into the report it appears as if the average trade estimate for the 2014-15 carryout is 1.864 billion bushels. The trade is also expecting that the 2015-16 USA ending stocks will come in at a projected 1.752 billion bushels.

Monday afternoon will bring the latest weekly crop planting progress report and as we head into the week-end it appears as if the trade estimates for that report are running in the 75 to 85% planted range. Anyway you cut it corn plantings should continue to be well ahead of average.

At the present time two of my three technical indicators are bearish both the July and December corn futures. The funds seemed to be engaging in some short covering today ahead of the report as they were buyers of 3,000 contracts during today’s session.

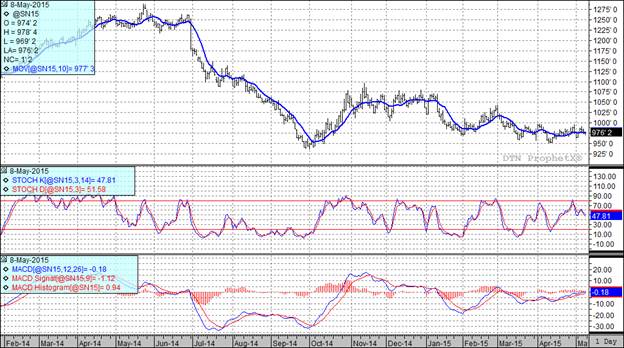

Soybean:

We had a very slow session with the funds being net buyers of 1,000 bushels as folks position ahead of next week’s USDA report.

Leading into the report the average trade guess is that we will be presented with a 2014-15 carryout of 360 million bushels with the 2015-16 carryout projected at 443 million bushels.

Tuesday’s USDA report will also give us their latest ideas on the South American crop. The trade is looking for the Brazilian crop to be pegged in the 93.5 to 95.0 MMT range. Last year’s crop was 86.87 MMT. The trade is also projecting that Argentina’s soybean production will be between 57.0-61.0 MMT. The crop last year totaled 54.0 MMT.

Monday we will get the latest planting progress report and at this juncture the trade is looking for the report to reflect that 30 to 40% of the crop has been planted thus far.

With todays close two of my three technical indicators are now bearish both the July and November soybean futures. Having said that it should be noted that in a choppy market like this the indicators are about worth as much as a bucket of warm spit.

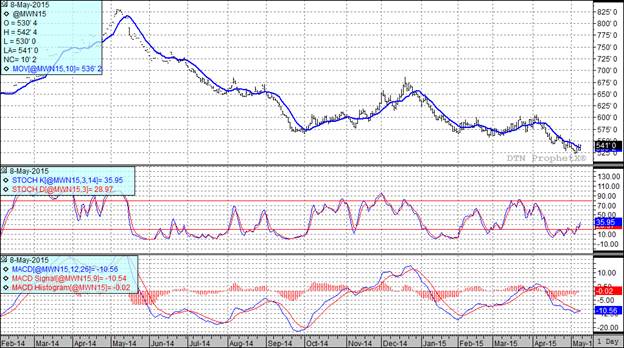

Wheat:

The projection for cooler temperatures in portions of Colorado, Nebraska and Kansas early next week was a supportive factor in today’s trade. We saw both speculative buying on the weather report as well as fund short covering. The fund short covering was also driven by position evening ahead of Tuesday’s USDA report. For the session the funds were buyers of roughly 4,500 contracts but are still short roughly 110,000 contracts as they head home for the week-end.

Speaking of the USDA report, as we head into it the trade is looking for an all wheat production number that falls somewhere between 2.003 and 2.188 billion bushels versus 2.026 billion bushels in 2014. The trade is also projecting the 2014-15 ending stocks to come in at 693 million bushels while the 2015-16 stocks are expected to be around 750 million bushels.

At the present time two of my three technical indicators are bullish both the Minneapolis and Kansas City July futures.

Top Trending Reads: