Closing Comments

Craig Haugaard

May 11, 2015

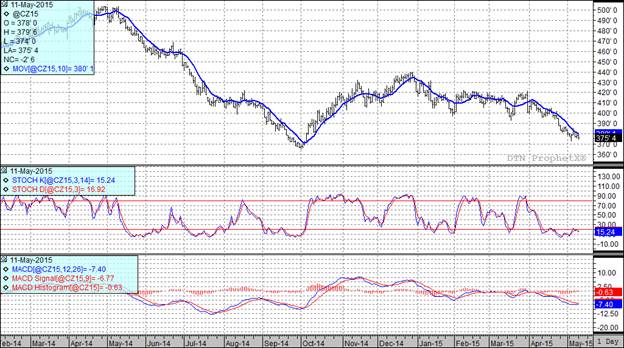

Corn:

We had very sold weekly export inspections once again this week. The trade was looking for a number in the 35 to 45 million bushels range so today’s announced number of 44.7 million bushels came in right at the top of the range. Other than that we had very little news in the market today. We did have some traders try to make the case that we have now had too much rain but the general consensus seems to be that the benefits from this rain will more than offset any drowned out areas.

After the close we received the weekly planting progress and crop conditions report. The trade as looking for significant progress in planting and at 75% planted today’s report certainly reflected that. The five year average is for us as a nation to be 57% completed with planting at this point in the year. The corn is starting to emerge with 29% reported as being emerged. That is up from 9% last week and slightly ahead of the five year average of 24% emergence for this point on the calendar.

Tomorrow we will have the May Crop Production and Supply & Demand reports. The trade is looking for the 2014/15 corn carryout to come in at 1.864 billion bushels, up slightly from the 1.827 billion bushels that was projected in April. The average trade guess for the 2015/16 carry-out is 1.752 billion bushels, but we have a fairly wide range of estimates with traders tossing around numbers that range from 1.551 billion bushels on the low end to 2.267 billion bushels on the high end. In looking at the world carry-out the average trade guess is that we will see 2014/15 at 190.01 MMT, up from 188.46 MMT in the April report. The trade is guessing that the 2015/16 guess will come out at 182.69 MMT in tomorrow’s report.

At the present time all three of my technical indicators are bearish both the July and December corn futures.

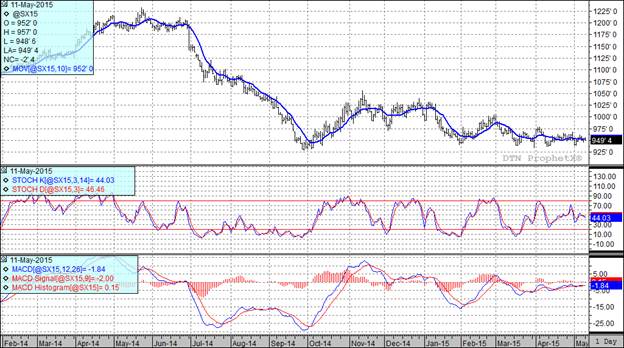

Soybean:

Export inspections this morning came in at 9.7 million bushels which is well ahead of the weekly average needed to achieve the USDA’s annual export projection. I would not be surprised to see them increase their export number in tomorrow’s report.

Speaking of tomorrow’s report that average trade guess is that we will see a 2014/15 carry-out of 360 million bushels. This would be down 10 million from the April report and may indicate the increased export demand mentioned in the preceding paragraph. The trade is also looking for the projected 2015/16 carry-out to come in at 443 million bushels. Viewed from a world perspective the 2014/15 carry-out is expected to come in at 90.22 MMT, up from 89.55 MMT in April’s report. The trade is also guessing that the world carry-out for 2015/16 will come in at 95.17 MMT. There seems to be no end in sight for low soybean prices.

We continue to see additional cases of bird flu popping up with some new cases appearing in Iowa. With these new cases we now have over 30 million birds impacted by bird flu in the USA.

At the present time two of my three technical indicators are bearish both the July and November soybean futures.

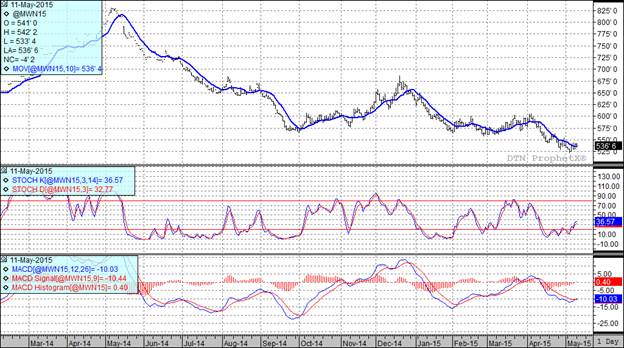

Wheat:

It was hard to find bullish news in the wheat market today.

Over the week-end we saw beneficial rains fall across a wide ranging area. We saw Ukraine, southern Russia and the wheat growing areas of China all receive much needed rains which should prove very beneficial to those crops.

This morning’s weekly export inspections numbers came in at 13.9 million bushels for wheat which was at the top end of trade guesses. We have four weeks left in the wheat marketing year and will need to average roughly double last week’s number to achieve the USDA projection. I don’t believe that it is going to happen so perhaps we will see them adjust the export projection in tomorrow’s report.

Speaking of tomorrow’s report, the average trade guess for the 2014/15 USA carry-out is 693 million bushels with the trade looking for a 2015/16 number of 750 million bushels. I suppose common sense would tell you that when you are projecting carry-outs to increase your odds for a significant rally are not very large. The trade is also looking for tomorrow’s report to continue to indicate a significant worldwide carry-out. The trade is currently looking for the 2014/15 number to come in at 196.67 MMT with the 2015/6 carry-out projected to be 193.53 MMT.

After the close we received the weekly Crop Progress numbers and they report that for winter wheat the crop is 56% headed which is ahead of the five year average of 45% headed on this date. The crop condition continues to improve as well. This week it moved up to 44% good to excellent. Last week we had 43% of the crop in that category while a year ago a mere 30% was rated as good to excellent. Spring wheat planting continues to move at an accelerated pace with 87% of that crop reported as being planted. The five year average is for 51% of the crop to be in the ground at this point. We are seeing spring wheat emergence running ahead of average as well with 54% currently emerged compared to the five year average of 25% emerged on this date.

The USA isn’t the only country running ahead of average with Canada’s spring wheat crop reportedly 45% planted.

I find it kind of interesting that all three of my technical indicators are bullish both the Minneapolis and Kansas City July futures. I tend to think that we are experiencing a dead cat bounce in an oversold market but as always I could be dead wrong and we may be on the cusp of a runaway bull market in wheat. I doubt it and in fact will put on my swim suit and walk down Main Street Ipswich on January 1st if the Minneapolis July futures rally above $5.75 in the next thirty days.

Top Trending Reads: