Closing Comments

Craig Haugaard

May 12, 2015

The USDA report was out today and frankly after looking at this report I don’t think there is enough lipstick in the world to make this pig look pretty.

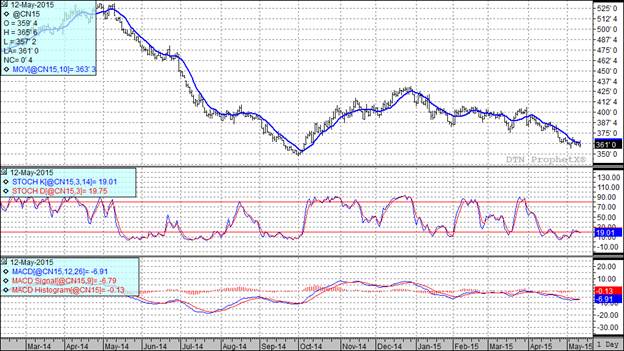

Corn:

The domestic corn numbers were not too bad today. The trade was expecting the 2014/15 carry-out to be projected at 1.864 billion bushels so the actual number of 1.851 was pretty much on the money. Last month they had it pegged at 1.827. Turning to 2015/16 the average trade guess coming into today’s report was 1.752 so again, the actual number of 1.746 billion bushels. Certainly nothing real bearish in those numbers, but then certainly nothing real bullish either. When looking at the world carry-out numbers is where the bears would seem to gather some courage. For 2014/15 the world carry-out was pegged at 192.5 MMT, up from last month’s 188.46 and the average trade guess of 190.01 MMT. Looking forward, the USDA is pegging the 2015/16 world carry-out at 191.94 which is sharply higher than the 182.69 MMT carry-out that the trade was expecting. In light of the world numbers the market did a good job to close higher today.

At the present time all three of my technical indicators are bearish both the July and December corn futures.

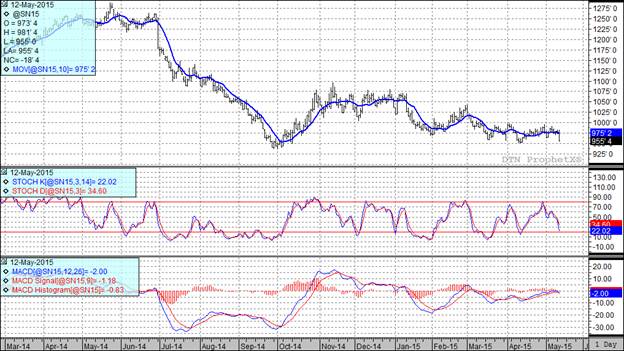

Soybean:

The bean market was rocked pretty hard by today’s report. Frankly, I was a little puzzled by the reaction. The trade was looking for the 2014/15 carry-out to come in at 360 million bushels which would have been down 10 million from last month. Instead the USDA gave us a number of 350 million as they increased both exports and crush by 10 million bushels. While that could have been conceived as friendly the projected carry-out for 2015/16 greatly exceeded the trade expectations. They were looking for a number of 443 million bushels and instead were given an eye popping 500 million bushel carry-out projection. This would seem to indicate that you would want to buy the July and sell the November futures but traders skipped the first part of that and just sold everything.

When viewed from a world perspective it doesn’t look any rosier for the bulls with the world carry-out for 2014/15 projected to come in at 85.54 MMT and then swell to 96.22 MMT for 2015/16. It would appear that if these numbers are correct the era of low prices is with us for a while.

At the present time all three of my technical indicators are bearish both the July and November soybean futures.

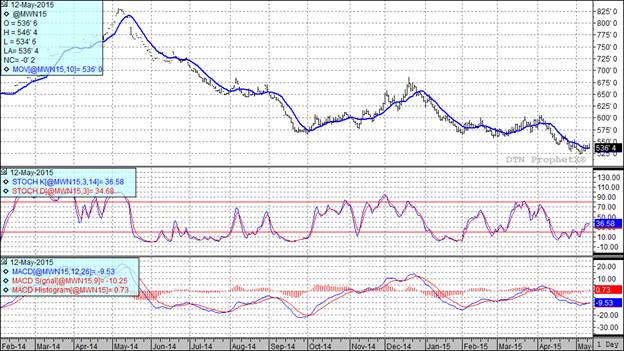

Wheat:

Today’s reports indicated an increase in the domestic and world wheat carry-out numbers. Domestically the trade was looking for the 2014/15 carry-out to check in at 693 million bushels but instead was given a number of 7090million. Jumping forward to 2015/16 the trade anticipated that the carry-out would be pegged at 750 so traders were a touch surprised with today’s prognostication of 793 million bushels.

On the world scene the 2014/15 carry-out is projected to be 200.97 MMT, 4.3 MMT more than the average trade guess. For 2015/16 the carry-out is projected to swell to 203.32 MMT. The trade really missed on this one as the average trade guess was 193.53 MMT. In the face of these numbers wheat probably performed better than one would have expected.

In spite of today’s lower close all three of my technical indicators remain bullish both the Minneapolis and Kansas City July futures

Top Trending Reads: